Formation of new govt fuels optimism

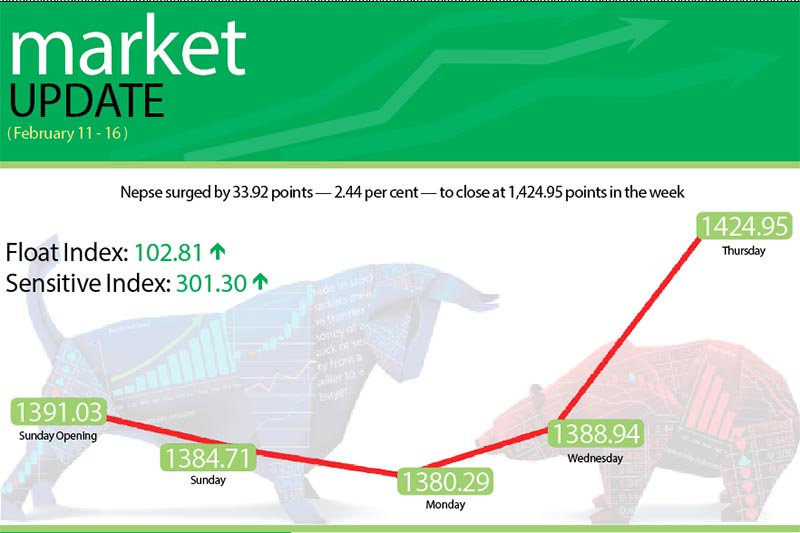

Investor sentiment got a major boost with the formation of a new government in the trading week between February 11 and 15, with the Nepal Stock Exchange (Nepse) index surging by 33.92 points or 2.44 per cent.

Opening at 1,391.03 points on Sunday, the benchmark index had dropped by 6.32 points by the day’s closing. Nepse continued downhill the next day by shedding 4.42 points. The sole secondary market remained closed on Tuesday as the country celebrated Maha Shivaratri festival. The local bourse reversed course thereafter, rising by 8.65 points on Wednesday and soaring by 36.01 points on Thursday to close the week at 1,424.95 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 7.30 points or 2.48 per cent to 301.30 points. Similarly, the float index that measures the performance of shares actually traded also went up by 2.77 points or the same percentage to 102.81 points.

In total, 3.79 million shares of 179 companies that amounted to Rs 1.54 billion were traded through 16,638 transactions during the review period. The traded amount was 0.62 per cent less than the preceding week when 17,901 transactions of nearly 4.20 million shares of 176 companies that amounted to Rs 1.55 billion had been undertaken. It has to be noted, though, that the share market had remained open for normal five trading days in the previous week.

All the subgroups landed in the green during the review week, with trading witnessing the highest gain of 5.17 per cent or 10.97 points to settle at 222.96 points. This was on the back of Bishal Bazaar Co’s share value going up by 3.82 per cent to

Rs 2,011 and that of Salt Trading Corporation soaring by 10 per cent to Rs 308.

Microfinance advanced by 3.85 per cent or 64.02 points to 1,725.74 points. Mero soared by 10.18 per cent to Rs 1,428, Nagbeli rose by 3.80 per cent to Rs 2,485, and Chhimek gained 2.86 per cent to Rs 1,044.

Development banks jumped by 3.59 per cent or 56.52 points to 1,628.83 points. Excel surged by 5.60 per cent Rs 377 and Shine Resunga went up by 3.33 per cent to Rs 310.

Insurance subgroup gained 3.14 per cent or 222.18 points to reach 7,288.64 points. Share price of Premier surged by 9.76 per cent to Rs 1,350, that of Shikhar by 5.24 per cent to Rs 1,225, and that of Rastriya Beema Co rose by 3.83 per cent to Rs 13,510, among others.

Commercial banks like Nabil advanced by 3.66 per cent to Rs 1,104 and Nepal Investment by 2.09 per cent to Rs 683. Consequently, banking — the subgroup with the highest weightage in the secondary market — ascended by 2.5 per cent or 30.33 points to 1,242.38 points.

Hydropower climbed 2.42 per cent or 43.05 points to 1,823.37 points. Share price of Chilime rested at Rs 891, up 2.18 per cent, while Sanima Mai settled at Rs 405, up 2.01 per cent.

Finance rose by 1.41 per cent or 9.98 points to 717.76 points, and manufacturing went up by 1.03 per cent or 25.18 points to 2,475.66 points.

The gain witnessed by hotels and others subgroups came in below one per cent. Hotels inched up by 0.99 per cent or 20.60 points to 2,104.45 points, while others edged up by 0.24 per cent or 1.83 points to 763.48 points.

Prabhu Bank secured the top position in terms of trading volume and turnover, with 293,000 of its shares changing hands that amounted to Rs 67.15 million. Nepal Life Insurance Co (Promoter) with Rs 60.50 million, Nepal Life Insurance Co with Rs 58.04 million, Nepal Investment Bank with Rs 56.59 million and Kumari Bank with Rs 56.49 million rounded up the top five companies with highest weekly turnover.

Nepal Investment Bank was the forerunner with regards to number of transactions — 590.

NEW LISTINGS

Company

Type

Units

Guheshwori Merchant Banking and Finance

Rights

1,973,928.77

Jebils Finance

Rights

2,889,562.50

Oriental Hotel

Bonus

1,425,106.35

Support Microfinance Bittiya Sanstha

Ordinary

600,000.00

Source: Nepse