Land revenue did not meet target

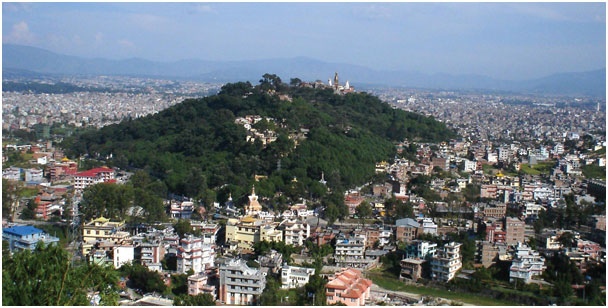

Kathmandu

In the fiscal year 2015-16, the Department of Land Reform and Management (DoLRM) could not meet its annual target of land and house revenue collection. The department’s target of collecting Rs 12.011 billion revenue could not be met and it was only able to collect Rs 11.909 billion. However, it witnessed a nine per cent increase in revenue collection in the fiscal year 2015-16 as compared to the previous fiscal year. According to data maintained by DoLRM, it collected Rs 11.90 billion against Rs 10.88 billion in the fiscal year 2014-15 from 104 different revenue collection offices across the country.

Stakeholders stated that due to the earthquake and blockade they could not meet the target. “Housing and land transactions could not move as much as expected in the first three quarters of the fiscal year due to the economic turmoil and blockade in Terai region,” said Uma Sharma, Section Officer at the Planning Department of DoLRM. However, she said that during the last quarter, land and house revenue collection jumped by 300 per cent when compared to the monthly target. According to her, the highest revenue was collected in mid-June to mid-July that totaled Rs 1.965 billion against the target of Rs 646.78 million which was 304 per cent higher.

Sharma informed, “The main reasons for overwhelming revenue collection at the end of the fiscal year was to avoid increment of minimum land valuation in the new fiscal, taking momentum on the reconstruction process and transferring properties.” Citing that increment of municipalities also significantly increased revenue collection, she said, “In VDCs only two per cent of registration tax is charged but with the announcement of VDCs into municipalities, the tax is four per cent and thus revenue increased.”

Revenue collection in the Kathmandu valley went up significantly by 60 per cent as compared to the previous fiscal. DoLRM collected capital gain tax of Rs 1490.72 million in the fiscal year 2015-16, while it collected Rs 934.68 million in the previous year from seven Inland Revenue Offices (IROs). Kathmandu (Dillibazar) IRO topped the chart with collection of Rs 343.53 million in the fiscal year 2015-16 with the same figure in the previous year.

“Being in the heart of the capital, the minimum valuation of land and houses in our area is high. This is the main reason why even though we have fewer transactions the revenue collection is the highest in the valley,” said Padmanidhi Soti, Chief Revenue Officer at Kathmandu (Dillibazar) IRO. According to him, they had the maximum transactions from banking institutions in the fiscal. “As the government has introduced loan schemes for reconstruction after the earthquake, we earned most of the revenue collection on transfer of property to banking institutions for loan,” informed Soti, adding that the transaction of apartments was nil after the earthquake.

Chabahil and Lalitpur LROs collected revenues that were up by 100 per cent as compared to the previous fiscal year. Chabahil collected Rs 265.08 million against Rs 100.52 million. The LRO of Lalitpur collected Rs 329.39 million revenue against Rs 163.74 million in the previous year. The revenue collection of Bhaktapur IRO increased by 40 per cent as compared to the previous fiscal. It collected Rs 150.70 million against Rs 106.94 million earlier.

A broker at Bhaktapur said, “The demand for land and houses from genuine buyers in Bhaktapur has increased significantly since mid-April,” adding that the price of land went up by 35 per cent. According to him, land that cost Rs 400,000 per anna last year is now being transacted at Rs 700,000.

He said that the land from Southern Sipadol to Western Nil Barahi areas are in high demand. He further added, “As the road from Bhaktapur connects Bardibas, the demand and valuation of land is high.” According to him, Bhaktapur became the second choice of preference for residential areas after Lalitpur.