Benchmark index edges up slightly

The country’s sole secondary market has witnessed continuous fluctuations as a result of the stockbrokers trying to control the share market, as per market analysts. They further claim that the stockbrokers have been trying to hide their weaknesses by laying the blame on government policies.

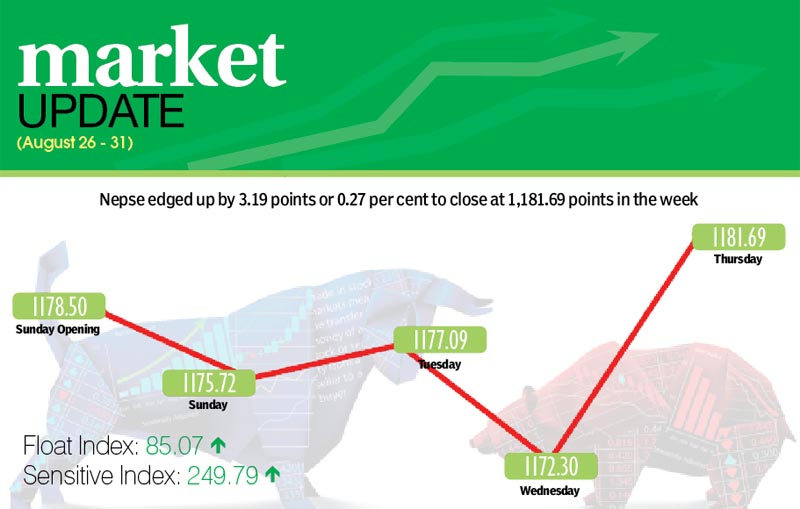

Riding this wave of fluctuations, the Nepal Stock Exchange (Nepse) index saw a marginal gain of 0.27 per cent or 3.19 points in the trading week between August 26 and 30.

“Stock brokers are still hiding their exact trading data and are themselves placing ‘buy’ and ‘sell’ orders to show they are conducting business,” said Prakash Rajhaure, an independent stock analyst.

As per him, broker firms are misusing loan of Rs 50 million that they can avail from banks and financial institutions without pledging any collateral. “If they can clean up their act, we will be able to witness positive signals in secondary market.”

The benchmark index opened on Sunday at 1,178.50 points and by end of the trading day it had slipped 2.78 points to 1,175.72 points. The market remained close on Monday as the Valley observed Gaijatra festival, which was a public holiday. When the market opened on Tuesday, index inched up by 1.37 points to 1,177.09 points. However, the local bourse dipped on Wednesday by 4.79 points to 1,172.30 points. On Thursday, the index reversed course to increase by 9.39 points to close the week at 1,181.69 points.

Meanwhile, the sensitive index went up by 0.32 per cent or 0.80 point to 249.79 points and the float index also ascended by 0.46 per cent or 0.39 point to 85.07 points.

In the review period, the manufacturing, banking and hotels subgroups saw some gains while the remaining subgroups landed in the red zone except for trading, which did not witness any transaction.

The manufacturing subgroup led the pack of gainers, rising by 0.82 per cent or 17.63 points to 2,157.6 points. The share price of Bottlers Nepal (Tarai) shot up by Rs 156 to Rs 6,211. Similarly, banking sub-index also rose by 0.73 per cent or 7.49 points to 1,021.79 points. This was due to Nabil Bank’s share price rising by two rupees to Rs 947. The hotels subgroup rose by 0.42 per cent or 7.63 points to 1,817.07 points.

Among those in red zone, life insurance subgroup was biggest loser of week, falling by 0.80 per cent or 44.88 points to 5,521.15 points, with Nepal Life Insurance’s share price down nine rupees to Rs 906.

The hydropower subgroup also descended by 0.56 per cent or 7.74 points to 1,366.34 points. This was due to Chilime’s share price going down by four rupees to Rs 711.

Likewise, microfinance subgroup fell by 0.35 per cent or 5.30 points to 1,473.93 points with share price of Chhimek Laghubitta Bikas Bank down by Rs 10 to Rs 890. Similarly, others sub-index dipped by 0.24 per cent or 1.73 points to 715.86 points.

Meanwhile, the development banks subgroup decreased by 0.20 per cent or 2.89 points to rest at 1,429.04 points and the finance sub-index descended by 0.16 per cent or 0.99 point to 607.82 points.

Likewise, the non-life insurance subgroup also fell by 0.04 per cent or 2.48 points to 5,764.15 points.

Altogether, 2.54 million shares of 180 firms worth Rs 803 million were traded through 11,788 transactions in the week. Traded amount was 31.81 per cent lower than total weekly turnover of previous week, which stood at Rs 1.17 billion. In the past week, 4.42 million shares of 185 firms had changed hands through 16,620 transactions. It has to be

noted, however, that market had remained open for normal five trading days in previous week.

In review period, Nepal Investment Bank (Promoter) took lead in weekly turnover with Rs 73.96 million and NMB Bank was forerunner in terms of trading volume, with 132,000 units of its shares changing hands. In terms of number of transactions, Nepal Life Insurance was at the top with 588 transactions.

Nepal Life Insurance Company with Rs 44.58 million, NMB Bank with Rs 40.75 million, NIC Asia Bank with Rs 33.38 million and NLG Insurance Company with Rs 24.95 million rounded up the top five firms in terms of weekly turnover.