Nepse index witnesses minor drop

Share investors seemed to be in wait-and-see mode in the period between January 21 and 25, with the Nepal Stock Exchange (Nepse) index recording a minor week-on-week dip of 1.99 points or 0.14 per cent.

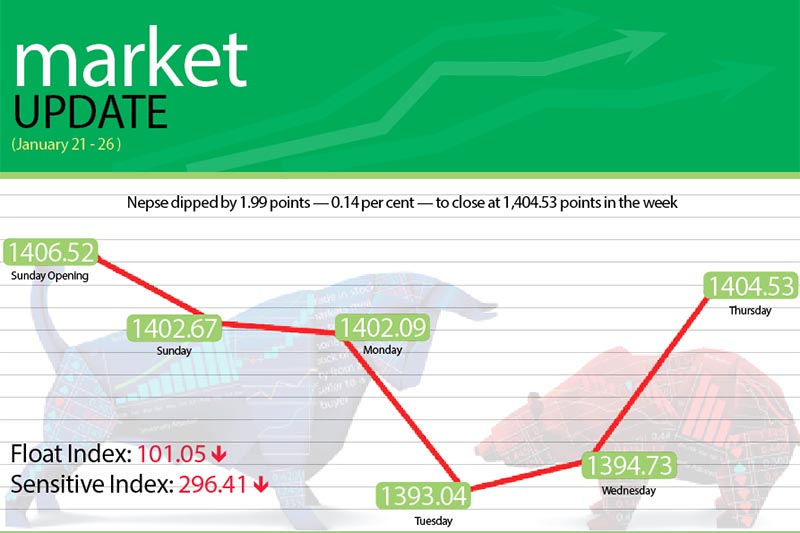

Starting the week at 1,406.52 points on Sunday, the benchmark index had dipped by 3.85 points by the time of closing for the day. Nepse index continued in the downward trajectory for the next two days, shedding 0.58 point on Monday and dropping by 9.05 points on Tuesday to retreat below the psychological level of 1,400 points. The local bourse reversed course thereafter, inching up by 1.69 points on Wednesday and gaining 9.80 points to rise above the threshold of 1,400 points again and close the week at 1,404.53 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, slipped by 0.45 point or 0.15 per cent to 296.41 points. Similarly, the float index that measures the performance of shares actually traded also edged down by 0.09 point or 0.09 per cent to 101.05 points.

Altogether, 5.06 million shares of 177 companies worth Rs 1.74 billion were traded through 19,133 transactions in the week. The traded amount was 58.74 per cent higher than the preceding week when 12,728 transactions of 2.46 million shares of 170 firms worth Rs 1.09 billion had been undertaken.

It has to be noted though that the share market had remained open for only four days in the previous week due to public holiday, against normal five days in review period.

Half of the subgroups witnessed some gain, while the other half landed in the red during the trading week.

Trading took the lead among the gainers, advancing by 12.79 per cent or 24.24 points to rest at 213.77 points. The subgroup was propelled by share price of Bishal Bazar Company surging by 16.87 per cent to Rs 1,988.

Manufacturing gained 1.57 per cent or 38.63 points to 2,491.17 points, primarily because of Unilever Nepal adding two per cent to Rs 28,311.

Hotels rose by 1.45 per cent or 30.72 points to 2,144.23 points. Taragaon Regency surged by five per cent to Rs 315, Soaltee went up by 1.46 per cent to Rs 277 and Oriental inched up by 0.45 per cent to Rs 667.

Others ticked up 0.09 per cent or 0.73 points to 767.56 points, while banking settled at 1,217.20 points, up 0.04 per cent or 0.52 points.

Conversely, insurance subgroup dropped by 1.06 per cent or 77.14 points to 7,193.30 points. The sub-index was weighed down by share value of insurance companies like National Life losing 1.64 per cent to Rs 1,495 and Premiumdescending by 3.57 per cent to Rs 1,349, among others.

Microfinance landed at 1,687.12 points, down 0.87 per cent or 14.86 points; finance slipped by 0.37 per cent or 2.65 points to 716.47 points; development banks edged down by 0.27 per cent or 4.31 points to 1,566.54 points; and hydropower dipped by 0.19 per cent or 3.59 points to close the week at 1,857.64 points.

Sanima Mai Hydropower was the forerunner in terms of total weekly turnover with Rs 160.76 million, followed by Global IME Bank (Promoter Share) with Rs 109.83 million, Nabil Bank with Rs 60.20 million, First Microfinance Development Bank with Rs 55.05 million and Neco Insurance with Rs 45.64 million.

Global IME Bank (Promoter Share) took the lead in terms of trading volume with its 615,000 shares changing hands, while First Microfinance Development Bank recorded most number of transactions — 776.

New listings

Company

Type

Unit

Om Development Bank

Rights

4,931,835.00

Surya Life Insurance

Bonus

656,250.00