Nepse index rebounds above 1,600 points

Kathmandu, December 3

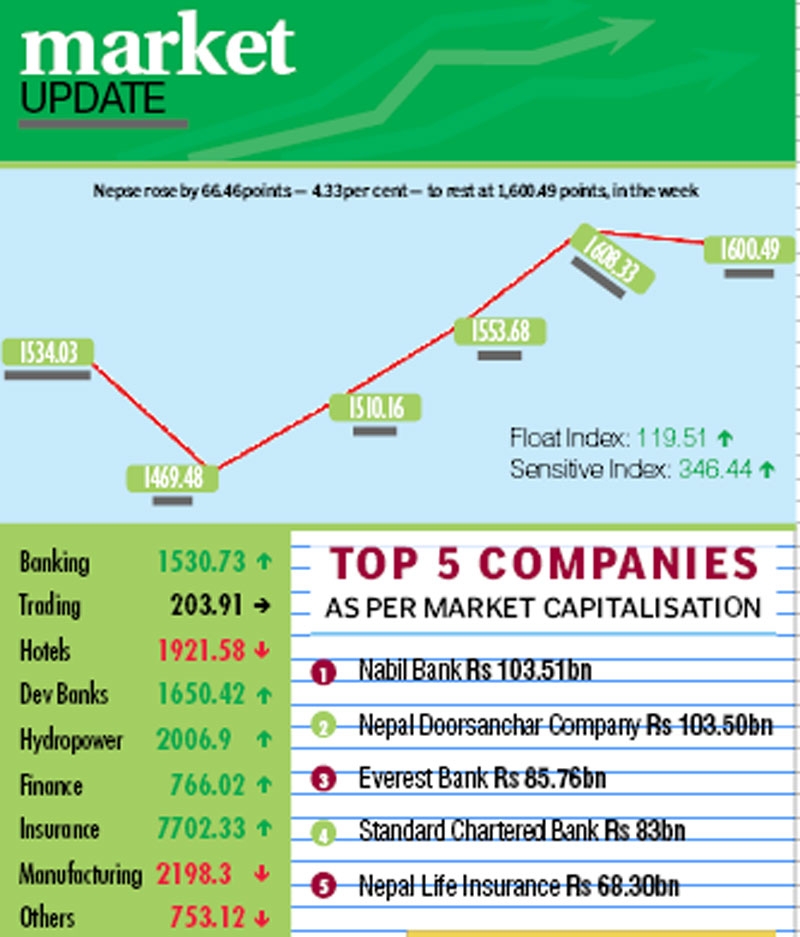

The domestic share market snapped three consecutive weeks of losses, with Nepal Stock Exchange (Nepse) index gaining 66.46 points or 4.33 per cent week-on-week to rest at 1,600.49 points — between November 27 and December 1.

The local bourse had witnessed a massive selling pressure on the first trading day of the week, with benchmark index taking a dive of 64.55 points to retreat below the 1,500-point threshold by closing.

OvAer the next three days, the market rebounded strongly as investors rushed to snap the shares at reduced prices. Nepse index gained 40.68 points on Monday to rest at 1,510.16 points and continued northbound on Tuesday and Wednesday, surging by 43.52 points and 54.65 points, respectively.

On Thursday, Nepse index dipped by 7.84 points on profit-booking, but managed to close above the 1,600-point threshold.

The intense selling pressure in the first trading day was owing to increased attraction of share investors towards higher interest rates on deposits being offered by banks and financial institutions.

Market analysts also pointed to the possibility of impact of demonetisation of INR 500 and INR 1,000 banknotes on the market movement as investors holding high amount of such currency might be selling shares due to Acash crunch.

Moreover, investors who had invested in stock of banks and financial institutions could have also offloaded the shares of BFIs that are yet to announce bonus and rights shares under their capital increment plan.

In total, 7.46 million shares of 152 companies worth Rs 5.83 billion were traded through 37,436 transactions in the week. The traded amount was 15.02 per cent higher than the previous week when 31,336 transactions of 7.33 million scrips of 152 companies that amounted to Rs 5.07 billion had been undertaken.

Sensitive index, which gauges performance of class ‘A’ stocks, went up by 15.27 points or 4.61 per cent to 346.44 points. Float index that measures performance of shares actually traded also rose 5.76 points or 5.06 per cent to 119.51 points.

Trading was the only subgroup to remain constant at 203.91 points.

Banking, the share market heavyweight, took the lead among the pack of five gainers by surging 88.64 points or 6.14 per cent to 1,530.73 points. This was on the back of share value of commercial banks like Nabil soaring by 4.95 per cent to Rs 1,674 and Standard Chartered by 4.22 per cent to Rs 2,960.

Development banks recouped some of the loss of 8.81 per cent of the previous week by ascending 67.98 points or 4.29 per cent to 1,650.42 points. Swabhalamban rose by 2.15 per cent to Rs 1,900 and Chhimek went up by 1.72 per cent to Rs 1,770.

Insurance subgroup rose by 209.28 points or 2.79 per cent to 7,702.33 points. Prime Life gained 5.63 per cent to Rs 1,875 and Shikhar climbed 1.71 per cent to Rs 3,750.

Hydropower advanced by 53.1 points or 2.72 per cent to 2,006.9 points. Even as Chilime dipped 0.28 per cent to Rs 1,062, the sub-index was buoyed due to hydro companies like Sanima Mai soaring by 6.1 per cent to Rs 870 and Ridi up 3.33 per cent to Rs 248.

Finance edged up 13.49 points or 1.79 per cent to 766.02 points.

At the other end of the spectrum, hotels slumped by 103.93 points or 5.13 per cent to 1,921.58 points. Even as Oriental rose by 2.04 per cent to Rs 500 and Taragaon inched up 1.36 per cent to Rs 224, Soaltee taking a dive of 7.41 per cent to Rs 350 was the deadweight for the sub-index.

Manufacturing fell by 29.93 points or 1.34 per cent to 2,198.3 points because of Bottlers Nepal (Tarai) losing 10.89 per cent to Rs 4,010.

Others managed to limit its loss to 0.28 point or 0.04 per cent to 753.12 points.

In the mean time, Everest Bank maintained its lead in terms of turnover with Rs 721.06 million followed by Shikhar Insurance with Rs 326.59 million, Bank of Kathmandu Lumbini with Rs 280.43 million, Siddhartha Bank with

Rs 241.84 million and National Life Insurance with Rs 190.61 million.

Bank of Kathmandu Lumbini topped the chart with regards to trading volume and number of transactions, with 437,000 of its scrips changing hands through 2,122 transactions.