Govt able to reduce revenue shortfall

The government has substantially reduced the revenue shortfall witnessed in recent months that had widened during supply disruptions from India. The government has missed revenue collection target by Rs 18.17 billion during the first 11 months of this fiscal, according to the Revenue Division of the Ministry of Finance.

The government had witnessed a shortfall of Rs 50.5 billion as compared to the target till the ninth month of this fiscal due to contraction in imports caused by the border blockade organised by the Madhes-based political parties.

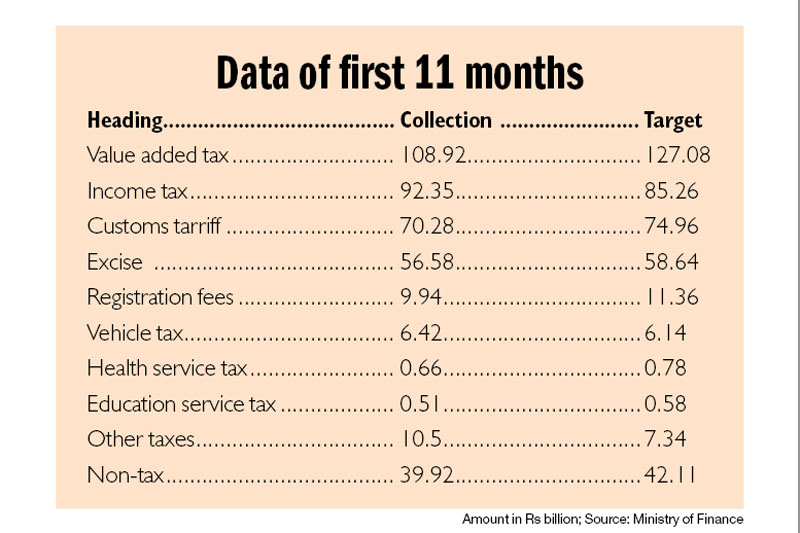

The government has collected Rs 396.1 billion against the target of Rs 414.27 billion in the first 11 months of the current fiscal.

Government’s revenue collection in review period is less by Rs 50 million as compared to the corresponding period of the previous fiscal 2014-15.

The government missed revenue collection target under all major headings except income tax and vehicle tax. In the review period, the government was able to collect Rs 70.28 billion through customs tariff, which is 94 per cent of the target.

Shortfall in collection of value added tax (VAT) — a major tax heading — stood at Rs 18.16 billion. Under the VAT heading, the government collected Rs 108.92 billion. The amount collected under VAT is 86 per cent of the target. The government collected Rs 56.58 billion through excise in the review period against the target of Rs 58.65 billion.

Under the education and health service taxes, the government was able to collect revenue worth Rs 507.62 million and Rs 664.79 million — 87 and 85 per cent of the target, respectively. The government also missed collection target under registration fees, with the collection of Rs 9.94 billion against the target of Rs 11.36 billion.

Similarly, government also missed non-tax revenue collection target. It collected Rs 39.92 billion under non-tax revenue heading, which is 95 per cent of the target.

The government, however, exceeded revenue collection target under income tax and vehicle tax. The government managed to collect Rs 92.35 billion under income tax against the target of Rs 85.26 billion. Similarly, the collection for vehicle tax stood at Rs 6.42 billion, while the target till the first 11 months of the fiscal was Rs 6.14 billion.

The government has a target to collect revenue worth Rs 475 billion in this fiscal. To meet this target, it needs to collect Rs 78.9 billion in the last month. However, the revenue collection in the 11th month (mid-May to mid-June) was not encouraging like in the 10th month (mid-April to mid-May). The government had collected Rs 60.82 billion in the 10th month. The monthly revenue collection in the last month of the review period, however, stood at Rs 38.89 billion.