NRB to float bonds worth Rs 67.50 billion

Up for grabs

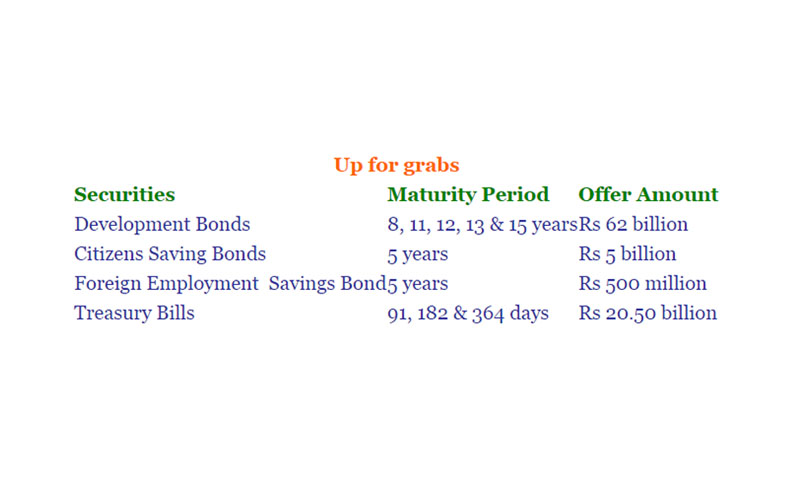

Securities

Maturity Period

Offer Amount

Development Bonds

8, 11, 12, 13 & 15 years

Rs 62 billion

Citizens Saving Bonds

5 years

Rs 5 billion

Foreign Employment Savings Bond

5 years

Rs 500 million

Treasury Bills

91, 182 & 364 days

Rs 20.50 billion

Kathmandu, March 4

Nepal Rastra Bank (NRB), the central monetary authority, will float bonds worth Rs 67.50 billion in between mid-March and mid-May, as part of the government’s plan to raise funds worth Rs 88 billion from the domestic market to support deficit financing.

This year, NRB, which issues bonds on behalf of the government, intends to float Development Bonds, with maturity period of eight, 11, 12, 13 and 15 years, worth Rs 62 billion, shows the domestic debt issuance calendar of the central bank.

A big chunk of these bonds are generally offered as competitive tender and the rest as non-competitive tender. This means a large number of these securities can be subscribed through competitive bidding process and the remaining through non-competitive bidding.

The competitive bidding is open for banking institutions, like commercial banks, development banks and finance companies, as well as non-banking institutions, like insurance companies, Employees Provident Fund, Citizen Investment Trust and merchant banks. But the non-competitive bidding is meant only for non-banking institutions.

Last year, yields on bonds, with maturity period of 15 years, had fallen to as low as 2.65 per cent due to presence of excess liquidity in the banking sector. This year too banks are struggling with the problem of excess liquidity, so chances of the government walking away with cheap credit cannot be ruled out.

Also, NRB is mulling over floating Rs five billion worth of Citizens Saving Bonds, with maturity period of

five years.

These bonds are targeted at general public and offer a fixed rate of return. Last year, yield on these instruments was fixed at eight per cent per annum.

These bonds can be bought from most of the banks and financial institutions in the form of promissory notes or stocks.

Bonds bought in the form of promissory notes can be traded by owners anytime based on mutual understanding.

But bonds purchased in the form of stocks can only be traded in the presence of NRB officials. This is because the stock option is for those who cannot read or write. And presence of NRB officials at the time of offloading these instruments protects owners from being duped into buying or selling the bonds.

The NRB also issues another type of bonds for general citizens, but their sales are restricted to overseas migrant workers, non-resident Nepalis or those who have returned home from foreign employment destinations less than four months ago.

This year, the central bank is planning to float Rs 500 million worth of Foreign Employment Savings Bond, with maturity period of five years. Like the Citizens Saving Bonds, Foreign Employment Savings Bonds also come with fixed rate of return. Last year, yield on these bonds stood at nine per cent per annum.

Among others, the NRB is also issuing 91-day, 182-day and 364-day Treasury Bills worth Rs 20.50 billion.