Nepse past 1,800-point mark

As stock investors continued to swarm towards the shares of commercial banks, the domestic share market set a new record today, with the Nepal Stock Exchange (Nepse) index breaching the threshold of 1,800 points.

The benchmark index, which had opened at 1,786.57 points had surged as high as 1,813.06 points in the early trading hour before paring back some of the gains, but settling at a fresh peak of 1,800.47 points at the day’s closing.

“Apart from being a seasonal phenomenon, investors have been attracted to the scrips of commercial banks in expectation of their good performance in the last quarter like in the previous quarters,” explained Rabindra Bhattarai, a share market analyst.

While the recent monetary policy has capped margin lending at 50 per cent, Bhattarai said most financial institutions were well within the limit and the policy would not have an adverse impact.

“The policy was mostly in favour of the secondary market and only investors who were pinning their hopes on the central bank requiring microfinance companies to raise their paid-up capital were left disappointed,” he added.

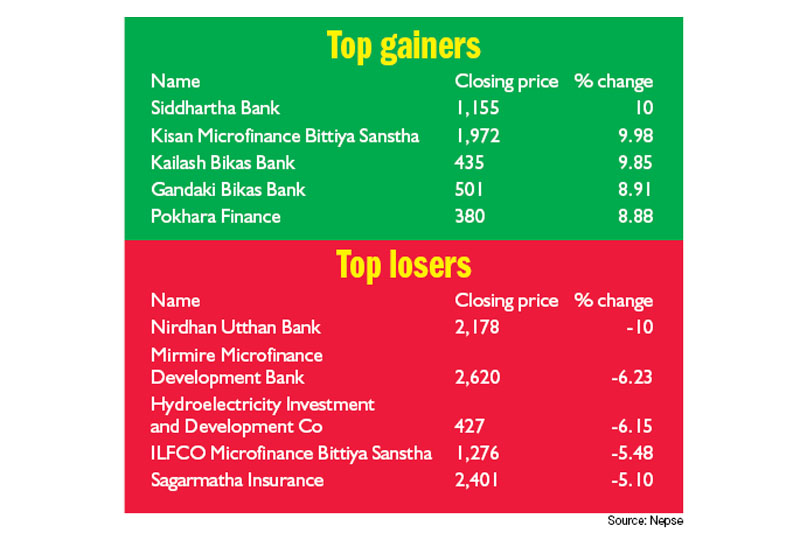

The sub-index of commercial banks led the pack of gainers today, with the banking subgroup surging by 2.13 per cent or 35.48 points to 1,699.95 points.

Hotels rose by 1.75 per cent or 35.33 points to 2,058.07 points; manufacturing and production went up by 1.51 per cent or 40.24 points to 2,706.66 points; and finance gained 1.04 per cent or 8.81 points to 852.27 points. The subgroup of development banks inched up 0.91 per cent or 15.77 points to 1,753.71 points.

Conversely, insurance subgroup plunged by 2.58 per cent or 240.19 points to 9,052.45 points; others dropped 1.98 per cent or 17.07 points to 844.78 points; and hydropower dipped 0.37 per cent or 9.93 points to 2,669.51 points.

Altogether, 2.9 million shares of 139 companies worth Rs 2.14 billion were traded through 9,730 transactions during the day. With the surge in transactions in the country’s only secondary market, the total market capitalisation today stood at Rs 1.98 trillion.

While Nepse had extended the trading period by one hour since Sunday, Bhattarai opined the trading volume has not gone up as expected.

The sensitive index, which gauges the performance of class ‘A’ stocks, went up by 0.93 per cent or 3.58 points to 388.10 points. Similarly, the float index that measures the performance of shares actually traded advanced by 1.18 per cent or 1.54 points to 132.50 points.

“Since the Nepse index is normally bullish in the period between mid-July to mid-September, there are high chances the benchmark index will breach the 2,000-point threshold in the near future,” Bhattarai said.