Current account in deficit of Rs 11.12bn

The current account slipped into a deficit of Rs 11.12 billion in the second month of fiscal year 2016-17 (mid-August to mid-September) from a surplus of Rs 38.48 billion in the same period of the previous year.

The deficit was ‘on the account of increase in trade deficit and dividend payments on foreign investment accompanied with decrease in foreign grants’, says the latest macroeconomic update unveiled today by Nepal Rastra Bank (NRB)’s research department.

In the first month of this fiscal, that is from mid-July to mid-August, the current account had slipped into a deficit of Rs 2.32 billion because of decline in remittance and foreign grants, from a surplus of Rs 8.15 billion in the same period of fiscal 2015-16.

Similarly, the overall balance of payments (BoP) recorded a deficit of Rs 3.50 billion in the second month of this fiscal from a surplus of Rs 31.88 billion in the same period of the previous fiscal. In the previous month, BoP had fallen into a negative territory and stood at Rs 2.13 billion from a surplus of Rs 4.77 billion in the same period of the previous year.

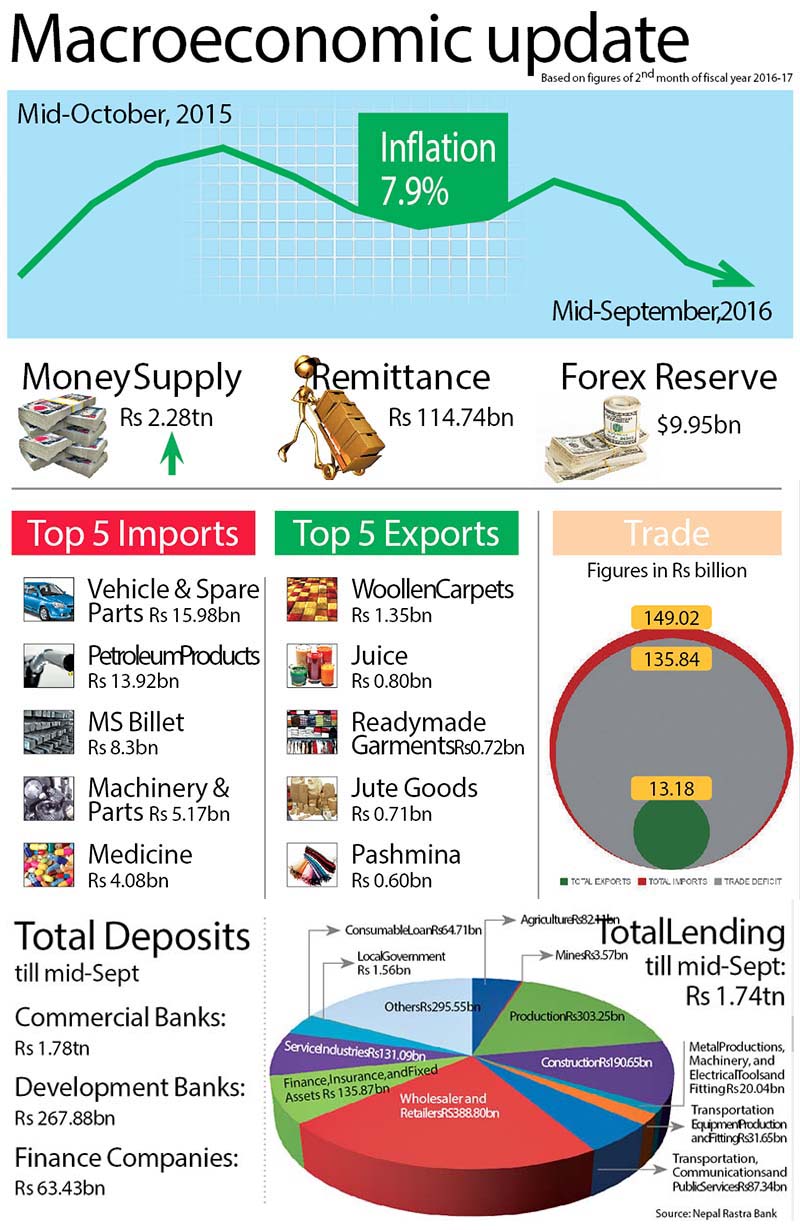

According to the monthly report unveiled by the central bank, merchandise exports increased 7.7 per cent to Rs 13.18 billion in the first two months of this fiscal compared to a drop of 15.2 per cent in the same period of previous year. But at the same time, merchandise imports increased a whopping 43.4 per cent to Rs 149.02 billion in the review period compared to a drop of 17.5 per cent in the same period of the previous year.

Because of this mismatch, the country’s total trade deficit in the review period expanded by a staggering 48.1 per cent to Rs 135.84 billion compared to contraction of 17.8 per cent in the same period of the previous year. The export-import ratio fell to 8.8 per cent in the review period from 11.8 per cent in the corresponding period of the previous year.

After declining by 2.5 per cent in the previous month, workers’ remittances increased 6.6 per cent to Rs 114.74 billion in the second month of this fiscal. A year-on-year comparison, however, shows a growth of 27.5 per cent in remittance in the corresponding period of the previous year.

The gross foreign exchange reserves decreased 0.6 per cent to Rs 1,032.70 billion as of mid-September from Rs 1,039.21 billion in mid-July. Based on the imports of the first two months of current fiscal year, the foreign exchange holdings of the banking sector is sufficient to cover the prospective merchandise imports of 14.1 months, and merchandise and services imports of 12 months.

In the review period, Nepal received capital transfer amounting to Rs 1.54 billion and foreign direct investment (FDI) inflow of Rs 2.19 billion against Rs 2.51 billion and Rs 834.7 million, respectively, in the previous year.

Because of a slow pace of government expenditure (Rs 31.55 billion) relative to resource mobilisation, the government accumulated cash balance of Rs 200.90 billion at NRB as of mid-September.

On a positive note, the central bank report says macroeconomic situation is gaining a gradual traction with rising capital expenditure of the government and rebound in industrial output along with promising summer crops under the agricultural sector.

Inflation eases to 7.9pc

KATHMANDU: The consumer price inflation eased to 7.9 per cent in mid-September from the level of 8.6 per cent in mid-August.

A year ago, consumer price inflation stood at 7.2 per cent. The higher rate of increase in prices of sugar and sugar products, fruit, pulses and legumes, alcoholic drinks, spices, clothes and footwear and miscellaneous goods and services exerted an upward pressure on the overall consumer price inflation in the review period, as per the latest macroeconomic update of Nepal Rastra Bank.

The report shows hilly region witnessed a relatively higher rate of inflation at 10.3 per cent followed by mountain region at 7.5 per cent, Tarai region at 7.4 per cent and Kathmandu Valley at 6.6 per cent in the review period.

The year-on-year consumer price inflation was lower at 4.3 per cent in India in the review period, showing an inflation wedge of 3.6 per cent.

Such inflation in the corresponding period of the previous year was 4.4 per cent in India and 7.2 per cent in Nepal, reflecting a narrower inflation differential of 2.8 per cent.