Investor speculations cause share market volatility

Kathmandu, September 16

The country’s sole secondary market witnessed massive volatility over the five days of the week between September 10 and 14.

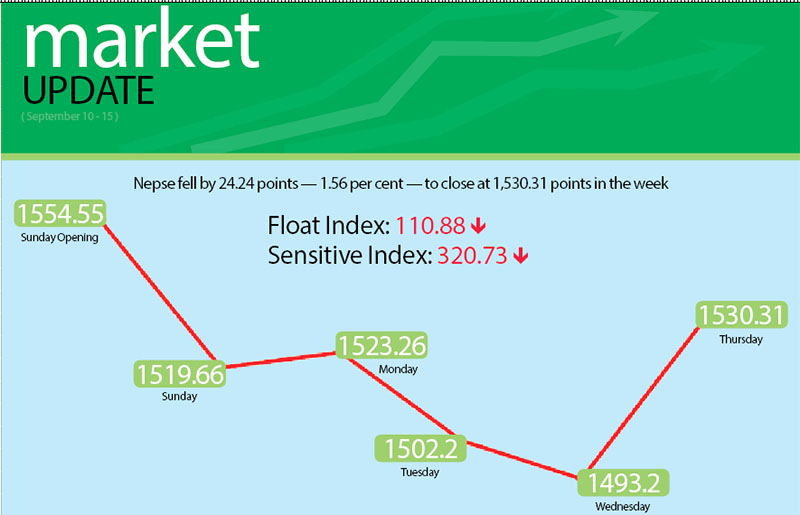

Opening at 1,554.55 points on Sunday, the benchmark index had dropped as much as 61 points before recovering some of the loss on last trading day of week to limit its weekly loss to 1.56 per cent to close at 1,530.31 points on Thursday.

Nepal Stock Exchange (Nepse) index had dropped to 1,519.66 points by the time of closing on Sunday. But on Monday, the market went up slightly and closed at 1,523.26 points. The local bourse was southbound on Tuesday and Wednesday resting at 1,502.2 points and 1,493.2 points, which was the lowest point during the week. Even though the Nepse index surged by 37.11 points — the highest gain of the week — on Thursday, it was insufficient to offset the earlier losses.

Moving in tandem with the benchmark index, sensitive index fell to 320.73 points, down by 1.61 per cent, and float index settled at 110.88 points, down 1.47 per cent.

Mekh Bahadur Thapa, chief executive officer of NIBL Capital, said market speculations could be attributed for the massive fluctuations seen in the market. “Investor sentiment was weighed down by the rumours that the regulatory authorities have started the process of investigating the investment made by large investors in the stock market and credits of banking sector, which created pressure on the secondary market,” he said.

Thapa also said that though the selling pressure had weighed on the benchmark index for most part of the week, the market rebounded towards the end of the week as savvy investors sought to capitalise on the reduced share prices.

The sub-index of commercial banks declined by 1.68 per cent during the week to 1,316.7 points. Share price of commercial banks like Everest dropped by 2.52 per cent to Rs 1,240 per unit.

The sub-index of development banks declined by the highest margin — 3.45 per cent to 1,917.43 points. Share price of National Microfinance Bittiya Sanstha listed under the development banks slumped by 11.53 per cent to Rs 3,224 and that of Laxmi Laghubitta plunged by 16.83 per cent to Rs 1,730 during the week.

Similarly, hydropower sector also shed 1.24 per cent to land at 1,762.98 points during the trading week. The sub-index of insurance sector also fell by 1.65 per cent to 8,515.83 points. The hotels sector dipped by 0.17 per cent to 2,374.09 points in the week.

Conversely, after holding steady for months, the trading sub-index soared by eight per cent to 231.25 points, primarily on the back of share value of Bishal Bazar Co surging by Rs 203 to Rs 2,233. Similarly, manufacturing sector inched up by 0.7 per cent to 2,592.32 points. The sub-indices of finance and others sectors also went up slightly. During the week, sub-index of finance edged up by 0.96 per cent to 789.82 points and others by 0.40 per cent to 718.99 points.

Altogether, 6.8 million shares of 177 companies worth Rs 3.61 billion were traded through 35,844 transactions in the week. The traded amount was 55.8 per cent higher than the total weekly turnover of the previous week of Rs 2.32 billion.

Nabil Bank secured the top position in terms of total turnover during the review period with Rs 191.44 million. It was followed by Nirdhan Utthan Bank Ltd with Rs 169.62 million, Nepal Life Insurance Company with Rs 158.28 million, Nepal Bank with Rs 123.29 million and Nepal Investment Bank with Rs 116.1 million.

Nepal Bank topped the list in terms of trading volume with 354,000 of its shares changing hands during the trading week and Himalayan Power Water was the topper in terms of number of transactions — 1,947.

New listings

Name

Type

Unit

Hamro Bikash Bank

Rights

370,351

Mirmire Microcredit Development Bank

Rights

150,000

Swarojgar Laghubitta Bikas Bank

Rights

349,993.60