Pro-investment budget fuels market rally

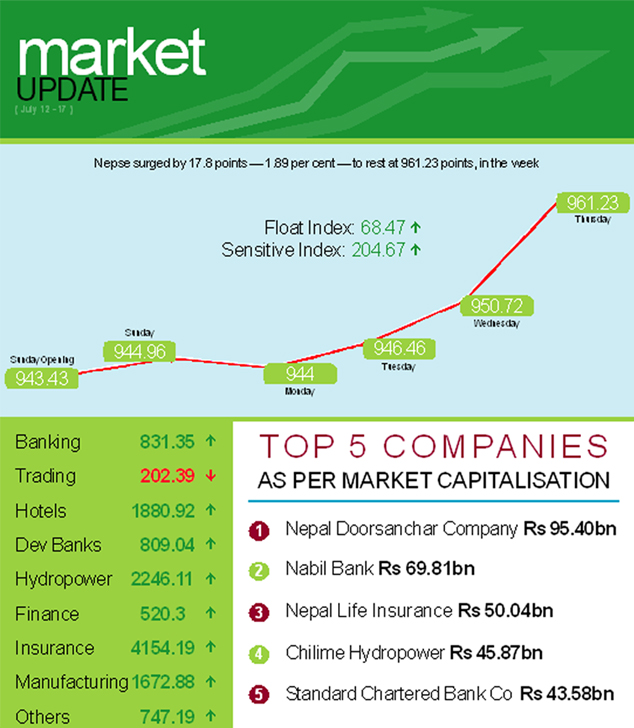

Stock investor sentiment got a major boost with the ‘investment-friendly’ budget announced for fiscal year 2015-16 on Tuesday. Hence, the Nepal Stock Exchange (Nepse) index surged by 17.8 points or 1.89 per cent week-on-week to rest at 961.23 points, from July 12 to 16.

The benchmark index that had opened at 943.43 points on Sunday had inched up 1.53 points by the day’s closing. The pre-budget jitters caused Nepse to shed 0.96 point on Monday, but recovered the loss the very next day by adding 2.46 points. Following the budget announcement, the local bourse gained 4.26 points on Wednesday and a hefty 10.51 points on Thursday.

Nepse was previously at this level in the second week of June, when the stock market had rallied following the news of political parties agreeing to form eight states in the country.

Altogether 3.49 million shares of 172 firms worth Rs 1.32 billion were traded at Nepse through 7,443 transactions in the trading week. Traded amount was 3.16 per cent higher than preceding week when transaction of 3.64 million scrips of 170 listed firms worth Rs 1.28 billion had been undertaken through 7,479 deals.

The sensitive index rose by 3.96 points to 204.67 points. Similarly, float index added 1.39 points to rest at 68.47 points.

Except trading, all subgroups witnessed gains in the week.

Hydropower subgroup took the lead in terms of points gained, clocking an impressive growth of 138.34 points to close at 2,246.11 points. Chilime’s share value rose by Rs 144 to Rs 1,683, and Butwal Power’s by Rs 16 to Rs 617, among others.

Manufacturing surged by 82.2 points to 1,672.88 points with Unilever’s share value rising by Rs 1,261 to Rs 21,561 and Himalayan Distillery’s by Rs 72 to Rs 684.

Hotels subgroup rose by 26.1 points to 1,880.92 points. While Soaltee’s share price remained constant week-on-week at Rs 425, that of Oriental gained Rs 60 to Rs 682 and Taragaon’s inched up two rupees to Rs 252.

Trailing close behind in terms of points gained, development banks added 26.09 points to rest at 809.04 points. Scrips of Infrastructure Development Bank closed at Rs 178, up seven rupees and Business Universal’s share value went up by five rupees to Rs 205.

Nearly recovering the loss of previous week, insurance subgroup rose by 20.86 points to 4,154.19 points. Rastriya Beema Sansthan’s scrips ascended by Rs 100 to Rs 5,100 and Life Insurance Co’s by Rs 19 to Rs 2,799.

The others subgroup gained 18.79 points to 747.19 points, with share value of Nepal Telecom surging by Rs 16 to Rs 636. Nepal Telecom’s market capitalisation surged by Rs 2.40 billion in the week to Rs 95.40 billion.

Banking also recorded a double-digit growth of 10.39 points to rest at 831.35 points. Even as Nabil’s stocks were down Rs 10 to Rs 1,910, the loss was offset by Standard Chartered’s share value rising by Rs 18 to Rs 1,943 and Agricultural Development Bank’s going up by Rs 22 to Rs 432, among others.

Finance inched up 3.79 points to 520.3 points, which was a step up from the previous week’s dip of 0.82 point. Conversely, trading subgroup dropped by 10.72 points to 202.39 points.