BoP records surplus of Rs 6 bn after over a year

Kathmandu, September 24

Amid concerns related to ballooning trade deficit, the Balance of Payments (BoP) recorded a surplus of Rs 6.05 billion in the first month of this fiscal, mid-July to mid-August, compared to a deficit of Rs 24.77 billion in the same month of previous fiscal year.

The BoP has recorded a surplus for the first time since July 2018.

The positive impact on the country’s BoP situation can be attributed to the fact that the country managed to raise its export volume and reduce import notably in the first month of this fiscal compared to the same month last year.

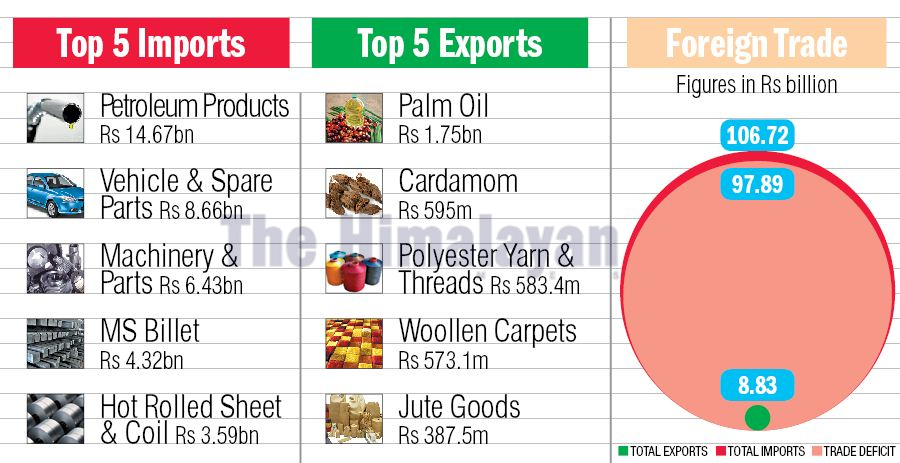

As per the Current Macroeconomic and Financial Situation report of the first month of fiscal 2019-20, which was unveiled by Nepal Rastra Bank (NRB) today merchandise imports contracted 11.5 per cent to Rs 106.73 billion against an increase of 54.3 per cent in the same period of the previous year. However, merchandise exports rose by 27.7 per cent to Rs 8.84 billion in August this year compared to an increase by 3.2 per cent in the same month of last year.

This was largely due to export of huge quantity of refined palm oil. The country started exporting refined palm oil a few months ago. Currently, crude palm oil is imported into the country, refined and then exported again.

The gross foreign exchange reserves of the country increased to Rs 1,064.64 billion in mid-August from Rs 1,038.92 billion in mid-July this year.

Meanwhile, the current account registered a deficit of Rs 9.37 billion in the review period. Such deficit stood at Rs 25.16 billion in the same period of previous year. In US dollar terms, current account deficit remained at $84 million in the review period compared to $228.5 million a year ago.

However, the remittance inflows increased by two per cent to Rs 75.40 billion in the review period, against an increase of 33.1 per cent in the corresponding period of the previous year.

Economist Bishwo Poudel said that all indicators, including BoP situation, imports and exports, were positive in the review month. “However, unnatural hike in inflation and the tepid growth in remittance inflow needs to be checked,” he said.