Political uncertainty spooks stock investors

Kathmandu, October 31

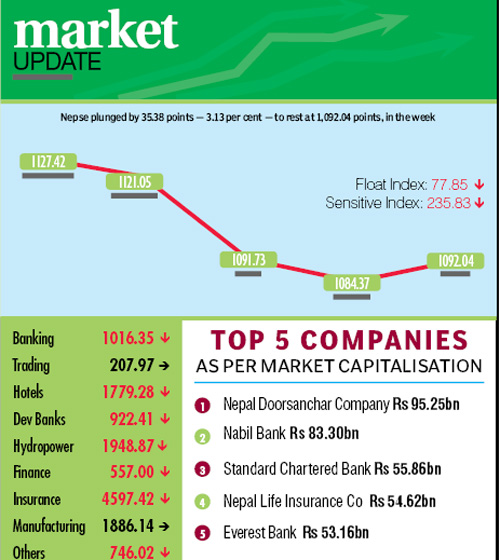

The effects of the political uncertainty and its subsequent economic toll were clearly visible in the country’s only secondary market, as the Nepal Stock Exchange (Nepse) index plummeted by 35.38 points or 3.14 per cent week-on-week to settle at over a two-and-a-half month low of 1,092.04 points, from October 25 to 29.

Opening on Sunday after the Dashain festival at 1,127.42 points, the benchmark index dipped by 6.37 points by the day’s closing. While the stock market remained closed on Monday in celebration of Kojagrat Purnima, the local bourse continued its downward trajectory, diving by a massive 29.32 points on Tuesday and another 7.36 points on Wednesday.

Even as rumours and speculations of positive political cues grew with Nepal inking a deal with China to import petroleum products and the election of the first female president of the country on Wednesday which helped the Nepse index jump 7.67 points on Thursday, it was insufficient to salvage the cumulative loss of the earlier three trading days.

Until now, Nepse had managed to close above the psychological level of 1,100 points after breaching the threshold on

August 16.

In total, 1.33 million units of shares of 166 companies worth Rs 804.43 million were traded during the week through 5,647 transactions.

The sensitive index, which gauges the performance of class ‘A’ stocks, dropped 7.88 points to 235.83 points. Likewise, the float index that measures the performance of shares actually traded also shed 2.73 points to settle at 77.85 points, during the review period.

Apart from manufacturing and trading, which remained constant at 1,886.14 points and 207.97 points, there was a stock bloodbath in the country’s only secondary market during the review period.

Insurance subgroup witnessed the biggest loss of 4.05 per cent to 4,597.42 points as stock price of insurance firms like Nepal Life Insurance dived by Rs 146 to Rs 3,150; National Life Insurance by Rs 149 to Rs 2,101 and Life Insurance Co Nepal by Rs 131 to Rs 3,239.

The banking subgroup plunged by 3.87 per cent to 1,016.35 points. The share value of Standard Chartered went down by Rs 163 to Rs 2,490, of Nabil by Rs 121 to Rs 2,279 and Himalayan Bank by Rs 24 to Rs 1,215, among others.

Hotels trailed close behind slumping 3.44 per cent to 1,779.28 points. Even as Oriental’s share price went up by

Rs 16 to Rs 591, the gain was offset by Soaltee’s dropping Rs 22 to Rs 408.

Development banks descended 2.56 per cent to 922.41 points. Scrips of Chhimek Laghubitta Bikas Bank closed

at Rs 1,675, down Rs 85 and Nirdhan Utthan was down Rs 31 to Rs 1,899, among others.

The hydropower sub-index fell 2.11 per cent to 1,948.87 points. Chilime tumbled by Rs 45 to Rs 1,345 and Sanima Mai by Rs 30 to Rs 765. Barun Hydropower, however, saw its stock price surge by Rs 90 to Rs 412.

Finance was down 1.02 per cent to 557 points, primarily with the share value of Pokhara Finance freefalling by Rs 141 to Rs 275.

With Nepal Telecom’s scrips dipping by three rupees to Rs 635, others subgroup managed to limit its loss to 0.47 per cent to 746.02 points.

Nepal Investment Bank (Promoter Share) topped chart in terms of number of shares traded and turnover with 105,000 of its scrips changing hands that amounted to Rs 85.67 million. Second in line in terms of turnover was Nepal Investment Bank with Rs 67 million, followed by Everest Bank with Rs 60.96 million, National Life Insurance with Rs 45.46 million and Nepal Life Insurance with Rs 39.98 million.

Meanwhile, Barun Hydropower Co took the lead in number of transactions clocking 1,030 deals.