Price of precious metals goes up

The price of precious metals went up marginally in the week of September 4 to 9, sparked by disappointing US economic news and a weaker dollar.

Financial markets had started pricing in a greater chance of a rate hike on September 21 on the back of a series of hawkish speeches.

However, data released on Tuesday showed US services sector activity slowed to a six-and-a-half-year low in August amid sharp drops in production and orders, pointing to slowing economic growth that further diminished prospects for a near-term interest rate increase.

The US non-manufacturing new orders index for August, which too was released on Tuesday, also fell to its lowest since December 2013.

Gold is highly exposed to interest rates and returns on other assets, as rising rates lift the opportunity cost of holding on to non-yielding bullion.

The prices of precious metals in the domestic market are governed by their rates in the international market.

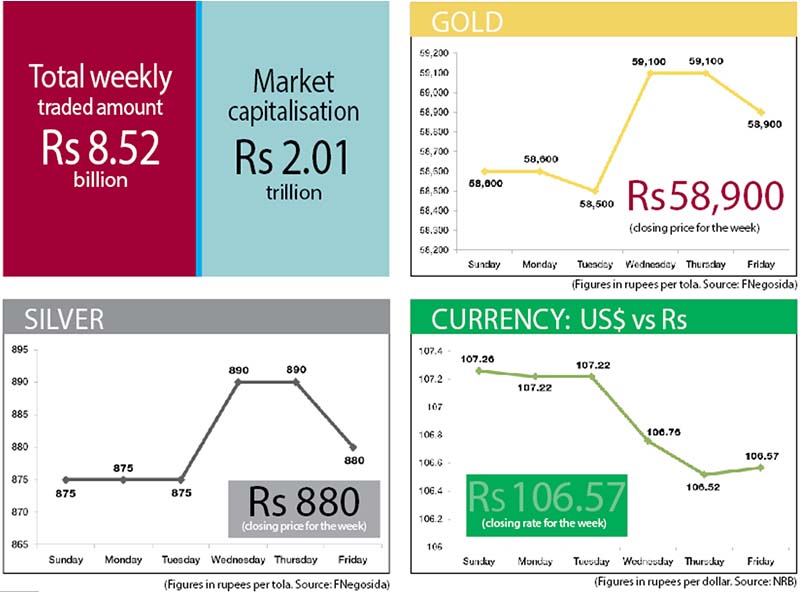

Gold was priced at Rs 58,600 per tola on Sunday and its price remained the same the next day.

On Tuesday, the price of the precious yellow metal dipped by Rs 100 to Rs 58,500 a tola. On Wednesday, bullion price rebounded strongly on the back of weak US data and rose by Rs 600 a tola to Rs 59,100 per tola. Its price stayed the same on Thursday before dipping by Rs 200 to be traded at Rs 58,900 per tola on Friday.

Over the week, the price of precious yellow metal rose by Rs 300 a tola or 0.51 per cent.

Similarly, silver was being traded at Rs 875 per tola on Sunday and its price remained the same over the next two days.

Similar to that of bullion, the price of the white metal went up by Rs 15 a tola to Rs 890 per tola on Wednesday. Silver was traded at the same rate on Thursday before dropping by Rs 10 to be priced at Rs 880 per tola on Friday.

Over the week, the price of precious white metal went up by five rupees a tola or 0.57 per cent.

Next week, investors will be looking for commentary regarding the timing of the next Fed rate hike, according to Federation of Nepal Gold and Silver Dealers’ Association (FeNeGoSiDA).

“Hawkish comments will be bullish for the greenback, which should pressure gold prices further. Taking September rate hike off the table would be considered dovish and this could underpin gold futures,” FeNeGoSiDA further stated.