Nepse above 1,100 pts again

Kathmandu, November 14

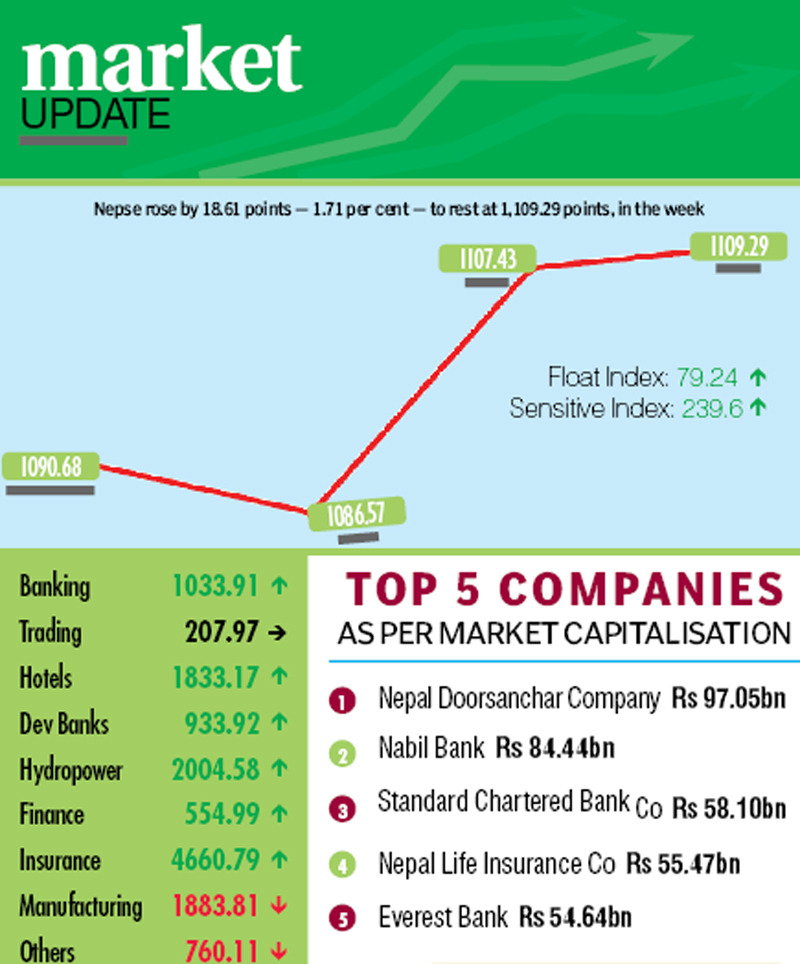

News and speculations of possible breakthrough in talks with the agitating Madhes-based parties and a way out of the current crisis helped the Nepal Stock Exchange (Nepse) index to surge 18.61 points or 1.71 per cent week-on-week to land at 1,109.29 points, from November 8 to 10.

Opening on Sunday at 1,090.68 points, the benchmark index had shed 4.11 points by the day’s closing. However, positive political cues helped the local bourse surge by 20.86 points on Monday and add another 1.86 points on Tuesday. Monday’s gain helped Nepse breach the threshold of 1,100 points after two trading weeks. The stock exchange remained closed on Wednesday and Thursday in celebration of the Tihar festival.

Altogether, 1.84 million shares worth Rs 628.05 million were traded through 3,934 transactions during the week. In the preceding week, when the stock market was open for regular five trading days, 6,284 transactions of 1.84 million shares of 141 companies worth Rs 926 million had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, increased by 3.82 points to 239.6 points. Likewise, the float index that measures the performance of shares actually traded also inched up 1.65 points to 79.24 points, during the review period.

Trading continued to remain constant at 207.97 points. Apart from manufacturing and others, all the subgroups witnessed gains.

The insurance subgroup recovered the loss of the previous week, surging by 2.48 per cent to 4,660.79 points on the back of National Life Insurance gaining Rs 90 to Rs 2,190 and Life Insurance Co Nepal up Rs 94 to Rs 3,300, among others in the trading week.

Banking trailed close behind, ascending by 2.41 per cent to 1,033.91 points. Nabil’s share value went up by Rs 60 to Rs 2,310 and that of Standard Charted by Rs 75 to Rs 2,590.

Hotels too climbed 2.05 per cent to 1,833.17 points. Soaltee’s stock price rose by Rs 10 to Rs 430 and Oriental’s gained Rs 12 to Rs 552.

Nagbeli Laghubitta Bikas Bank saw its share price gain Rs 79 to Rs 2,047 and Chhimek’s was up Rs 40 to Rs 1,730, which in turn helped the development banks sub-index rise by 1.65 per cent to 933.92 points.

The gain witnessed in hydropower and finance subgroups was muted. Hydropower was up 0.57 per cent to 2,004.58 points and finance managed to inch up 0.33 per cent to 554.99 points.

Meanwhile, Unilever saw its share price plunge by Rs 520 to Rs 26,000 and Himalayan Distillery’s rested at Rs 530, down Rs 10, which in turn dragged manufacturing sub-index down 1.53 per cent to 1,883.81 points.

Similarly, Nepal Telecom’s stock price taking a beating by eight rupees to Rs 647 cost the others subgroup 1.22 per cent and it landed at 760.11 points.