Nepse drops for second consecutive week

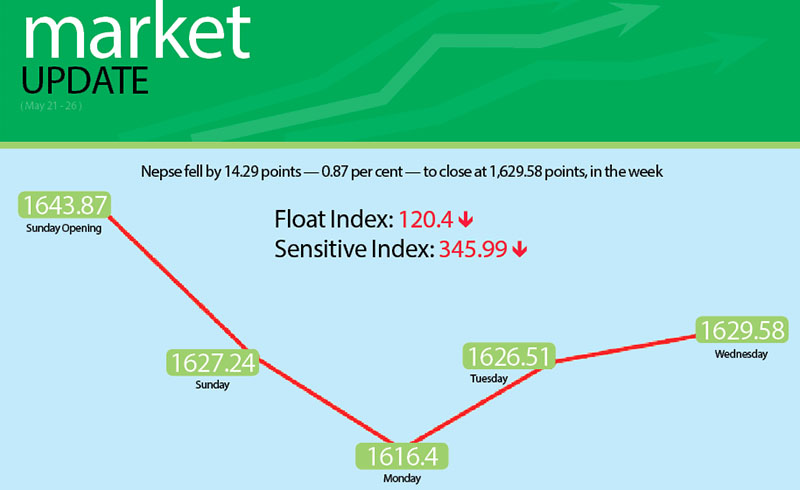

The Nepal Stock Exchange (Nepse) index recorded a week-on-week loss of 14.29 points or 0.87 per cent in the trading week between May 21 and 24.

Whereas the country’s only secondary market used to be bullish during elections in the past, Nepse seemed less affected by the local polls this time around — a sign of market maturity, according to share market analysts. “The market movement would likely be governed by the budget announcement in the coming week.”

The benchmark index, which had opened at 1,643.87 points on Sunday, had dropped by 16.63 points by the day’s closing. Continuing southbound, Nepse index fell by another 10.84 points on Monday. Starting Tuesday, however, the local bourse reversed course and nearly recovered the loss of the previous day by going up 10.11 points. On Wednesday, Nepse inched up by 3.07 points. Since Thursday was a public holiday, the benchmark index closed the week at 1,629.58 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, slipped by 3.95 points or 1.13 per cent to 345.99 points. Similarly, the float index that measures the performance of shares actually traded also dropped by 1.03 points or 0.85 per cent to 120.40 points.

Altogether, 4.57 million shares of 155 companies that amounted to Rs 2.69 billion were traded through 23,735 transactions during the week. The traded amount was 4.27 per cent higher than the preceding week when 18,428 transactions of 8.33 million shares of 155 firms worth Rs 2.58 billion had been undertaken.

Among the subgroups, trading held steady at 212.76 points.

Similar to the previous week, manufacturing subgroup saw significant surge — up 137.18 points or 5.89 per cent to 2,464.46 points. This was on the back of Bottlers Nepal (Tarai)’s share value increasing by a

staggering 19.28 per cent to Rs 7,205, and that of Himalayan Distillery soaring by an eye-popping 43.36 per cent to Rs 820.

Finance and others also managed to land in the green zone. However, their gain was limited to less than one per cent — finance rose by 6.45 points or 0.83 per cent to 780.65 points and others inched up by 4.05 points or 0.59 per cent to 691.23 points.

The rest of the subgroups landed in the red, with hotels leading the pack of gainers. With a drop of 51.25 points or 2.23 per cent, hotels subgroup wiped out the gain of 1.68 per cent of the previous week and the sub-index landed at 2,244.74 points in the review period. Soaltee’s shareholders saw their stock price fall by 2.46 per cent to Rs 357. Oriental lost 2.08 per cent to Rs 705 and Taragaon Regency descended by 1.76 per cent to Rs 279.

After managing to limit its loss of 0.39 per cent in the past week, insurance subgroup plummeted by 128.58 points or 1.45 per cent to land at 8,758.75 points this time around. This was because of the subgroup heavyweights like Nepal Life slumping by 3.27 per cent to Rs 2,190 and Life Insurance Corporation taking a dive of 23.86 per cent to Rs 2,170, among others.

Banking subgroup retreated by 19.43 points or 1.31 per cent to 1,458.17 points. Commercial banks like Standard Charted was down 4.52 per cent to Rs 2,196 and Everest dropped by 2.97 per cent to Rs 1,698.

Similarly, hydropower landed at 2,066.16 points, down 25.44 points or 1.22 per cent. Chilime plunged by 2.05 per cent to Rs 860, Barun fell by 1.36 per cent to Rs 290 and Dibyashwari lost 3.43 per cent to Rs 225.

Development banks shed 5.72 points to 1,970.26 points, limiting its loss to 0.29 per cent. Nagbeli fell by 1.24 per cent to Rs 3,190 and Chhimek dipped by 0.96 per cent to Rs 1,644.

Meanwhile, Himalayan General Insurance Co retained its top spot in terms of turnover with Rs 137.68 million, followed by Siddhartha Bank with Rs 126.36 million, Standard Chartered Bank with Rs 121.39 million, Nepal Bank with Rs 107.67 million and Nepal Life Insurance Co with Rs 104.11 million.

Lalitpur Finance (Promoter) was the forerunner in terms of trading volume, with 444,000 of its shares changing hands.

Mero Microfinance Bittiya Sanstha topped the chart with regard to most number of transactions — 1,889.