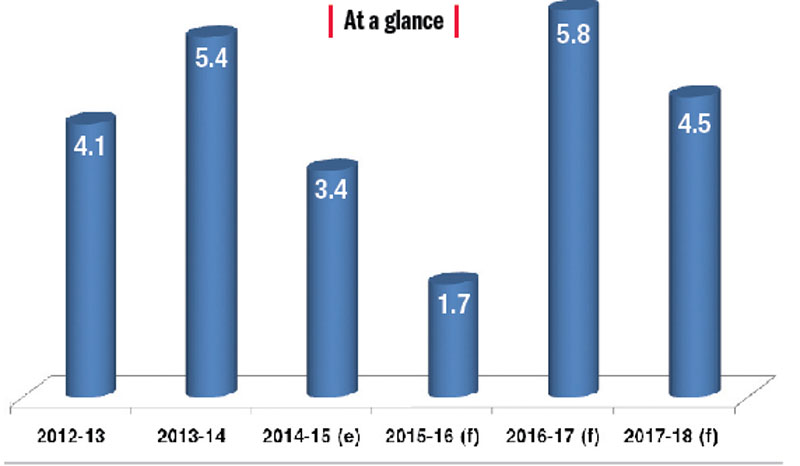

WB revises down growth to 1.7pc this fiscal

Kathmandu, January 7

The economic prospects for the country seem to be getting bleaker, as the World Bank (WB) has revised down the growth for fiscal year 2015-16 to 1.7 per cent, versus an estimate of 3.7 per cent prior to the trade disruption.

This is the slowest growth rate among all South Asian nations.

In its ‘Regional Outlook for South Asia’ as a part of ‘Global Economic Prospects’ report, the Bank has said: “However, there remains considerable uncertainty around the point forecast, with growth likely to range anywhere between one and 2.3 per cent.”

The report has identified ‘an escalation of existing tensions in Nepal’ as the key risk to the country.

Stating that budget execution, particularly capital spending, has been a longstanding challenge in Nepal, the report says ‘slow progress in post-earthquake reconstruction, coupled with political tensions, could dampen any post-earthquake rebound’.

The cost from the earthquakes in the spring of 2015 is estimated at about a third of the gross domestic product (GDP). Activity has since been further hurt by domestic protests and a closure of land trading routes through India in the second half of 2015. This has led to acute fuel and food shortages, and put a halt to reconstruction efforts. Moreover, investment and other economic activities have been hit hard.

“Plans to build major hydropower projects in partnership with China and India are likely to see considerable delays in the current environment,” as per the report.

READ ALSO

On a positive note, however, the WB has said, ‘activity should gradually recover as government reconstruction spending is ramped up in the later years of the forecast period’. This is because Nepal is planning to substantially increase spending for reconstruction and is in turn expected to push the fiscal balance into a modest deficit.

For fiscal year 2016-17, the country’s growth forecast has been revised up 0.3 percentage point to 5.8 per cent, while the growth for 2017-18 has been projected at 4.5 per cent.

In terms of the region, the report has said that GDP growth in South Asia rose from 6.8 per cent in 2014 to seven per cent in 2015 — the fastest rate among developing regions — as recovery took hold in India, and as the region benefited from lower oil prices and improved resilience to external shocks.

The Bank has projected a moderate further acceleration in economic activity, with regional growth rising to 7.5 per cent in 2018, buoyed by strengthening investment and a broadly supportive policy environment.

While the risks to growth in the region are mainly domestic and country specific, the report has said, “South Asia may also face external headwinds from an increase in interest rates in the United States, although vulnerabilities are greatly reduced since the ‘taper tantrum’ of 2013.”

While the closed nature of the region (compared with other emerging market regions) has reduced exposure to large global shocks, it also limits the potential of South Asian firms to benefit from the strengthening of demand in the United States and Europe over the medium term. At the same time, the scope for negative spill-overs from global financial market volatility may be rising, as India increasingly integrates into global capital markets, the report adds.