Trading muted in secondary market

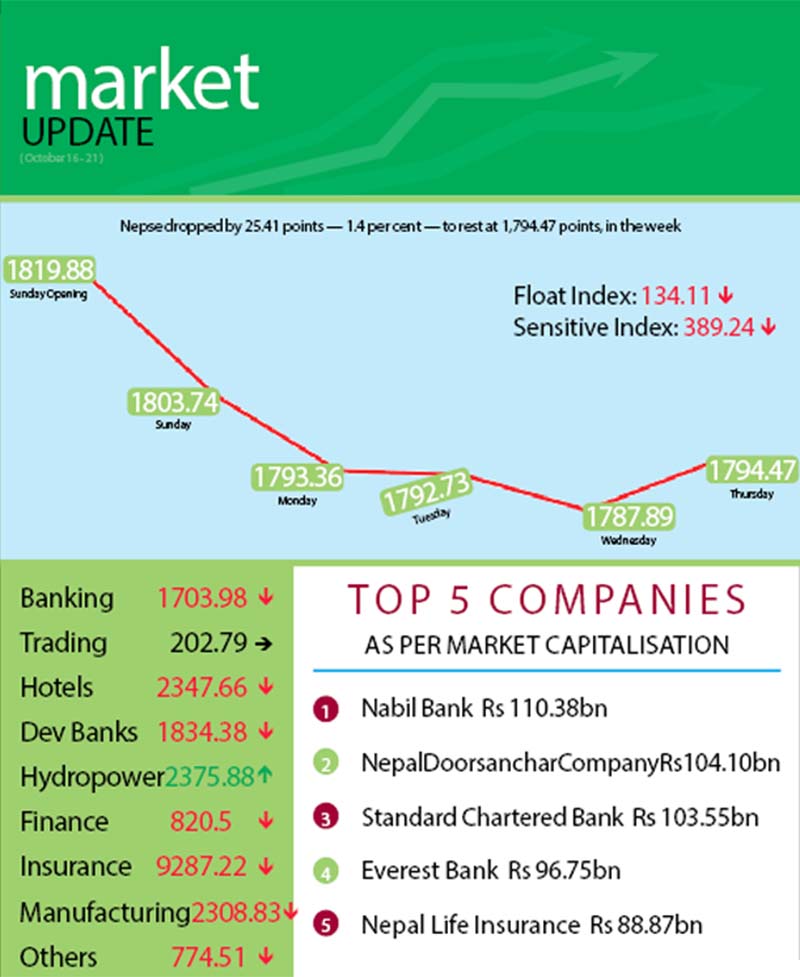

The country’s only secondary market witnessed muted trading in the week after Dashain holidays, while the Nepal Stock Exchange (Nepse) index dropped 25.41 points or 1.4 per cent to 1,794.47 points between October 16 to 20.

After a week-long break as the country celebrated Dashain festival, the benchmark index had opened at 1,819.88 points on Sunday. Nepse had dropped 16.14 points by the day’s closing and continued southbound the next three days. On Monday, Nepse index retreated below the 1,800-point threshold by falling 10.38 points, dipped 0.63 point on Tuesday and shed another 4.84 points on Wednesday. The local bourse managed to inch up 6.58 points on Thursday.

Altogether, 3.89 million shares of 149 companies worth Rs 3.01 billion were traded through 17,178 transactions in the week. In the week preceding the Dashain holidays, the share market had recorded 21,955 transactions of 5.5 million scrips of 158 listed firms that amounted to Rs 4.75 billion.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 5.89 points or 1.49 per cent to 389.24 points. Likewise, the float index that measures the performance of shares actually traded also dipped by 1.98 points or 1.45 per cent to 134.11 points.

Apart from trading, which has remained stationery at 202.79 points since June 28, hydropower was the sole subgroup to witness gain in the trading week. Hydropower sub-index inched up 8.41 points or 0.35 per cent to 2,375.88 points. This was on the back of share value of Sanima Mai advancing by 2.69 per cent to Rs 955, and Api up two per cent to Rs 612, among others.

Among the remaining subgroups, hotels saw the biggest plunge of 130.24 points or 5.26 per cent to land at 2,347.66 points. Soaltee’s share price took a dive of 6.09 per cent to Rs 447, that of Taragaon Regency dropped 3.68 per cent to Rs 262 and of Oriental fell 2.75 per cent to Rs 530.

Finance lost 17.56 points or 2.09 per cent to 820.5 points, weighed down by Citizen Investment Trust down 3.14 per cent to Rs 4,601.

Banking — the market heavyweight — retreated by 31.05 points or 1.79 per cent to 1,703.98 points. Commercial banks like Standard Chartered dropped by 1.78 per cent to Rs 3,693 and Nepal Investment fell by 2.7 per cent to Rs 794.

The rest of the subgroups managed to limit their losses below one per cent — development banks was down 15.48 points or 0.84 per cent to 1834.38 points; others was down 6.37 points or 0.81 per cent to 774.51 points; insurance was down 63.9 points or 0.68 per cent to 9,287.22 points; and manufacturing was down 13.91 points or 0.6 per cent to 2,308.83 points.

Meanwhile, Kumari Bank was the forerunner in all three categories — weekly turnover, trading volume and number of transactions — with 628,000 of its scrips worth Rs 386.28 million changing hands through 2,148 transactions.

The other listed companies to make to the list of top five in terms or turnover were Bank of Kathmandu Lumbini with Rs 195.7 million, Shikhar Insurance with Rs 163.62 million, Everest Bank with Rs 154.06 million and Jyoti Bikas Bank with Rs 127.28 million.