Bull market rages on

Kathmandu, August 22

From the Central Depository System and Clearing Ltd (CDSC) implementing mandatory paperless transaction of banking stocks, to the Nepal Stock Exchange (Nepse) index breaching the previous all-time high and pushing past the threshold of 1,200 points — the trading week of August 16 to 20 saw some historic moments in the country’s only secondary market.

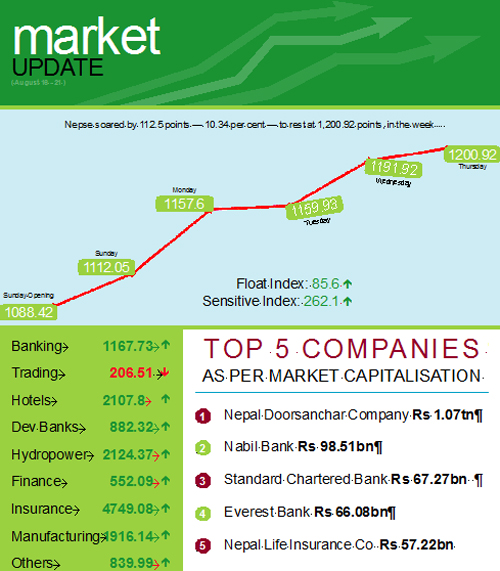

The benchmark index was northbound throughout the trading week. Starting at 1,088.42 points on Sunday, Nepse increased by 23.63 points by the day’s closing. On Monday, the index soared by a massive 45.55 points. However, the gain was muted on Tuesday, as Nepse index inched up by a minimal 2.33 points.

Come Wednesday, with the CDSC enforcing mandatory online trading of shares of commercial banks, the demand outweighed the supply, as per stock analysts. Hence, the local bourse surged by a hefty 31.99 points to land at 1,191.92 points — an all-time high. The previous all-time high had been recorded on August 31, 2008, when Nepse had settled at 1,175.38 points.

Then on Thursday, Nepse managed to top the previous day’s record to cross the threshold of 1,200 points, closing the week at 1,200.92 points. Week-on-week, the local bourse soared by a whopping 112.5 points or 10.34 per cent.

“While new stock investors fear they might not make enough money when the market is moving relentlessly higher, the investors who

are already in might want to exit faster when the market heats up worrying about possible downside risks,” opined CEO of NMB Capital Shreejesh Ghimire. “This could push up the selling pressure as the exit door becomes smaller with limited buyers.”

Stating that valuations are the best possible measure of potential risks and rewards, and are very much corelated to the future returns, Ghimire added, “This might be the right time to adopt a wait-and-see stance and for investors to consider certain aspects like the timeframe they have in mind before profit-taking, among others, prior to entering the market.”

On the central bank’s latest monetary policy, he said if the banks and financial institutions opt for consolidation, growth could be more sustainable. “Adding huge capital demands more businesses to serve it. For this, the economy should be robust with strong government spending, meaning a high and consistent GDP growth mainly fuelled by productive investments, exports growth and/or import substitution.”

Altogether 8.43 million units of shares of 169 companies worth Rs four billion were traded in the stock exchange during the trading week, through 24,635 transactions. The traded amount was 26.12

per cent higher than the preceding week when 21,487 transactions of 5.56 million scrips of 168 firms amounting to Rs 3.18 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, climbed 27.29 points to 262.1 points. Similarly, the float index that measures the performance of shares actually traded also rose by 8.14 points to 85.6 points during the review period.

Bishal Bazaar Co’s share value went down by Rs 76 to Rs 2,108, which in turn dragged the trading subgroup down by 6.41 points to 206.51 points.

All the remaining subgroups recorded double- and triple-digit gains.

Banking, the subgroup with the highest stake in market capitalisation, recorded a phenomenal gain of 146.39 points to land at 1,167.73 points. Everest Bank’s stock price rose massively by Rs 530 to Rs 3,350 and Nepal Investment Bank’s by Rs 105 to Rs 1,105, among others.

Hotels subgroup took the lead in terms of points gained, rocketing by 232.01 points to 2,107.8 points. Taragaon’s share value dipping by three rupees to Rs 238 did not affect the sub-index much as Oriental’s stock price went up by Rs 102 to Rs 687 and Soaltee’s by Rs 60 to Rs 498.

Insurance clocked a gain of 139.41 points to 4,749.08 points, as Sagarmatha Insurance’s shares gained Rs 173 to close at Rs 950 and Nepal Life Insurance’s shares closed at Rs 3,300 (up Rs 60), among others.

Himalayan Distillery’s share value dropping by Rs 15 to Rs 739 had a minimal impact on the manufacturing subgroup, which surged by 113.38 points to 1,916.14 points on the back of Unilever’s share value escalating by Rs 2,310 to Rs 26,010.

Nepal Telecom’s stock price leapt up by Rs 94 to Rs 715, which consequently helped the others subgroup record a rise of 110.42 points to land at 839.99 points.

Development banks, hydropower and finance subgroups witnessed double digit gains — adding 25.49 points to 882.32 points, 22.82 points to 2, 124.37 points and 12.81 points to 552.09 points, respectively.

Everest Bank recorded the highest turnover of Rs 219.08 million, followed by Global IME Bank with Rs 218.54 million, Nepal Investment Bank (Promoter Share) with Rs 202.17 million, Nepal Bangladesh Bank with Rs 189.46 million and NIC Asia Bank with Rs 188.94 million.

Similarly, Nabil Balanced Fund-I was the forerunner with regards to number of shares traded with 1.51 million of its scrips changing hands. Likewise, Century Commercial Bank topped the chart in terms of transactions, clocking 1,371 deals.