Growth in uptake of crop insurance remains tepid

Kathmandu, November 18

Though the government provides 75 per cent subsidy on premium, the growth in number of farmers interested in crop insurance has remained weak, shows the official data.

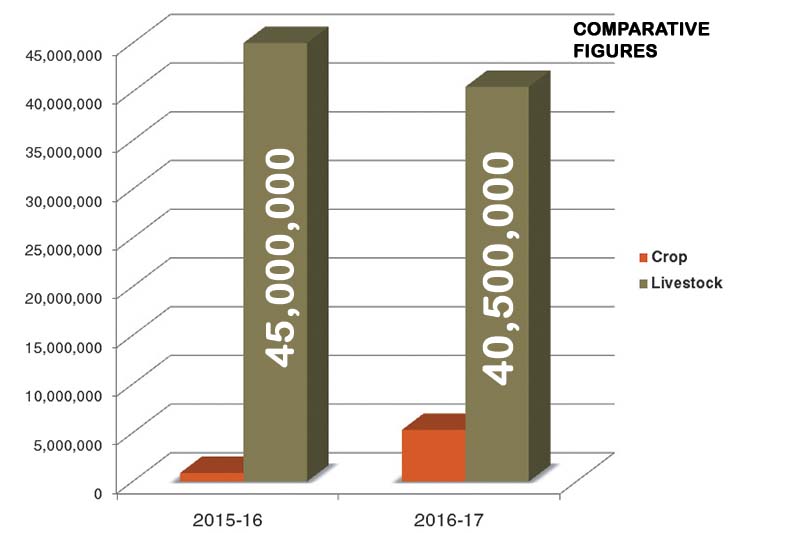

According to the data of Ministry of Agricultural Development (MoAD), the government’s subsidy for crop insurance premium in the first two months of fiscal year 2016-17 was Rs 5.3 million, significantly higher than the figures of the corresponding period of last year.

However, the amount is very low when compared to the subsidy on premium for livestock insurance in the same period, which was a whopping Rs 40.5 million. This shows that livestock insurance accounts for a much higher percentage in farm insurance, even though the government provides 75 per cent subsidy on premiums of both crop and livestock insurance.

In a bid to facilitate farmers with the subsidy scheme, the government had increased the subsidy in crop insurance premium to 75 per cent in 2014 from 50 per cent earlier.

The government’s subsidy for insurance premium of crop in the previous fiscal 2015-16 was Rs 881,000 in the first two months, while that for livestock was more than Rs 45 million.

MoAD officials believe that though crop insurance is less popular than livestock insurance among farmers, their interest towards crop insurance is gradually growing.

“Farmers as well as insurance companies are more attracted towards livestock insurance compared to crop insurance due to higher level of clarity in investment required as well as returns in the livestock businesses. On the other hand, the actual investment needed in crop farming is unclear,” Shankar Sapkota, deputy spokesperson for MoAD, told The Himalayan Times.

Sapkota also said that farmers are slowly becoming more aware about the benefits of crop insurance as well as the facility on premium that government provides them.

“As many farmers are yet to know about the premium facility of the government on both crop and livestock insurance, we all need to extensively and efficiently disseminate information to the farmers about such subsidy facilities,” Sapkota said, adding that MoAD is planning to appoint one agriculture officer in each village development committee of the country for the same.

However, Sapkota said that the subsidy on farm insurance premium has been able to attract attention of a large number of farmers, who are engaged in commercial farming of livestock and crop. Informing that agro-insurance is growing slowly in Nepal, Sapkota said, “The country’s agriculture industry will be further attracted towards insurance once the Insurance Policy comes into effect.”