Benchmark index rebounds

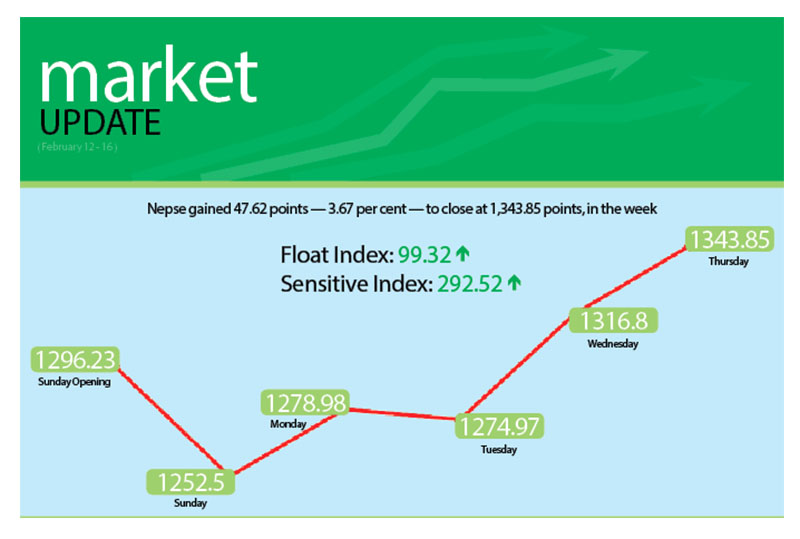

The domestic share market recovered some of the loss of the previous week in the trading week of February 12 to 16 as investors rushed to capitalise on the reduced stock prices. Owing to the buying pressure, the Nepal Stock Exchange (Nepse) index recorded a weekly gain of 47.62 points or 3.67 per cent to close at 1,343.85 points.

Opening at 1,296.23 points on Sunday, the benchmark index had slumped by 43.73 points by the day’s closing as share investors continued to offload their stocks owing to the credit crunch in the financial sector. On Monday, Nepse recovered some of the loss by rising 26.48 points, but shed 4.01 points the next day on profit-booking. On Wednesday and Thursday, the local bourse rebounded by 41.83 points and 27.05 points, respectively to annul the loss of the previous days.

In total, 7.90 million shares of 155 companies worth Rs 2.58 billion were traded through 29,327 transactions during the review period. The traded amount was 48.38 per cent higher than the preceding week when 20,005 transactions of 18.88 million shares of 156 firms that amounted to Rs 1.74 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 11.06 points or 3.93 per cent to 292.52 points. Similarly, the float index that measures the performance of shares actually traded also went up by 3.51 points or 3.66 per cent to 99.32 points.

Whereas trading remained steady at 206.16 points, manufacturing was the only subgroup to land in the red this time around. Share value of Bottlers Nepal (Tarai) dropping by 4.07 per cent to Rs 3,743 and that of Himalayan Distillery down 4.03 per cent to Rs 595 weighed on the manufacturing sub-index, as it fell by 16.66 points or 0.77 per cent to 2,145.2 points.

Conversely, after taking massive hammering in the recent weeks, the insurance subgroup rebounded strongly in the week with the sub-index surging by 428.99 points or 7.97 per cent to 5,809.86 points. Insurance companies like National Life gained 7.92 per cent to Rs 1,784 and Shikhar Insurance soared by 11.18 per cent to Rs 1,820.

Hotels also nearly recovered the loss of 7.93 per cent of the past week by increasing 108.2 points or 6.64 per cent to 1736.33 points. This was on the back of Soaltee ascending by 8.43 per cent to Rs 283, Oriental gaining 30.4 per cent to Rs 474 and Taragaon Regency up 3.12 per cent to Rs 198.

Banking rose by 46.61 points or 3.74 per cent to 1,292.58 points because of stock price of commercial banks like Nepal Investment going up by 4.54 per cent to Rs 690 and Himalayan Bank up 5.49 per cent to Rs 865.

Development banks went up by 42.48 points or 3.06 per cent to 1,431.46 points. Shareholders of Swabhalamban saw their stock price rise by 12 per cent to Rs 1,120 and those of Chhimek witnessed their share price go up by 9.96 per cent to Rs 1,005, among others.

Similarly, hydropower went up by 23.79 points or 1.53 per cent to 1,573.09 points; finance rose by 6.62 points or 1.09 per cent to 615.76 points and others inched up 4.63 points or 0.68 per cent to 684.87 points.

Meanwhile, Prabhu Bank retained its top position in terms of weekly transaction and turnover — 1,804 transactions and Rs 129.12 million. The other listed companies to make it to the list of top-five in terms of traded amount were Nepal Bangladesh Bank with Rs 117.39 million, Bank of Kathmandu Lumbini with Rs 115 million, National Life Insurance Co with Rs 95.46 million and Nepal Life Insurance Co with Rs 91.83 million.

Laxmi Value Fund – I was the forerunner in terms of trading volume with 912,000 of its scrips changing hands.