Nepse index edges up by 0.49pc

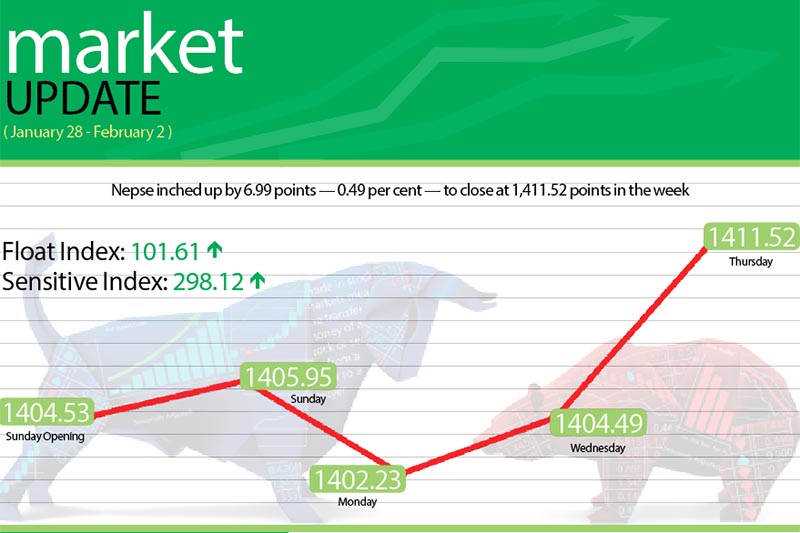

In a relatively stable trading week between January 28 and February 1, the Nepal Stock Exchange (Nepse) index rose by 6.99 points or 0.49 per cent week-on-week.

Opening at 1,404.53 points on Sunday, the benchmark index had inched up 1.42 points to 1,405.95 points by the day’s closing. On Monday, Nepse dropped by 3.72 points to 1,402.23 points. The secondary market remained closed on Tuesday as the country observed Shahid Diwas (Martyr’s Day). The local bourse reversed course and gained 2.26 points to reach 1,404.49 points on Wednesday and rose by 7.03 points on Thursday to close the week at 1,411.52 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 1.71 points or 0.58 per cent to 298.12 points. Likewise, the float index that measures the performance of shares actually traded also edged up by 0.56 point or 0.55 per cent to 101.61 points.

In total, 3.47 million shares of 172 companies worth Rs 1.37 billion were traded through 16,769 transactions. The traded amount was 21.28 per cent less than the preceding week when 19,133 transactions of 5.06 million shares of 177 companies that amounted to Rs 1.74 billion had been undertaken.

It has to be noted though that the country’s sole secondary market had remained open for trading for the normal five days in the previous week. The results were mixed for the 10 subgroups, with five logging gains while the other five recording losses.

Development banks led the pack of gainers, rising by 1.12 per cent or 17.54 points to 1,584.08 points. Swabhalamban rose by 1.92 per cent to Rs 1,325 and Chhimek inched up 0.69 per cent to Rs 1,027, among others.

Trading went up by 0.86 per cent or 1.85 points to 215.62 points, on the back of Bishal Bazar Co’s share value going up by 1.11 per cent to Rs 2,010.

Banking, the share market heavyweight, settled at 1,227.08 points, rising by 0.81 per cent or 9.88 points. Even as Everest lost 0.46 per cent to Rs 863, share price of commercial banks like Nepal Investment jumped by 2.29 per cent to Rs 669, which propped up the sub-index.

Microfinance inched up by 0.68 per cent or 11.42 points to 1,698.54 points and insurance sub-index rested at 7,227.54 points by advancing 34.24 points or 0.47 per cent.

Hydropower, on the other hand, dropped by 1.36 per cent or 25.37 points to land at 1,832.27 points. The subgroup was weighed down by Chilime retreating by 1.35 per cent to Rs 875 and Barun down 2.66 per cent to Rs 183.

The rest of the losers in the review period managed to limit their losses below one per cent. Hotels dipped by 0.37 per cent or 7.99 points to 2,136.24 points, manufacturing slipped by 0.3 per cent or 7.44 points to 2,483.73 points, others was down 0.22 per cent or 1.73 points to 765.83 points and finance shed 0.02 per cent or 0.16 point to 716.31 points.

Sanima Mai Hydropower secured the top spot in terms of weekly turnover with Rs 82.52 million. It was followed by Nepal Life Insurance with Rs 78.04 million, Nepal Bank with Rs 76.35 million, Nabil Bank with Rs 47.27 million and Laxmi Bank with Rs 46.30 million.

Nepal Bank was the forerunner in terms of trading volume with 211,000 of its shares changing hands, while with 674 transactions logged in its name, Nepal Investment Bank took the lead in terms of most number of transactions.

New listings

Company

Type

Unit

Global IME Bank

Bonus

8,080,341.66

Kabeli Bikas Bank

Bonus

140,352.00

Laxmi Bank

Bonus

7,472,412.00

Siddhartha Insurance

Bonus

1,069,035.00

Source: Nepse