BoP at Rs 14.43bn surplus despite fall in remittance inflow

Kathmandu, November 21

The country’s balance of payments (BoP) remained at a surplus of Rs 14.43 billion in the first three months of the current fiscal year despite a drop in remittance, thanks to the gradual rise in exports.

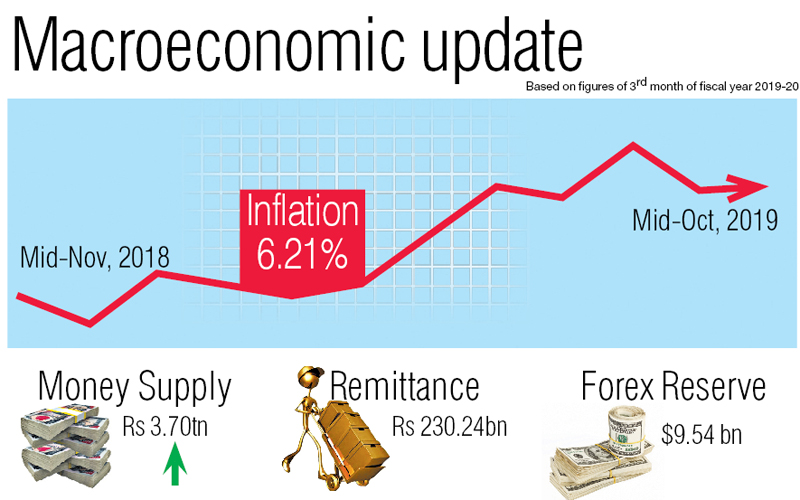

As per the Macroeconomic Status (mid-July to mid-October) report published by Nepal Rastra Bank (NRB) today, the country’s BoP remained in surplus compared to a deficit of Rs 35.42 billion in the same period of the previous year.

The central bank report shows that remittance inflows decreased by 4.9 per cent to Rs 230.24 billion in the review period, which could have hit the BoP situation. However, the country’s exports surged by 14.4 per cent to Rs 27.17 billion in the same period, thereby supporting the BoP.

Mainly exports of palm oil, cardamom, medicine (ayurvedic), jute goods, yarn (polyester and others), among others, increased whereas exports of zinc sheet, juice, readymade garments, woollen carpets, wires, among others, decreased in the review period, shows the report.

Meanwhile, merchandise imports slumped by 10.3 per cent to Rs 334.95 billion in first three months of current fiscal, against a rise of 43.6 per cent in the same period of the previous year.

However, the current account registered a deficit of Rs 27.18 billion in the review period. Such deficit was recorded at Rs 81.74 billion in the same period of the previous year.

The NRB report shows market prices going much higher as the year-on-year consumer price inflation stood at 6.21 per cent in mid-October compared to 4.68 per cent a year ago. While the food and beverage inflation stood at 7.04 per cent, non-food and service inflation stood at 5.55 per cent in review month.

Within the food and beverages group, prices of vegetables, meat and fish, fruits and spices subgroups rose significantly in the review month, as per the central bank. Likewise, within the non-food and service group, prices of housing and utilities, clothes and footwear, and education sub-groups rose in the review month.