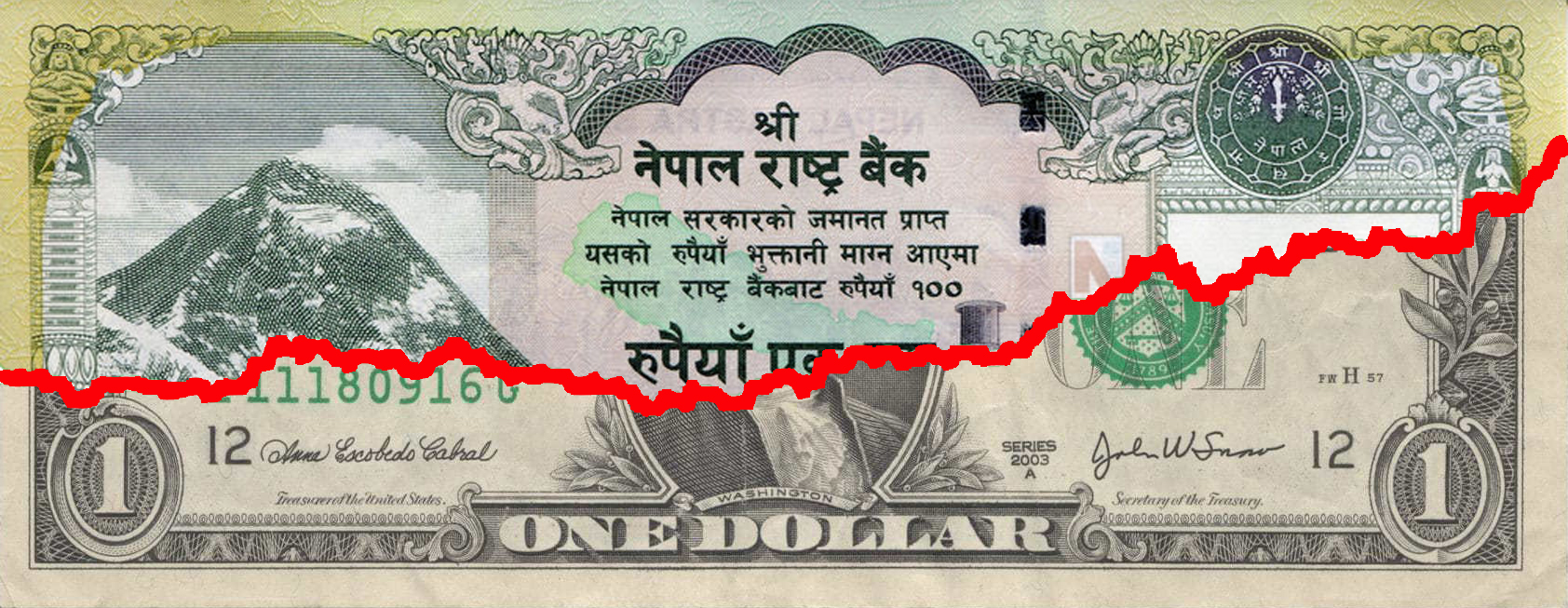

Currency depreciation could dampen festive mood

Kathmandu, September 8

The sharp depreciation of Nepali currency vis-à-vis US dollar in recent months could severely hit consumers during the festive season as the market price of imported goods is likely to surge.

Nepali currency vis-à-vis the US dollar has depreciated by 4.6 per cent since the beginning of this fiscal and by 11.97 per cent in the last one year.

According to Bhisma Raj Dhungana, executive director of Foreign Exchange Management Department of Nepal Rastra Bank (NRB), traders normally open letters of credit to import goods for the festive season around 45 days before the start of the festivals.

“Traders have mainly conducted business in India and China in this fiscal due to the volatility of the US dollar,” said Dhungana. “As around two-thirds of the imports is carried out from India, there may not be a severe impact on inflation due to the depreciation of Nepali currency.”

“However, import of petroleum products has become costlier due to stronger dollar. It will raise cost of production and cost of ferrying goods and as a result, price of goods will certainly increase,” he added

Central bank has provided facility to open letter of credit in Indian currency to import goods from India and in renminbi from China. Around 14 per cent of total imports is carried out from China.

Dhungana further said the price of goods imported from India may rise slightly due to the impact that the depreciation of the Indian currency vis-à-vis the dollar could have on the cost of production, but the price of Indian goods will not increase as much as the goods from third countries.

Due to the depreciation of Nepali currency over the years, Nepal’s import is highly concentrated with India in recent times as imports from the southern neighbour are comparatively cost effective.

However, Rajendra Malla, vice chairperson of Nepal Chamber of Commerce, said that the market price will surge considerably in an import-based economy like Nepal, as the currency has depreciated sharply vis-à-vis the US dollar.

Economist Keshav Acharya also said that though only 20 per cent of the country’s imports is carried out from third countries, the stronger dollar will affect the price of Indian and Chinese goods even if payment of imports from these neighbours are settled in Indian currency and renminbi, respectively.

He, however, said that strong market monitoring is a must to control the rampant price rise of goods citing

the currency depreciation. “Inflation could rise significantly if the government allows vendors to fix the price of goods in a rampant manner during the festive season,” added Acharya.

He further said that the trend in Nepal is that vendors do not make adjustments in the price of goods once prices rise due to certain circumstances, like currency depreciation, even though things come back to order. “Fuel price rise is a cause of concern because it will adversely affect the price of daily utilities and make living costlier as transportation cost goes up along with fuel price hike.”

Acharya stated that the government must conduct strong market monitoring during the festive season to safeguard consumers from rampant price hike of goods.