Nepse index soars on bullish sentiment

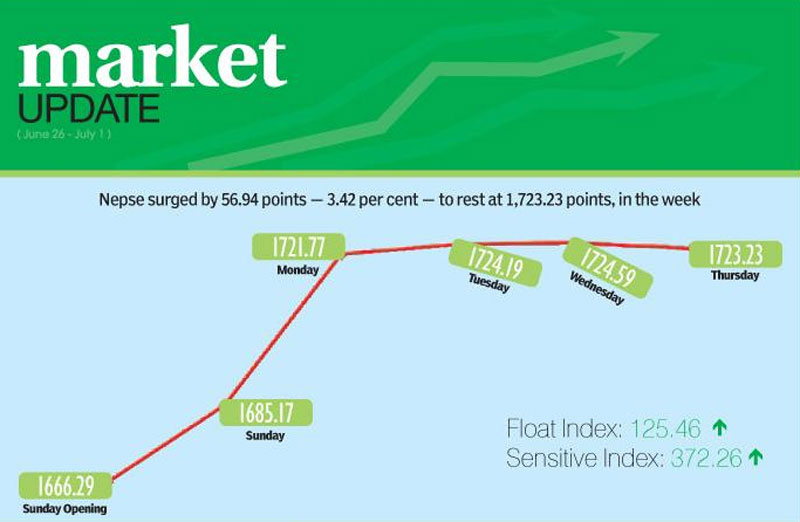

Buoyant investor sentiment pushed the Nepal Stock Exchange (Nepse) index to record a weekly gain of 56.94 points or 3.42 per cent and surge past the threshold of 1,700 points, in the trading week of June 26 to 30.

Beginning the week at 1,666.29 points on Sunday, the benchmark index had surged by 18.88 points by the day’s closing. The bullish investor sentiment pushed Nepse up 36.6 points — the highest single-day gain of the week — on Monday to cross the threshold of 1,700 points. The local bourse continued in the upward trajectory on Tuesday and Wednesday — inching up 2.42 points and 0.4 point, respectively. On Thursday, Nepse dipped marginally by 1.36 points on profit-booking to close the week at 1,723.23 points.

In total, 22.84 million shares of 150 companies worth Rs 8.39 billion were traded through 32,839 transactions during the week. The traded amount was 7.32 per cent higher than the previous week. Back then, 32,018 transactions of 11.09 million scrips of 147 firms that amounted to Rs 7.82 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 12.87 points or 3.58 per cent to 372.26 points. Similarly, the float index that measures the performance of shares actually traded also increased by 4.77 points or 3.95 per cent to 125.46 points during the trading week.

Apart from manufacturing, all the subgroups witnessed gains in the week. Unilever Nepal’s share value dropped by Rs 700 to Rs 35,000 per unit, which weighed on the manufacturing sub-index, pulling it down 0.95 per cent to 2,407.34 points.

Development banks led the market rally in the week. The sub-index went up by 5.39 per cent to 1,747.25 points. Stock price of Chhimek rose by Rs 173 to Rs 2,370, Nagbeli went up by Rs 225 to Rs 4,150 and Swabhalamban by Rs 112 to Rs 2,960.

Banking — the subgroup with most weightage in the country’s sole secondary market — trailed close behind with a rise of 4.63 per cent to 1,567.03 points. Nabil’s share value ascended by Rs 70 to Rs 2,410 and that of Himalayan by Rs 95 to Rs 1,585, among others.

Finance increased by 3.83 per cent to 776.35 points, mostly on the back of Citizen Investment Trust resting at Rs 4,600, up Rs 250.

Nepal Telecom’s stock price went up by Rs 10 to Rs 684, which in turn pulled others subgroup up 1.48 per cent to 803.58 points.

Hydropower — the subgroup that was the top gainer in the previous week — climbed 1.12 per cent to 2,745.66 points. This was primarily because Chilime rose by Rs 42 to Rs 1,457.

Trading landed at 202.79 points (up 0.7 per cent), insurance at 9,553.11 points (up 0.45 per cent), and hotels at 2,027.15 points (up 0.34 per cent).

Meanwhile, Everest Bank topped the chart in terms of turnover with Rs 374.37 million, followed by Lumbini General Insurance with Rs 321.8 million, Nepal Bangladesh Bank with Rs 286.66 million, Nepal SBI Bank with Rs 280.24 million and NMB Bank with Rs 259.61 million.

NIBL Samriddhi Fund – I was the forerunner with regards to trading volume, with 8.89 million of its scrips changing hands. Century Commercial Bank clocked 1,215 transactions — the most number of transactions recorded by a single listed firm in the week.