Revenue collection target likely to be met

It seems by the end of this fiscal the government will be able to recover the revenue collection that had taken a hit during the four-month-long border blockade.

This is because the government has exceeded the monthly revenue collection target by 80 per cent in the 10th month of this fiscal, which has made a significant contribution in making up for the shortfall of previous months to a large extent. The government had witnessed shortfall worth Rs 50.5 billion as compared to the target set till the ninth month of this fiscal.

With the surge in collection, the gap has now been narrowed down to Rs 18.46 billion as the government was able to collect Rs 60.82 billion in the 10th month (mid-April to mid-May) of this fiscal, against the monthly target of Rs 33.81 billion.

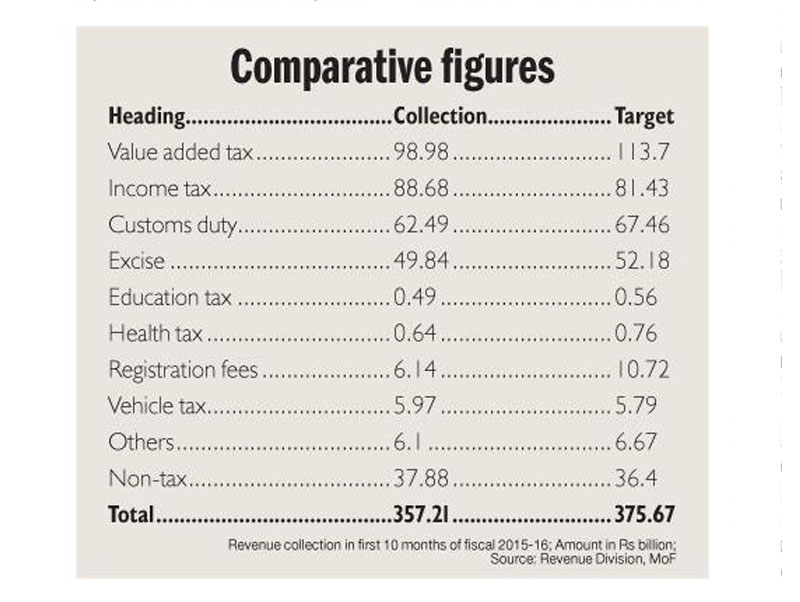

The total revenue collection in the first 10 months of this fiscal stood at Rs 357.21 billion against the target of Rs 375.67 billion for the given period. The collection amount is 14 per cent higher as compared to the revenue collection of the corresponding period of the last fiscal.

By the end of the 10th month, it can be said that the government is in a comfortable position to meet its annual target of Rs 475 billion. Now, the government needs to collect around Rs 118 billion in the remaining two months of this fiscal to meet the annual target set for revenue collection.

The submission of Rs 12 billion from Ncell as capital gains tax in the 10th month was the main factor in tapering the gap between the set target and collection of revenue.

The government missed collection target in major contributors of revenue, namely, value added tax (VAT), customs tariff, excise, registration fees, education and health service tax and others heading. However, collection of income tax, vehicle tax and non-tax exceeded the target in the review period.