Political uncertainty rattles stock investors’ nerves

Kathmandu, October 10

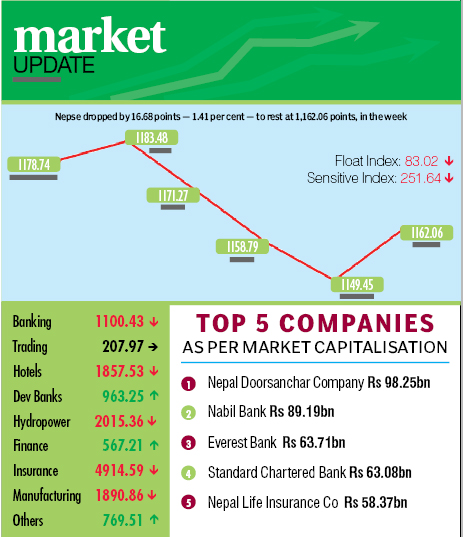

The ongoing Tarai protests and political uncertainty caused the Nepal Stock Exchange (Nepse) index to decline by 16.68 points or 1.41 per cent week-on-week to rest at 1,162.06 points, from October 4 to 8.

Opening at 1,178.74 points on Sunday, the benchmark index added 4.74 points by the day’s closing. However, the increasing political uncertainty dampened investor spirit, who rushed to offload their stocks. Consequently, Nepse tumbled by 12.21 points, 12.48 points and 9.34 points on Monday, Tuesday and Wednesday, respectively.

Even as the local bourse increased by 12.61 points on Thursday, it was not enough to offset the losses of previous three trading days.

Altogether 3.76 million units of shares of 155 companies worth Rs 2.13 billion were traded during the week through 10,573 transactions. The traded amount was 7.65 per cent higher than the previous week when 9,914 transactions of 3.07 million scrips of 151 firms amounting to Rs 1.99 billion had been undertaken.

The sensitive index dropped 3.98 points to 251.64 points. Likewise, the float index also shed 1.11 points to land at 83.02 points.

Apart from trading, which remained constant at 207.97 points, most subgroups witnessed double digit losses and even those that managed to land in the green terrain recorded only minimal gains.

Manufacturing saw a massive loss of 7.46 per cent to close at 1,890.86 points. This was mostly due to Unilever Nepal’s share value plummeting by Rs 2,899 to Rs 26,091 and Himalayan Distillery down nine rupees to Rs 540.

Hotels dropped 2.89 per cent to 1,857.53 points. Oriental’s stock price landed at Rs 570 (down Rs 26), Soaltee’s at Rs 436 (down Rs 12) and Taragaon Regency’s at Rs 231 (less Rs 11).

Banking subgroup declined 1.93 per cent to 1,100.43 points. Nabil Bank’s share price went down by Rs 110 to Rs 2,440 and Nepal Investment’s dropped by Rs 23 to Rs 1,040, among others.

Close on its heels, hydropower retreated by 1.28 per cent to 2,015.36 points, with Chilime losing Rs 20 to Rs 1,405, Sanima Mai ending at Rs 806 (down five rupees) and Ridi closing at Rs 385 (down Rs 10).

Meanwhile, the insurance sub-index dipped 0.58 per cent to 4,914.59 points.

Even with an increase of a mere 0.66 per cent to 963.25 points, development banks took the lead among the gainers. Chhimek Laghubitta Bikas Bank added Rs 99 to Rs 1,799 and Swabalamban Bikas Bank surged by Rs 101 to Rs 2,303, among others.

Nepal Telecom, the company with the highest market capitalisation among the firms listed at Nepse, saw its stock price rise one rupee to Rs 655, thereby helping the others subgroup inch up 0.15 per cent to 769.51 points. Finance managed to land in the green zone, but barely, by adding 0.02 point to 567.21 points.

Everest Bank topped the charts in terms of turnover with Rs 277.72 million, followed by Nepal Life Insurance with Rs 114.93 million, International Leasing and Finance Co with Rs 100.01 million, Nabil Bank (Promoter Share) with Rs 89.54 million and Nepal Investment Bank (Promoter Share) with Rs 86.51 million.

International Leasing and Finance Co was the forerunner in terms of number of shares traded with 451,000 of its scrips changing hands. Meanwhile, Everest Bank (Promoter Share) took the lead in terms of transactions with 641 deals.