Fiscal Act 2015-16 lenient on casino operators

As the government is struggling to recover millions of rupees owed by casinos in royalty fees and penalty, the Fiscal Act 2015-16 has shown additional leniency to the operators of the casinos in hope that it manages to get it hands on at least part of the due amount.

The Fiscal Act 2015-16 has written off 75 per cent of the royalty amount and 50 per cent of fines on old royalty dues of the casinos that had shut down before mid-October 2013. For the casinos that were forcibly shut down after the enforcement of the new regulation, the Act has waived 25 per cent of the royalty and 50 per cent of the fine amount. Moreover, the royalty submission deadline has been extended till mid-January, 2016.

This means that the casinos that had shut down voluntarily prior to mid-October 2013 will be required to pay only 25 per cent of the due royalty and 50 per cent of fines, while those that were forced to close will have to pay 75 per cent of outstanding royalty and 50 per cent of fines.

The government had shut down all the casinos operating in the country when they failed to obtain the operating licence as per the new regulation on April 19, 2014.

The government in last year’s Fiscal Act had extended royalty submission deadline till mid-October, 2014 of the fiscal 2014-15. However, all of the casinos had failed to clear the dues by the given time.

The government, then formed a panel led by Director General of the Department of Tourism Tulasi Prasad Gautam and comprising the undersecretaries of finance ministry, labour ministry and tourism ministry to recommend the actions that should be taken against casino operators.

The panel, after holding consultations with stakeholders and experts, recommended that the government give them a chance to clear the dues before taking any action against them. The panel had also recommended blacklisting the casino operators to prohibit them from borrowing from banks and conducting other businesses, among others, if they failed to clear the dues by the given deadline.

The government, through Fiscal Act 2014-15, had also floated some options for the casino operators to clear their dues. However, they had been given only three months time and the penalty amount had also not been waived back then.

The chances of recovery of the long pending dues are higher this year as the government has waived 50 per cent of the fine and given the operators six months to clear their dues.

“We’ve had discussions with the casino operators while preparing the report and they had asked for additional time and some schemes on due amount and the government has done so,” Gautam said, adding, “If they again refuse to settle the due amount, they will be blacklisted and will not be able to operate other businesses either.”

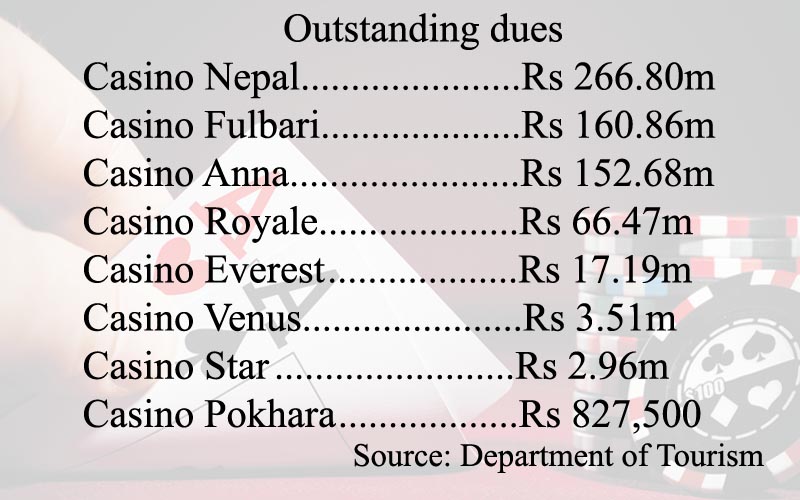

The eight casinos owe altogether Rs 671.3 million in royalty dues to the government and about Rs 300 million additional charges in interest amount and liability to their workers, according to the Department of Tourism.

There are only two casinos in operation as per the new regulation, which was first introduced on July 22, 2013. The new rules were, however, only enforced from April 2014 in a bid to give additional time to all casinos to clear their dues and obtain new licence.

Currently, two new casinos — Casino Mahjong and The Millionaire’s Club & Casino — are being operated as per the new regulation.

As per the new provision, casinos need to have Rs 250 million as paid-up capital and submit bank guarantee of Rs 30 million to ensure royalty and Rs 20 million as licence renewal fee every fiscal.