Liquidity crisis hits secondary market

Kathmandu, November 9

Share investor confidence has gone on a tailspin with banks and financial institutions reeling under liquidity crunch.

“We have been facing liquidity crisis even after the festivals have ended as BFIs are struggling to attract deposits,” said Radha Pokharel, chairperson of Nepal Pujibazar Laganikarta Sangh.

BFIs are facing liquidity crunch as the government has not sanctioned around Rs 100 billion that the state agencies need to pay to the contractors for various development works.

The issue of liquidity has added to the woes of share investors, who were already grappling with lack of policy clarity at Nepal Stock Exchange (Nepse).

Share analysts claim the government, especially the share market regulator, has not been doing its part in addressing the concerns of investors, which is why the secondary market has been gripped by the bearish trend for months now.

“Despite our repeated requests, the government is yet to address our concerns like finalising calculation method of capital gains tax and reducing cap on margin loans,” said Pokharel.

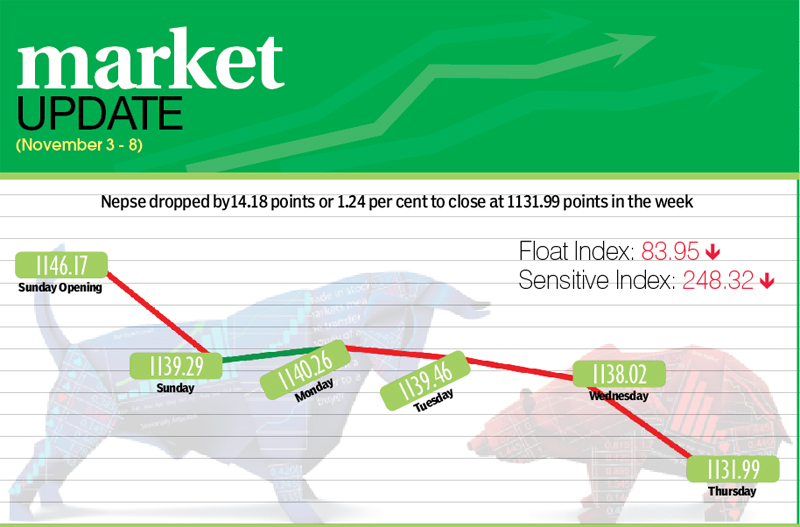

As a result, Nepse index fell by 1.24 per cent or 14.18 points to 1,131.99 points in trading week of November 3 to 7. Sensitive index slipped by 1.49 per cent or 3.76 points to 248.32 points and float index shed 0.97 per cent or 1.14 points to 83.95 points.

Weekly turnover stood at Rs 1.23 billion. In the previous week, the market was open for only one day and had recorded transactions worth Rs 254 million. In this regard, the average daily turnover in the review week dropped by 3.09 per cent to Rs 246.46 million.

The secondary market had opened on Sunday, with the benchmark index at 1,146.17 points. It had dropped by 6.88 points by the end of the day. The market went up by 0.97 point on Monday. However, the market reversed course the next day and remained southbound for the rest of the week — down 0.81 point on Tuesday, 1.44 points on Wednesday and 6.05 points on Thursday.

In the review week, trading, mutual funds, microfinance and hydropower sub-indices managed to land in the green zone.

The trading subgroup was the biggest gainer, climbing by 12.46 per cent or 36.16 points to 326.39 points. This was due to share price of Salt Trading Corporation jumping by Rs 65 to Rs 723. Likewise, mutual funds sub-index went up by 3.29 per cent or 0.30 point to 9.4 points.

Microfinance rose by 0.71 per cent or 10.56 points to 1,479.56 points and hydropower inched up by 0.05 per cent or 0.48 point to 949.71 points.

Conversely, others subgroup was the biggest loser of the week, slumping by 3.26 per cent or 21.30 points to 630.60 points, weighed down by share price of Nepal Telecom dropping Rs 21 to Rs 617. Similarly, finance sub-index fell by 2.25 per cent or 12.96 points to 561.02 points and hotels subgroup slipped by 2.13 per cent or 38.93 points to 1,782.40 points.

Moreover, banking subgroup fell by 1.37 per cent or 14 points to 1,039.18 points and manufacturing landed at 2,395.74 points, down 1.33 per cent or 32.23 points.

Similarly, life insurance subgroup slipped by 1.12 per cent or 45.75 points to 5,007.84 points. Non-life insurance sub-index shed 0.92 per cent or 38.44 points to 4,140.77 points and development banks fell by 0.92 per cent or 14.39 points to 1,550.55 points.

In the review week, Prabhu Bank was the leader in terms of weekly turnover with Rs 147.23 million. It was followed by NMB Bank with Rs 112.64 million, Nabil Bank with Rs 66.51 million, Prabhu Bank (Promoter Share) with Rs 57.39 million and Nepal Bank with Rs 51.87 million.

In terms of weekly trading volume also Prabhu Bank was the forerunner with 553,000 of its shares changing hands. NMB Bank with 328,000 shares, Nepal Bank with 166,000 shares, Mega Bank Nepal with 124,000 shares and NCC Bank with 27,000 shares rounded up the top five in this category.

Meanwhile, Rasuwagadhi Hydropower topped in terms of number of transactions with 1,499 transactions. It was followed by Sanjen Jalavidhyut with 1,369, Prabhu Bank with 994, NMB Bank with 971 and Nabil Bank with 662 transactions.

New listing

Company Type Units

NMB Bank Merger 19,115,790.56