Investor sentiment takes a hit

Kathmandu, October 14

Nepal Stock Exchange (Nepse) index dropped more than two per cent during the five trading days of the week between October 8 and 12 — the week after the declaration of leftist alliance in the country for the forthcoming elections. The country’s sole secondary market had started to decline in the previous week just after the declaration of the leftist alliance.

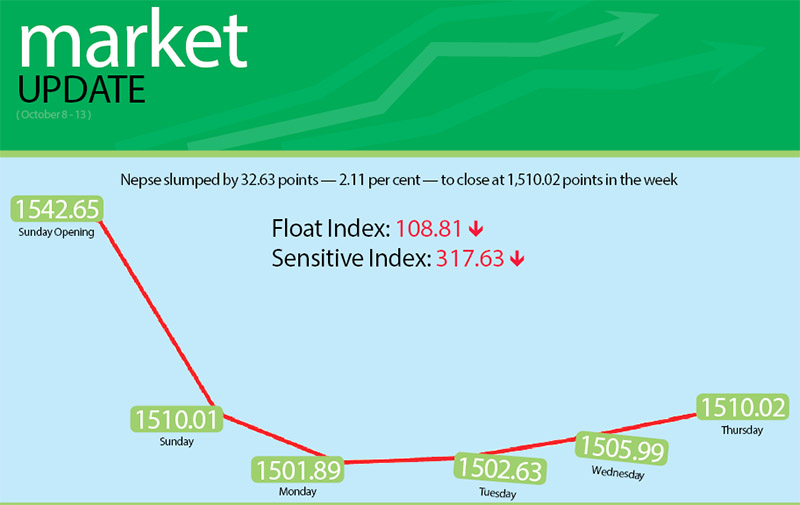

Opening at 1,542.65 points on Sunday, the benchmark index had slumped by 32.64 points by the time of closing for the day. Nepse index slipped further to 1,501.89 points on Monday. However, the local bourse reversed course thereafter — inching up to 1,502.63 points on Tuesday, edging up to 1,505.99 points on Wednesday and finally resting at 1,510.02 points on Thursday.

In tandem with Nepse index, the sensitive and float indices also dipped in the review period. The sensitive index fell to 317.63 points, declining by 1.93 per cent and the float index landed at 108.81 points, down 2.54 per cent.

According to the investors, the political development of the last two weeks had a major role in dragging the secondary market down.

Nawaraj Acharya, chairman of Nepal Capital Market Investors Association, said that investor sentiment has taken a hit as the latest political developments have created uncertainty regarding the elections. “Moreover, banks have still not slashed the interest rates, even though the credit crunch situation has eased, which has also dampened the mood,” he said.

Another technical reason, according to Acharya, is uncertainty in implementation of the fully automated trading platform. Nepse had declared that the fully automated trading system would be implemented from November. But, there has been no headway in this front.

Apart from the sub-index of others, all the sub-indices landed in the red during the week. The others sector rested at 779.72 points, inclining by 6.47 per cent or 47.43 points in the review period. This was basically on the back of share price of Nepal Telecom — the company with the highest market capitalisation among the listed companies — surging by 7.73 per cent to Rs 780.

The sub-index of commercial banks fell by 2.75 per cent to 1,295.78 points in the week. Share price of Everest Bank came down to Rs 1,210, down 1.47 per cent. Similarly, shareholders of Standard Chartered Bank saw their share value drop by 4.13 per cent to Rs 2,114 per unit.

Sub-index of development banks declined by 3.65 per cent to 1,839.25 points during the week. Similarly, sub-index of finance also slipped by 2.77 per cent to 771.95 points. The manufacturing sector closed at 2,567.73 points, declining by 44.45 points or 1.7 per cent.

Similarly, the sub-index of hotels rested at 2,322.39 points, falling 72.31 points or 3.02 per cent during the review period. The hydropower sector shed 2.05 per cent to 1,793.32 points in the week. Likewise, the trading sector slipped by 13.6 points or 5.81 per cent to 220.27 points. The sub-index of insurance sector closed at 8,247.25 points, with a loss of 211.10 points or 2.49 per cent.

A total of 3.94 million units of shares of 172 companies worth Rs 1.76 billion were traded through 20,008 transactions in the review period.

Chilime Hydropower Company topped the list in terms of transactions with Rs 135.63 million. Similarly, Standard Chartered Bank was in the second position with Rs 65.03 million, Nepal Telecom was in the third position with Rs 55.65 million, Nepal Bank was in the fourth position with Rs 55.14 million and Nepal Life Insurance Company was in the fifth position with Rs 52.72 million in the review period.

Likewise, Nepal Bank secured the top position in terms of trading volume with 162,000 units of its shares changing hands and Chilime Hydropower Company was the forerunner in terms of number of transactions, with 1,122.

New listings

Company

Type

Unit

Lumbini General Insurance

Rights

3,900,000

NB Insurance Company

Rights

2,700,000

Purnima Bikash Bank

Rights

66,911.82