Nepse index surges nearly 10pc

The country’s only secondary market saw the share market bull propel the Nepal Stock Exchange (Nepse) index to over a three-month high in the week of March 19 to 23. Also in a clear indication of improving investor sentiment, the daily traded amount averaged Rs 1.15 billion in the review period, against Rs 448 million in the previous week.

“Investors have been attracted to the secondary market in recent days on expectations of the local polls being held in the near future,” explained Priya Raj Regmi, president of Stock Brokers Association of Nepal, adding that as we have a relatively thin market, it is bound to witness some volatility.

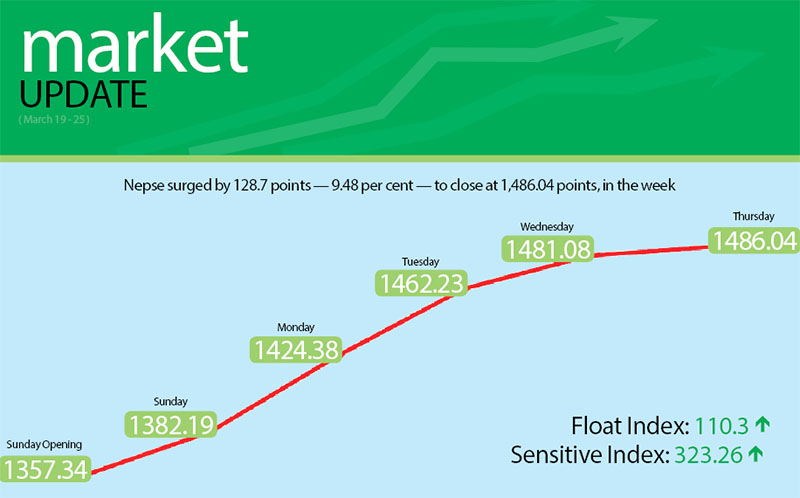

Opening at 1,357.34 points on Sunday, the benchmark index had gone up by 24.85 points by the day’s closing. The local bourse surged by 42.19 points on Monday, surging past the barrier of 1,400 points. With investor optimism showing no sign of abating, Nepse index advanced by 37.85 points on Tuesday and added another 18.85 points on Wednesday. Thursday’s gain was relatively muted at 4.96 points, with Nepse index ending the week at 1,486.04 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 28.43 points or 9.64 per cent to 323.26 points.

Likewise, the float index that measures the performance of shares actually traded also went up by 10.25 points or 10.24 per cent to 110.3 points.

All in all, 1.08 billion shares of 155 companies that amounted to an eye-popping Rs 5.78 billion were traded through 41,363 transactions during the week. The traded amount was a whopping 222.13 per cent higher than the previous week when 12,759 transactions of 3.85 million shares of 156 firms worth Rs 1.79 billion had been undertaken. It has to be noted, though, that the share market had remained open for only four days in the previous week owing to a public holiday.

According to Regmi, the trading volume and turnover are directly correlated to the movement of the benchmark index — meaning, share investors flock to the market when the market moves north.

Moreover, the upsurge in the share market is also ‘seasonal’ meaning that the country’s secondary market usually witnesses bull run starting mid-March as most listed companies would have declared their dividends through annual general meetings and investors who invest in shares within the next four months can get their returns the next year.

While trading remained steady at 206.16 points, all the subgroups landed in the green zone.

The insurance subgroup retained its top position among the gainers by surging 963.69 points or 15.39 per cent to 7,226.9 points.

Development banks posted a rise of 182.19 points or 12.37 per cent to land at 1,655.32 points.

Adding to the previous week’s gain of 2.79 per cent, the hydropower subgroup ascended 191.47 points or 11.65 per cent to 1,835.36 points.

Hotels more than recovered the loss of 0.79 per cent of the past week by rebounding by 164.66 points or 9.18 per cent to 1,957.6 points.

Banking advanced by 112.13 points or 8.72 per cent to 1,398.17 points.

Finance climbed 48.86 points or 7.92 per cent to 665.74 points.

Others rose by 12.43 points or 1.9 per cent to 666.94 points.

Inching up 0.45 point or merely 0.02 per cent, the manufacturing subgroup landed at 2,181.56 points.

Meanwhile, National Life Insurance Co secured the top position in terms of weekly turnover with Rs 325.56 million, followed by Nepal Credit and Commerce Bank with Rs 252.72 million, Nepal Bangladesh Bank with Rs 220.45 million, Prabhu Bank with Rs 218.63 million and Sanima Bank with Rs 213.34 million.

With regard to trading volume, National Hydropower topped the chart with 849,000 of its shares changing hands.

Nepal Bangladesh Bank recorded the most number of transactions — 1,892.