Nepse drop fuels share sale spree

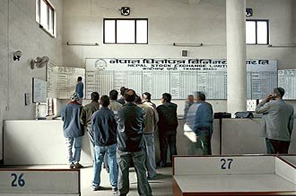

KATHMANDU: The selling pressure of commercial banks that pulled the Nepal Stock Exchange (Nepse) down by 6.37 points to 693.64 points from today morning’s opening of 700.01 points has sent investors into a frenzy.

“Investors are nervous and selling like anything,” said Rabindra Pradhan, stock broker No 32. “Shares of Standard Chartered Bank Nepal, Nabil Bank and Himalayan Bank, which used to be hot potatoes are no more attracting investors,” he said adding that investors are on a selling spree due to low confidence and uncertainty. Commercial banks like Standard Chartered bank Nepal lost Rs 140 and Everest Bank lost Rs 46 per share today pulling the banking index down by eight points to 720.26 points. Banks and financial companies have over 85 per cent stake in the Nepse.

Secondary market pundits were of the opinion that after the budget Nepse would bounce back. However, the secondary market is not showing any sign of recovery and is instead sliding down everyday. “The reduction of capital gain tax by five per cent to put it at 10 per cent could not inject any confidence in the secondary market,” Pradhan added.

The year on year (y-o-y) Nepse index decreased by 27.1 per cent to 678.74 points in mid-June 2009. This index was 930.65 a year ago. Likewise, the sensitive index — based on July 2006 — stood at 182.32 points in Mid-June 2009. It was 243.48 in mid-June 2008, according to the central bank data.

The float index — calculated on the basis of final transaction as on August 24, 2008 at market price — remained at 65.56 points in Mid-June 2009. However, market capitalisation increased by 39 per cent to Rs 451.17 billion in mid-June 2009. Total paid-up capital of listed companies stood at Rs 59.32 billion in the review period, increasing by 122.9 per cent over the same period last year. Of the total Nepse listed securities worth Rs 33.56 billion up to mid-June 2009, bonus shares, right shares, ordinary shares and bonds accounted for Rs 1.9 billion, Rs 9.3 billion, Rs 19.1 billion and Rs 3.3 billion, respectively.

More than the fundamentals of the company or the

promoters and chief executive officers, it is the bonus

shares and rights shares that are the major attractions for investors when they invest

in any company. Ordinary shares constituted the largest portion due to Nepal Telecom’s shares. The monthly turnover to market capitalisation ratio remained at 0.48 per cent in mid-June 2009, compared to 0.60 per cent a year ago. Total number of companies listed at the Nepse also increased to 159 this mid-June in comparison to 148 a year ago. Among them, 128 are banks and financial institutions — including insurance companies, said the central bank.