Local bourse down by 14.89 points

The country’s sole secondary market witnessed a downward trend in the trading week between March 17 and 21 as investors were in a hurry to book early profits.

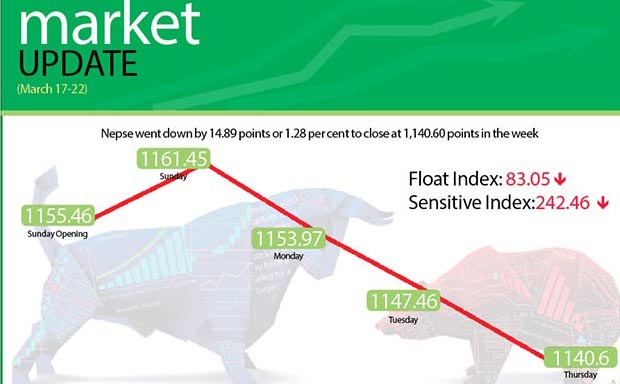

However, some share investors have said that the secondary bourse declined as a result of insufficient loanable funds in banks and financial institutions. As a result, the Nepal Stock Exchange (Nepse) index was in a downward trend in the review week, shrinking by 1.28 per cent or 14.89 points.

“The index dipped since investors were in a hurry to book profits as it was after a long period of time that the Nepse index had crossed the 1,100-point mark,” said Radha Pokharel, chairman of Nepal

Pujibazar Lagani karta Sangh.

However, she added that the market also slowed down due to the lack of confidence among investors, which the government needs to immediately build through policy changes.

Similar to the Nepse index, the sensitive index also went down by 1.47 per cent or 3.62 points to 242.46 points and float index fell by 1.48 per cent or 1.25 points to 83.05 points.

In the review period, weekly turnover decreased by 41.05 per cent as compared to the previous week to Rs 1.15 billion. In the previous week the market witnessed turnover of Rs 1.95 billion. Likewise, the daily average turnover went down by Rs 288.27 million, which was a decline of 26.31 per cent in comparison to the previous week when it stood at Rs 391.2 million.

The secondary market had opened at 1,155.46 points on Sunday and went up by 5.99 points by the end of the trading day. However, it reversed course and descended by 7.48 points the next day. The market continued to drop on Tuesday, falling by 6.51 points. On Thursday too, the secondary bourse decreased by 6.86 points to close the week at 1,140.60 points. It has to be noted that the market remained closed on Wednesday as there was a public holiday in the hilly regions of the country in celebration of Fagu Purnima.

In the review week, only the manufacturing and finance subgroups landed in the green zone. The manufacturing sub-index increased by 1.97 per cent or 39.49 points to 2,036.94 points with the share price of Unilever Nepal rising by Rs 380 to Rs 19,380. Likewise, the finance subgroup rose by 1.07 per cent or 6.54 points to at 617.68 points.

Meanwhile, non-life insurance subgroup led the pack of losers falling by 2.31 per cent or 127.52 points to 5,377.53 points with share price of Everest Insurance declining by five rupees to Rs 580. Similarly, the trading sub-index fell by 2.26 per cent or 5.67 points to 244.89 points.

Meanwhile, microfinance sub-index descended by 2.03 per cent or 28.86 points to 1,386.33 points and the life insurance subgroup dipped by 1.89 per cent or 112.65 points to 5,847.02 points.

Moreover, hydropower subgroup fell by 1.61 per cent or 18.97 points to 1,156.62 points and the hotels sub-index dropped by 1.50 per cent or 26.46 points to rest at 1,728.06 points.

The banking sub-index also lost 1.27 per cent or 12.69 points to 985.13 points. The development banks subgroup decreased by 1.22 per cent or 17.96 points to land at 1,449.97 points and others sub-index inched down by 0.69 per cent or 4.90 points to 703.84 points.

In the review week, Global IME Bank (Promoter Share) was the leader in terms of weekly turnover with Rs 93.72 million. It was followed by Nepal Life Insurance with Rs 48.77 million, Shine Resunga Development Bank (Promoter Share) with Rs 44.60 million, Nepal Investment Bank with Rs 44.12 million and Citizen Investment Trust with Rs 42.78 million.

In terms of weekly trading volume also, Global IME Bank (Promoter Share) took the lead with 530,000 of its shares changing hands. Shine Resunga (Promoter Share) with 343,000 shares, Upper Tamakoshi Hydropower with 154,000 shares, NCC Bank with 127,000 shares and Civil Bank with 118,000 shares were the other top firms to record high trading volume.

Meanwhile, Upper Tamakoshi Hydropower topped the chart in terms of number of transactions — 1,505. It was followed by Nepal Life Insurance Company with 533, Gurans Life Insurance with 440, Prabhu Bank with 403 and Everest Bank with 401 transactions.

New Listings

Company

Type

Units

Butwal Power

Bonus

2,218,834

Citizens Bank International

Bonus

2,914,457.73

Deprosc Laghubitta Bittiya Sanstha

Bonus

703,100

NMB Bank

Bonus

8,743,784

Sana Kisan Bikas Bank

Bonus

1,572,069.82

Shivam Cement

IPO

44,000,000

Universal Power Company

IPO

21,003,500

Source: Nepse