Are SEZs losing appeal among domestic investors?

Kathmandu, February 12

Though the government came up with the concept of Special Economic Zones (SEZs) years ago with the view to promote export-oriented industries and overall exports, domestic firms seem to be reluctant to set up industries within such zones.

As an evidence of how SEZs have failed to attract domestic investors following the inability of the government to ensure timely infrastructural set-up within such zones, only 11 out of 19 business firms that had earlier signed an agreement to establish industries within the country’s maiden SEZ have come forward to begin construction of their factories within the Bhairahawa SEZ.

Publishing a notice on January 24, SEZ Authority had called these 19 firms to take approval from the authority to start construction of their factories inside the Bhairahawa SEZ within 15 days. However, only 11 firms had taken the approval from SEZ Authority within the given deadline of last Friday.

Hence, SEZ Authority has now extended the deadline till February 25 for remaining eight domestic companies to take the approval.

Meanwhile, private sector players have said that though SEZs are a good platform for investors, such zones will not lure domestic firms to set up factories there unless the government effectively implements various adopted policies to promote industries within SEZs.

“So far, the government has not completed infrastructural set-up within the SEZ in Bhairahawa and the electricity supply is also still uncertain. This has definitely discouraged investors planning to set up factories inside the Bhairahawa SEZ,” said Bhawani Rana, president of Federation of Nepalese Chambers of Commerce and Industry (FNCCI) — the umbrella body representing country’s private sector, adding that sound infrastructural set-up and implementation of adopted policies to promote industries inside SEZs would attract investors to such zones in the future.

The SEZ Act 2016 envisages developing export-oriented industries in the country by offering raft of incentives to the industries established in SEZ. The law has guaranteed income tax exemption for industries inside SEZ for the first five years of establishment.

Moreover, industries that use up to 60 per cent of domestic raw materials will get 50 per cent income tax exemption for the next five years and 25 per cent exemption for the following five years. The SEZ Act has also envisioned giving zero customs duty facility to such industries while importing raw materials.

“The charm of SEZ depends on how effectively the government implements all these provisions,” added Rana.

However, SEZ Authority is hopeful that the remaining firms that have agreed to set up industries inside Bhairahawa SEZ will take approval from the government within the extended deadline of February 25.

“It is not that investors are not attracted towards SEZs. However, proper coordination among government agencies to ensure quality infrastructure inside planned SEZs is crucial to attract industries within such special zones,” said Chandika Bhatta, executive director at SEZ.

According to him, the firms that have taken approval from the government to start construction of their factories within Bhairahawa SEZ have been seeking more land in recent times, while the SEZ Authority has been finding it difficult to offer them additional plots.

Bhairahawa SEZ has altogether 69 plots and all have been booked already, according to SEZ Authority.

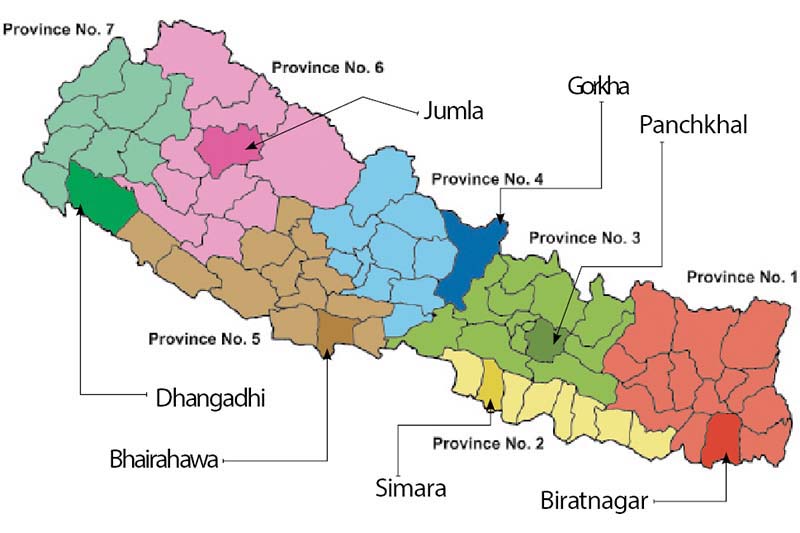

The government plans to set up 14 SEZs across the country — two each in every province — in the long run.