Benchmark index crosses 1,400-point threshold

KATHMANDU, JULY 25

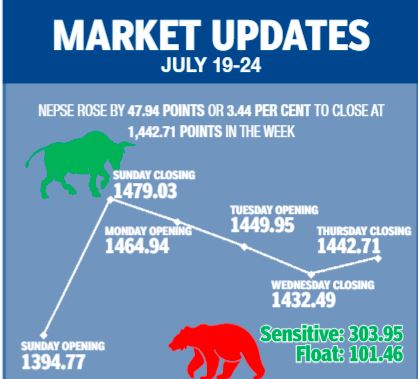

On the back of Nepal Rastra Bank introducing investment-friendly policies for the secondary market, the Nepal Stock Exchange (Nepse) index has witnessed a positive trend in the last couple of weeks. And keeping with this trend, the benchmark index increased by 3.44 per cent or 47.94 points to 1,442.71 points in the trading week between July 19 and 23.

As per Uttam Aryal, chairperson of Investors Association of Nepal, the stock market has become vibrant of late as investors are excited about the provisions included in the Monetary Policy which are capital market-friendly. “That is the reason why the stock exchange saw positive circuit breakers in the initial days of the Monetary Policy being launched,” he added.

“However, the market went into a correction mode later when short-term investors booked profit as the market soared significantly,” Aryal explained, adding that investors are now in a wait and watch mode to see if the Monetary Policy is effectively implemented. According to him, whenever the central bank brings policies to uplift the overall economy, Nepse also witnesses a boom.

Along with the benchmark index, the sensitive index also went up by 3.10 per cent or went up by 3.10 per c 8.88 points to 303.95 points and float index gained 3.51 per cent or 3.44 points to 101.46 points.

The weekly turnover increased massively by 40.77 per cent as compared to the previous week to Rs 7.60 billion. In the previous week, the market had witnessed transactions worth Rs 5.39 billion.

Similarly, trading volume also surged to 1.91 million stocks changing hands this week from 1.51 million in the previous week.

The secondary market had opened on Sunday at 1,394.77 points and surged by 84.26 points by the end of the first trading day. It, however, dropped by 14.09 points on Monday, 14.99 points on Tuesday and 17.46 points on Wednesday. The local bourse reversed course on Thursday rising by 10.22 points to close the week at 1,442.71 points.

In the review week, trading, hydropower and finance subgroups landed in the red zone. The trading sub-index dropped by 1.79 per cent or 16.01 points to land at 873.96 points. Hydropower fell 0.40 per cent or 3.95 points to 972.16 points and finance sub-index descended by 0.26 per cent or 1.72 points to 669.82 points.

Meanwhile, the hotels subgroup, which was the highest gainer of the week, surged by 13.06 per cent or 193.35 points to 1,673.35 points, with the share price of Soaltee going up by Rs 14 to Rs 173 and that of Taragaon Regency rising by Rs 47 to Rs 231.

Similarly, non-life insurance ascended by 4.89 per cent or 309.83 points to 6,634.39 points as the share price of Himalayan General rose by nine rupees to Rs 425.

Likewise, banking subgroup soared by 4.42 per cent or 52.74 points to 1,246.74 points as the share value of Nabil went up by Rs 60 to Rs 850 and Nepal Investment increased by Rs 19 to Rs 459.

Moreover, life insurance subgroup ascended by 4.06 per cent or 333.96 points to 8,552.45 points with the share price of Nepal Life expanding by Rs 68 to Rs 1,342. Likewise, development banks edged up by 3.36 per cent or 59.55 points to 1,831.04 points as the share value of Jyoti Bikas Bank went up by Rs 10 to Rs 181.

Meanwhile, manufacturing subgroup increased by 3.12 per cent or 85.89 points to 2,833.13 points as the share price of Bottlers Nepal (Tarai) rose by Rs 121 to Rs 6,416.

Similarly, others subgroup inched up by 1.79 per cent or 13.87 points to 789.19 points.

Likewise, mutual funds went up by 1.04 per cent or 0.11 point to 10.59 points and microfinance subgroup rose slightly by 0.54 per cent or 13.09 points to 2,458.55 points.

In the review week, Nepal Reinsurance Company was the leader in terms of weekly turnover with Rs 601.66 million.

It was followed by NMB Bank with Rs 488.70 million, Nepal Life Insurance Co with Rs 461.57 million, NIC Asia Bank with Rs 420.26 million and Himalayan Distillery with Rs 333.63 million.

In terms of weekly trading volume, NMB Bank was the forerunner with 1,098,000 of its shares being traded. It was followed by Nepal Reinsurance Company with 1,092,000, NIC Asia Bank with 706,000, Global IME Bank with 578,000 and Mega Bank Nepal with 541,000 shares changing hands.

Meanwhile, NIC Asia Laghubitta Bittiya Sanstha topped in terms of number of transactions with 30,470 transactions. It was followed by Nepal Reinsurance Company with 14,606, NMB Bank with 4,136, NIC Asia Bank with 2,733 and Nepal Life Insurance Co with 2,624 transactions.

A version of this article appears in e-paper on July 26, 2020, of The Himalayan Times.