Remittance inflow drops after almost four years

Kathmandu, October 23

Inflow of remittance has dropped for the first time in four years, as per Nepal Rastra Bank (NRB).

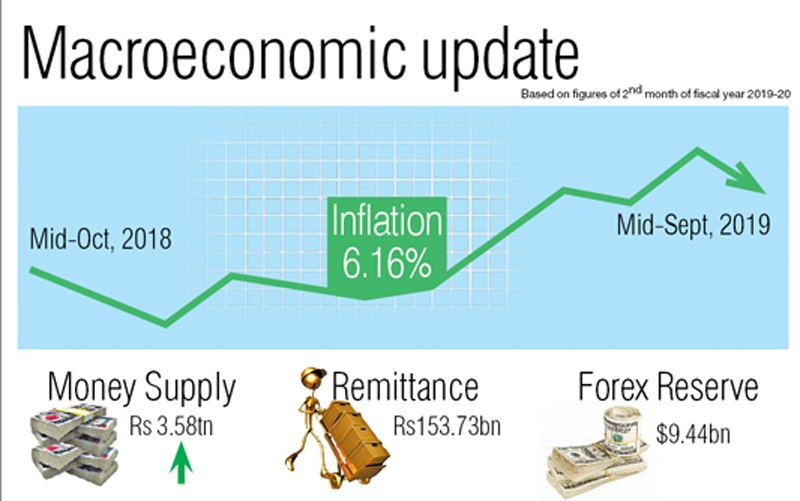

The current macroeconomic report of the first two months of 2019-20 unveiled by NRB shows that the remittance inflow decreased by 0.3 per cent to Rs 153.73 billion in the first two months of this fiscal (from mid-July to mid-September) compared to an increase of 33.4 per cent in the same period of the previous year.

Sarita Bhatta, executive director at the Foreign Exchange Management Department of the central bank, said that remittance inflow was down after almost four years.

“We are yet to analyse the actual reason behind the fall in remittance. However, the remittance inflow may have decreased as the growth in outflow of migrant workers has been tepid in the recent months,” Bhatta said.

However, she said the remittance inflow may increase in the third month of the fiscal (mid-September to mid-October) as workers often send money home ahead of the festive season.

Similarly, the halt in the supply of migrant workers to Malaysia since almost one year has also been cited as the reason behind the fall in remittance.

As per the NRB report, the number of Nepali workers (institutional and individuals) that migrated for foreign employment increased 0.2 per cent in the review period.

Decline in remittance is often taken as a serious concern in economies like Nepal which are highly driven by remittance.

Meanwhile, country’s trade deficit narrowed 3.1 per cent to Rs 211 billion in the two months of 2019-20 fiscal year. While merchandise exports increased 25.9 per cent to Rs 18.5 billion in the two months of this fiscal compared to an increase of eight per cent in the corresponding period of previous fiscal, merchandise imports decreased 1.2 per cent to Rs 229.50 billion in the review period.

Similarly, the balance of payments (BoP) remained at a surplus of Rs 8.83 billion in the review period compared to a deficit of Rs 25.45 billion in the same period of the previous year. Based on the imports of two months of current fiscal, the foreign exchange reserves of the banking sector is sufficient to cover prospective merchandise imports of 9.6 months, and merchandise and services imports of 8.4 months, as per NRB.

However, year-on-year consumer price inflation stood at 6.16 per cent in mid-September against 3.86 per cent a year ago. Food and beverage inflation stood at 6.51 per cent, whereas non-food and service inflation stood at 5.89 per cent in the review month.