Nepse index rises by 27.69 points

Kathmandu, March 16

The country’s sole secondary market witnessed an upward trend in the trading week between March 10 and 14 as the government has agreed to implement the Permanent Account Number (PAN) provision only for traders who have daily transactions of above Rs 500,000.

The Securities Board of Nepal (SEBON) has informed that PAN will be implemented only for high-volume traders. As a result, the Nepal Stock Exchange (Nepse) index was in a bullish trend in the review week, rising by 2.45 per cent or 27.69 points.

“As different investor associations and SEBON reached an agreement to make PAN mandatory only for big traders investor sentiment has become positive,” said Uttam Aryal, chairman of Investors Association of Nepal.

Furthermore, Nepal Rastra Bank has asked banks and financial institutions (BFIs) to reduce the interest spread rate to 4.75 per cent by April 30. The central bank has also directed them to drop the spread rate to four per cent from the beginning of next fiscal (July 17). “This means that BFIs will have to bring down the lending rate by at least one to two per cent, which is good news for share investors,” said Aryal.

In the review period, weekly turnover increased by 99.77 per cent as compared to the previous week to Rs 1.95 billion. In the previous week the market witnessed turnover of Rs 979.16 million. Likewise, the daily average turnover rose by Rs 391.2 million, which is a rise of 59.81 per cent in comparison to the previous week when it stood at Rs 244.79 million.

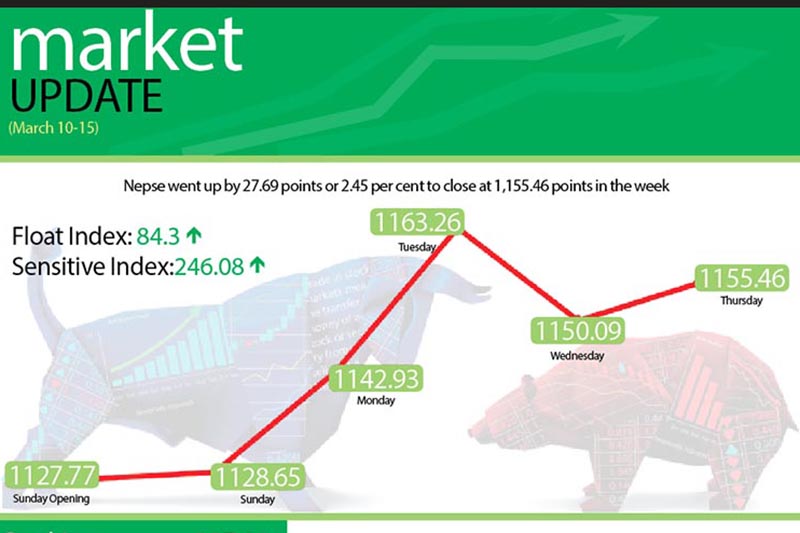

The secondary market had opened at 1,127.77 points on Sunday and inched up by 0.88 point by the end of the trading day. However, it jumped up by 14.28 points on Monday. The market continued to ascend, soaring by 20.33 points on Tuesday. However, the next day it descended by 13.17 points. But on Thursday, the secondary bourse again increased by 5.37 points to close the week at 1,155.46 points.

In the review week, only the manufacturing subgroup landed in the red zone, declining by 0.41 per cent or 8.24 points to 1,997.45 points.

Meanwhile, the hydropower subgroup led the pack of gainers, soaring by 3.74 per cent or 42.48 points to 1,175.59 points with the share price of Chilime Hydropower rising by Rs 10 to Rs 517. The banking sub-index also rose by 3.59 per cent or 34.59 points to 997.82 points as share price of Nepal Investment Bank increased by Rs 17 to Rs 534.

Similarly, the trading sub-index went up by 3.32 per cent or 8.07 points to 250.56 points. It was due to the share price of Bishal Bazar Company ascending by Rs 95 to Rs 1,700.

Likewise, microfinance subgroup went up by 2.89 per cent or 29.76 points to 1,415.19 points with the share price of Chhimek Laghubitta Bikas Bank going up by seven rupees to Rs 893. Meanwhile, finance sub-index rose by 2.50 per cent or 14.93 points to 611.14 points.

Moreover, development banks subgroup also increased by 2.42 per cent or 34.79 points to land at 1,467.93 points and the hotels sub-index ascended by 2.09 per cent or 36 points to rest at 1,754.52 points.

Meanwhile, the life insurance subgroup went up by 0.94 per cent or 55.91 points to 5,959.67 points. Likewise, non-life insurance subgroup increased by 0.72 per cent or 39.84 points to 5,505.05 points and others sub-index inched up by 0.63 per cent or 4.46 points to 708.74 points.

In the review week, National Life Insurance was the leader in terms of weekly turnover with Rs 210 million. It was followed by Nepal Life Insurance with Rs 93.97 million, NCC Bank with Rs 92.64 million, Upper Tamakoshi Hydropower with Rs 82.52 million and Prabhu Bank with Rs 77.45 million.

In terms of weekly trading volume, NCC Bank took the lead with 433,000 of its shares changing hands. Upper Tamakoshi Hydropower with 347,000 shares, Prabhu Bank with 330,000 shares, Machhapuchchhre Bank with 277,000 shares and Civil Bank with 245,000 shares were the other top firms to record high trading volume.

Meanwhile, Upper Tamakoshi topped the chart in terms of number of transactions — 2,658. It was followed by Prabhu Bank with 955, Nepal Life Insurance with 871, NCC Bank with 797 and NIC Asia Bank with 708 transactions.

New Listings

Company

Type

Units

Asha Laghubitta Bittiya Sansthan

IPO

2,074,000

Jebils Finance

Rights

1,970,694.50

Sanima Debenture 2085

IPO

1,354,712

SBL Debenture 2082

IPO

2,162,559

Source: Nepse