Govt doesn’t have fiscal space to launch supplementary budget

Economic reforms cannot open the floodgates as in 1990s

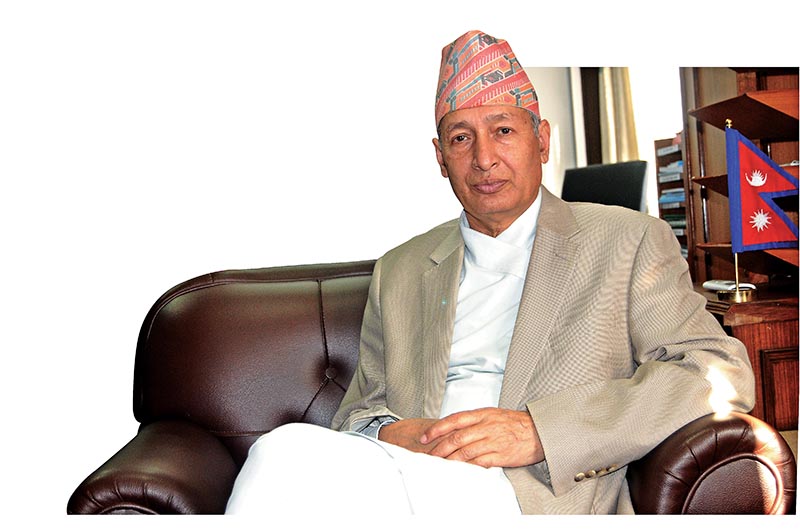

On January 1, Rs 102.5 used to fetch a US dollar. Since then, the value of Nepali rupee has slumped by over 12 per cent. Today, one needs to fork out over Rs 115 to buy each dollar. Rampant devaluation of rupee is not a good sign for an import-dependent country like Nepal, which spends more than Rs 15 on imports of merchandise goods for every rupee of goods that it exports. This import-export gap widens the country’s current account deficit — a situation where expenses made on imports of goods and services surpass income generated through exports of goods and services. This imbalance in current account ultimately hits the country’s foreign exchange reserves and reduces the stock of loanable funds in banks and financial institutions because most of the income generated by the country ends up in foreign land to settle import bills. Rupak D Sharma and Pushpa Raj Acharya of The Himalayan Times met Finance Minister Yubaraj Khatiwada to discuss this issue, the government’s budgetary operations and performance of various sectors of the economy. Excerpts:

Rapid depreciation of Nepali rupee and prospects of further jump in imports are expected to hit the country’s current account. How are you assessing the situation?

Rapid currency depreciation has been posing a threat to most of the developing economies. And Nepal is no exception. Nepal has been hit by this turmoil as our currency is pegged with Indian rupee, which has been losing value for quite some time now. The strength of our currency will be determined by the movement of Indian rupee in the coming days as well, because we are not planning to revise the currency peg any time soon. Our import bill and dollar-denominated debt repayment obligation will definitely rise if Nepali rupee continues to weaken. But this trend will not last forever because a certain currency cannot gain strength for a prolonged period of time — that’s what historical evidences show. So, corrections will eventually take place. However, there are short-term risks of currency depreciation, such as deterioration in current account. The only way to prevent this is by lowering imports of goods like petroleum and agricultural products and even certain construction materials. But it is not possible to curb imports of certain goods because the country is currently making huge investments in physical infrastructure. This means we cannot cut down imports of machinery, construction materials and other capital goods. Yet, the effects of a weak rupee on current account can be negated if we can ramp up exports. Currently, the government is providing cash incentive of five per cent on exports. If we factor in incentive provided by a weak rupee, exporters are now entitled to incentive of more than 10 per cent. So, we have to increase production of exportable items such as handicraft products, which include pashmina and woollen carpets.

Theoretically, weak currency should attract foreign direct investment and stimulate exports. Although both exports and inflow of foreign capital have gone up over time, isn’t the volume too low?

The exchange rate can work as an incentive if there is excess productive capacity in the economy. If we try to enhance productive capacity after the currency depreciates, the incentive provided by exchange rate can evaporate by the time we increase production. Exchange rate depreciation also gives a boost to the value of nominal national currency, which should increase the flow of foreign investment. But foreign investors are sceptic about stepping into a country with a weak currency, as such nations do not have robust foreign exchange reserve, which can create problems while repatriating dividend.

Does this mean a weak currency will not provide any advantage to Nepal and will only stoke inflation because of higher imports?

A weak rupee will definitely build inflationary pressure. We can manage inflationary pressure to some extent, as output from various sectors in the country is expected to grow. But since we import a lot, the risk of exchange rate-driven inflation will persist. However, we are not that worried as most of the macroeconomic indicators, apart from that of trade, are sound. For example, revenue collection has been buoyant so far. We also expect agricultural sector to grow by 4.5 to five per cent and performance of construction and services sector to remain robust. We also hope tourism sector to grow once the new international airport in Bhairahawa comes into operation in next nine months or a year. So, we are positive about meeting eight per cent economic growth target.

But the widening of current account deficit can squeeze banks’ ability to supply credit, dashing hopes of meeting eight per cent growth target, isn’t it?

The shortage of loanable fund has ended for now because of higher public spending in the last few months of the last fiscal year, which ended in mid-July. But the banking sector may face this problem again. So, banks will have to increase external borrowing in the coming days, as credit appetite has gone up, especially in infrastructure and manufacturing sectors. But, mind you, emerging economies like Nepal, which is lately growing quite rapidly, will continue to feel stress of this type. This is because of lag effect. In other words, higher growth tends to push up demand for goods and financial resources. But supply may not be able to meet that demand. Our job is to manage these side-effects of rapid growth. So, I don’t see a major risk of macroeconomic imbalance.

But isn’t it true that sound macroeconomic indicators alone cannot drive economic growth unless every sector performs well?

Different sectors, such as physical infrastructure, hydropower, agriculture, manufacturing, tourism and financial, should perform well to drive growth. A sector may not be able to contribute much if its capacity has hit the saturation point. So, we have to make sure every sector is growing well. Take the example of tourism infrastructure. We now have infrastructure to cater to one million tourists a year. But we are now eyeing two to three million tourists per year. For this, we have to increase investment not only in hotels and airline companies, but in other

areas that can help draw tourists.

What about the performance of other sectors, such as labour, energy and transport?

We have recently introduced a new labour law, which has been well received, albeit the hike in minimum wages has created some discomfort. Now we have to focus on enhancing labour productivity, otherwise output cost will be affected and incidence of working poverty will continue to rise. In the energy sector, problems related to electricity generation are gradually being addressed. Jump in electricity output will gradually reduce energy imports from India, which will strengthen our balance of payments. We now have to strengthen power transmission and distribution infrastructure. We are planning to engage power generators in construction of transmission lines and compensate them later or adjust the cost in royalty that they have to pay to the government. However, the government will have to build electricity distribution infrastructure on its own. Mobilising investment, both public and private, in the energy sector is not that difficult. The difficulty is in mobilising financial resources to strengthen the transport sector, where we have a financing gap of billions of rupees.

Talking about transport sector, talks of multiple railway projects have lately dominated the public discourse. Can Nepal mobilise hundreds of billions of rupees to build these railway lines?

Railway is a capital-intensive sector, which generates returns after a long time. Therefore, multilateral lending agencies have not shown much interest to invest in this area. We can resort to bilateral lending window to arrange funds, but government-to-government deals generally take longer time to

conclude. Yet, we need railway network to move passengers as well as goods because this is the only way we can reduce dependence of petroleum products. Currently, we are holding talks with India, Korea and Japan for construction of East-West railway line. We have not started negotiations yet, but we are hopeful about getting their support.

Whenever the topic of investment in big infrastructure projects arises, we only hear about participation of the public sector, except in hydropower. Why is it so?

Nepal’s private sector has certain limitations. It does not have the capacity to make long-term investment. It basically lacks the capacity to inject equity and support projects through debt financing. One of the reasons for this is lack of long-term vision. The private sector, in developing countries like Nepal, often focuses on the medium-term. In medium-term, the private sector finds trading more lucrative than investment in industrial or infrastructure sector. But that does not mean private sector is doing nothing here. It is making investment in hydropower, transport and aviation sectors, except airports. But again, if the rate of return on investment is not even 15 per cent, why should it bother to invest in those sectors?

But private sector’s role is important to make the economy robust. Look at the example of 1990s, when the country achieved highest economic growth rates. Although structural reforms made at that time are generally cited as reasons for high growth, it was private sector’s participation in economic activities that gave a fillip to the economy, isn’t it?

In the early 1990s, a restricted economy was fully opened up. The opening of floodgates prompted the economy to expand rapidly. That growth was largely led by the manufacturing sector and tariff concessions provided by various countries. However, we failed to develop adequate physical infrastructure at that time, which has also affected our trading abilities. The current international trade regime is not as distorted as in the past. It has become more competitive and economic reforms cannot open the floodgates as in the 1990s.

Let’s change the topic. Many are now saying the government is planning to introduce supplementary budget to incorporate populist programmes, such as increasing old-age benefits, which did not feature in annual budget. Is it true?

The constitution clearly says supplementary budget can be introduced if there is a big resource gap or if the country faces an extraordinary situation wherein expenditure must be increased. Generally, supplementary budget is launched after the mid-term review of the budget. But only two months have passed since the new fiscal year began, so it is not timely to discuss this issue. The other thing is that no one has raised the issue of supplementary budget seriously. Those who talked about it meant to say that the government can resort to constitutional provision on supplementary budget if there is need. The government has not discussed this issue seriously.

Can the government mobilise additional financial resources if there is need to introduce supplementary budget?

There is no way we can revise revenue collection target upward, because there is no sector that can generate windfall gains. In fact, the central government’s income has shrunk because we have started sharing revenue with sub-national governments since the beginning of this fiscal year to

institutionalise federalism. Also, development partners will not give us a blank cheque to introduce supplementary budget without assessing the situation of at least six to seven months of this fiscal year. So, we don’t have fiscal space to incorporate new or more programmes in the budget. And we should not introduce supplementary budget if there is no fiscal space.

The central government will continue to face financial problems unless sub-national governments start generating revenue on their own. But there are also complaints that local bodies are haphazardly collecting taxes in the name of strengthening revenue base. How are you assessing this situation?

Local level was allowed to collect taxes even before the country made a shift from unitary to federal system of government. But most of them were not collecting taxes at that time. For example, property, real estate and house rent taxes were not collected properly in the past, even though there were provisions to do so. They were only raising entertainment and advertisement taxes, which were easier to collect. As new local governments started imposing these taxes, people expressed unhappiness. A preliminary report of a study conducted by us says the local level is yet to exploit their full potential in terms of generating own-source revenue. There is also a misconception that the government should deliver public goods and services effectively and efficiently without imposing taxes. Even some of the elected representatives talk along this line. How can the government provide security, ensure good governance, build physical infrastructure and deliver public services without collecting taxes from people? However, there were some local units that had breached constitutional norms in terms of tax collection. We have already asked such units to roll back the decision.