Nepse index closes in on 1,600 points

KATHMANDU, SEPTEMBER 19

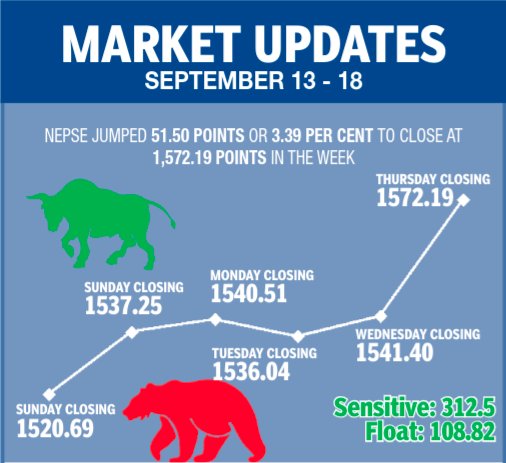

As investors continued to pour their funds into the country’s only secondary market, the Nepal Stock Exchange (Nepse) index advanced by 3.39 per cent or 51.50 points week-on-week in the trading period between September 13 and 17.

The weekly turnover surged by 24.01 per cent to Rs 14.29 billion against the previous week’s total traded amount of Rs 11.52 billion.

Similarly, the number of transactions climbed 38.57 per cent to 201,425 from 145,359 in the previous week.

The trading volume too soared from 26.98 million shares changing hands in the past week to 42.34 million shares traded over the review period.

Market analysts attribute the recent bull run in the share market primarily to fewer alternative investment opportunities, high liquidity in the market, lower interest on deposits being offered by banks and financial institutions at the moment, among other reasons.

The appeal of investment in the secondary market is also evidenced by the fact that the total market capitalisation of Nepse has reached Rs 2.09 trillion — an all-time high.

The benchmark index that had opened at 1,520.69 points on Sunday had gone up by 16.56 points by the time of closing and added another 3.26 points on Monday. On Tuesday, Nepse slipped by 4.47 points on market correction, but more than recovered it the very next day by gaining 5.36 points. The local bourse jumped by 30.78 points on Thursday to close the week at 1,572.19 points — over a sixmonth high. The last time Nepse had closed at the current level was back on March 1, when it had rested at 1,591.36 points.

Whereas sensitive index, which measures the performance of class ‘A’ stocks, rose by 3.69 per cent or 11.12 points to 312.5 points, the float index that gauges the performance of shares actually traded went up by 3.81 per cent or 3.99 points to 108.82 points.

Among the subgroups, nine recorded gains, while three landed in the red.

Hotels — the subgroup that had landed in the red in the past week — led the pack of gainers by surging an eye-popping 23.13 per cent or 354.07 points to 1,884.54 points.

Adding to the previous week’s rise of 1.96 per cent, the hydropower subgroup’s gain was more impressive in the review week at 16.92 per cent or 186.67 points to 1,290.05 points.

Finance subgroup ascended 6.65 per cent or 45.32 points to 726.86 points. The sub-index had inched up 0.97 per cent or 6.52 points in the past week.

Development banks went up by 4.31 per cent or 75.91 points to 1,837.96 points.

Life insurance rose by 3.61 per cent or 343.92 points to 9,879.96 points and banking was on its heels with a gain of 3.39 per cent or 40.99 points to 1,249.38 points.

Mutual funds went up by 1.48 per cent or 0.16 point to 10.97 points.

Non-life insurance subgroup that had recorded the highest points gain in the past week rose by 1.36 per cent or 109.29 points to 8,147.48 points. It had jumped 567.90 points in the previous review week.

Others inched up by 0.33 per cent or 3.39 points to 1,020.69 points.

After securing the spot of top gainer in the preceding week by advancing 14.59 per cent, the trading subgroup landed at the bottom of the list this time around. The sub-index fell by 1.60 per cent or 16.53 points to 1,016.83 points.

Manufacturing and microfinance subgroups managed to limit their losses to below one per cent.

Manufacturing shed 0.56 per cent or 17.28 points to 3,066.18 points and microfinance slipped by 0.08 per cent or 2.05 points to 2,605.46 points.

Among the companies to record the highest weekly turnover, Nepal Reinsurance Co Ltd topped the chart with Rs 824.86 million, followed by Nepal Life Insurance Co Ltd with Rs 531.57 million, Nepal Bank Ltd with Rs 410.78 million, Neco Insurance Co Ltd with Rs 392 million and Citizen Investment Trust with Rs 346.03 million.

Meanwhile, Nepal Bank Ltd was the forerunner in terms of trading volume with 1.33 million of its shares changing hands. Arun Kabeli Power Ltd with 1.31 million shares, Arun Valley Hydropower Development Co Ltd with 1.17 million shares, Kumari Bank Ltd with 1.14 million shares and Api Power Co Ltd with 1.12 million shares rounded up the top five in this category.

NRN Infrastructure and Development Ltd with 17,885 transactions secured the trophy of company with highest number of trades. Nepal Reinsurance Co Ltd with 9,359 transactions was second, Reliance Life Insurance Ltd with 6,399 transactions was third, Ajod Insurance Ltd with 4,306 transactions was fourth and Upper Tamakoshi Hydropower Ltd was fifth with 3,799 trades.

A version of this article appears in e-paper on September 20, 2020, of The Himalayan Times.