Political uncertainty hits Nepse index

The political uncertainty weighed on the sentiment of share investors with the Nepal Stock Exchange (Nepse) index recording a week-on-week drop of 30.1 points or 1.89 per cent in between June 18 and 22.

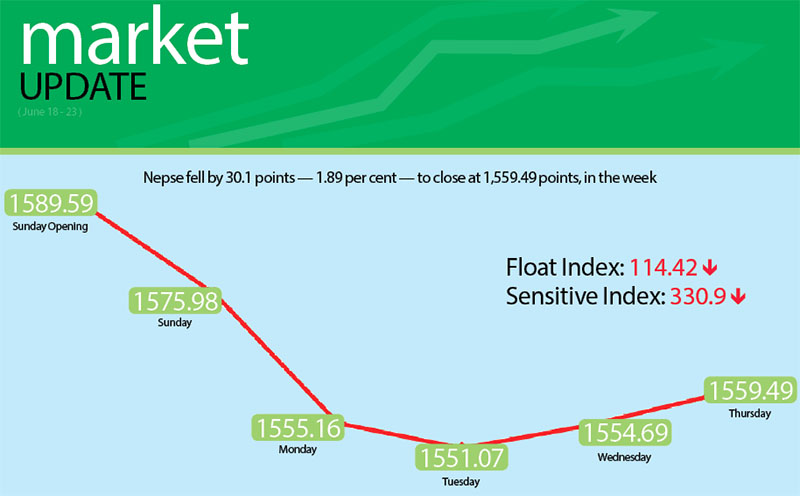

Opening at the previous week’s close of 1,589.59 points, the benchmark index had dropped by 13.61 points by Sunday’s closing. The Nepse index remained southbound for the next two days — slumping by 20.82 points on Monday and shedding 4.09 points on Tuesday. The local bourse reversed course thereafter, inching up 3.62 points on Wednesday and adding 4.8 points on Thursday to close the week at 1,559.49 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 6.71 points or 1.99 per cent to rest at 330.9 points. Similarly, the float index that measures the performance of shares actually traded also declined by 2.65 points or 2.26 per cent to land at 114.42 points.

Altogether, 5.29 million shares of 164 companies that amounted to Rs 2.96 billion were traded through 25,858 transactions. The traded amount was similar to the past week when 30,647 transactions of 4.91 million shares of 161 firms worth Rs 2.96 billion had been undertaken.

Among the subgroups, trading continued to hold steady at 212.76 points.

The rest of the subgroups landed in the red, with insurance leading the pack of losers. Insurance sub-index took a dive of 188.73 points or 2.25 per cent to close the week at 8,188.98 points.

Insurance companies like Nepal Life slumped by 3.03 per cent to Rs 2,045 and National Life plummeted by 3.83 per cent to Rs 2,260. The securities market regulator had suspended the trading of Everest Insurance on suspicion of insider trading. The market price and turnover of the insurance company had gone up significantly a few days prior to the announcement of issuance of 600 per cent rights share.

However, it was the loss of the banking subgroup — the share market heavyweight — that was the deadweight on the benchmark index. The sub-index lost 31.91 points or 2.24 per cent to settle at 1,391.38 points. Share value of Nepal Credit and Commerce Bank, which had resumed trading after nearly three weeks, plunged by 6.51 per cent to Rs 359, while major banks like Nabil and Standard Chartered fell by 1.89 per cent to Rs 1,452 and 0.52 per cent to Rs 2,275.

Hydropower was down 33.71 points or 1.69 per cent to 1,962.33 points. Along with Everest Insurance, the Securities Board of Nepal had also suspended the trading of National Hydropower on reports of dispute among the directors of the company. Among other hydropower firms listed in the secondary market, Chilime edged down by 0.72 per cent to Rs 829 and Api fell by 1.77 per cent to Rs 555.

Adding to the previous week’s dip of 0.98 per cent, finance subgroup lost 11.54 points or 1.52 per cent to land at 748.96 points. Similarly, manufacturing, which had managed to limit its loss to below one per cent in the previous week declined by 35.83 points or 1.48 per cent to 2,375.98 points.

Development banks descended by 26.7 points or 1.37 per cent to 1,917.72 points. Share price of Chhimek went down by 1.29 per cent to Rs 1,530 and Nirdhan Utthan shed 0.76 per cent to Rs 1,965, among others.

Even though they too landed in the red, hotels and others subgroups managed to limit their losses to below one per cent. Hotels fell by 17.34 points or 0.78 per cent to 2,206.62 points and others dipped by 0.29 point or 0.04 per cent to 688.05 points.

Meanwhile, Everest Bank retained its top position in terms of turnover with Rs 300.68 million, followed by Prime Life Insurance with Rs 176.1 million, Everest Insurance with Rs 159.74 million, Prabhu Bank (Promoter) with Rs 148.29 million and Standard Chartered with Rs 128.74 million.

Prabhu Bank’s promoter share was the forerunner in terms of trading volume, with 80,000 of its scrips changing hands. Similarly, Everest Bank topped chart with regard to most number of transactions — 2,093.