Panic selling weighs on stock index

Kathmandu, September 26

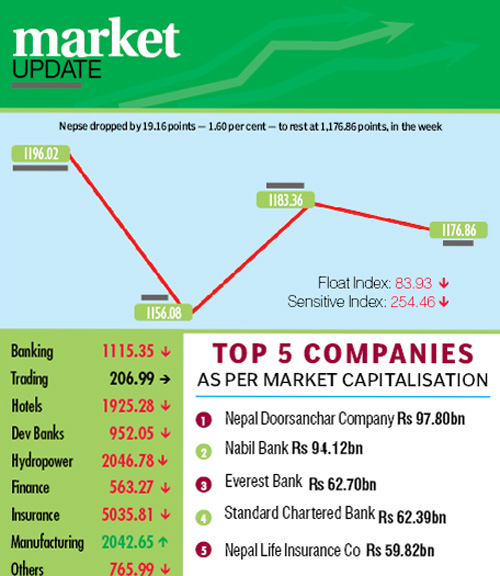

Failure to pacify the agitating Madhes-based political parties and rumours of India imposing economic blockade pushed stock investors to a selling frenzy, resulting in the Nepal Stock Exchange (Nepse) index declining by 19.16 points or 1.60 per cent week-on-week to rest at 1,176.86 points, from September 22 to 24.

As the country’s only secondary market remained closed on Sunday and Monday to celebrate the promulgation of the new constitution, the benchmark index had opened at 1,196.02 points on Tuesday.

However, as rumours started circulating about India imposing economic blockade on Nepal, stock investors resorted to panic selling and started offloading their shares, which in turn resulted in Nepse plunging by 39.94 points by the day’s closing.

On Wednesday, the optimism picked up somewhat as the government authorities assured there was no truth in the hearsay and the local bourse nearly recovered all the loss of the previous day, ascending 27.28 points. On Thursday, however, Nepse shed 6.5 points again.

Altogether 2.63 million units of shares worth Rs 1.63 billion were traded during the week through 7,885 transactions. It is to be noted that the stock market was open for only three days. In the previous week, when the market was open for five days as it normally is, 16,274 transactions of 6.6 million scrips of 174 firms amounting to Rs 3.21 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, dropped 4.04 points to 254.46 points. Similarly, the float index that measures the performance of shares actually traded also dipped by 1.36 points to 83.93 points, during the review period.

Trading continued to hold steady at 206.99 points throughout the trading week. Meanwhile, manufacturing was the only subgroup to land in the green zone, adding 0.44 per cent to 2,042.65 points on the back of Bottlers Nepal (Tarai) gaining Rs 154 to Rs 2,500.

Conversely, hydropower sub-index slumped by 2.85 per cent to 2,046.78 points, with Chilime’s share value dropping by Rs 46 to Rs 1,439, and that of Sanima Mai’s by Rs 28 to Rs 770, among others.

Nepal Telecom’s scrips lost Rs 18 to Rs 652, which in turn dragged down the others subgroup 2.68 per cent to 765.99 points.

Insurance plunged by 2.24 per cent to 5,035.81 points with the likes of Nepal Life Insurance Co losing Rs 100 to Rs 3,450, and Life Insurance Co Nepal down Rs 115 to Rs 3,495, among others.

Banking, the sub-group with the highest stake in market capitalisation of Nepse, descended by 1.44 per cent to 1,115.35 points. Nabil Bank’s stock price dropped by Rs 65 to Rs 2,575 and share value of Standard Chartered was down Rs 31 to Rs 2,795.

Trailing close behind, development banks lost 1.31 per cent to 952.05 points, weighed down by Nagbeli slumping by Rs 320 to Rs 1,930, Diprox by Rs 34 to Rs 1,706 and Chhimek Laghubitta Bikas Bank by Rs 25 to Rs 1,600.

Hotels and finance subgroups dipped by 0.98 per cent to 1,925.28 points and 0.28 per cent to 563.27 points, respectively.