Wednesday’s rebound limits Nepse index’s loss to 0.25 per cent

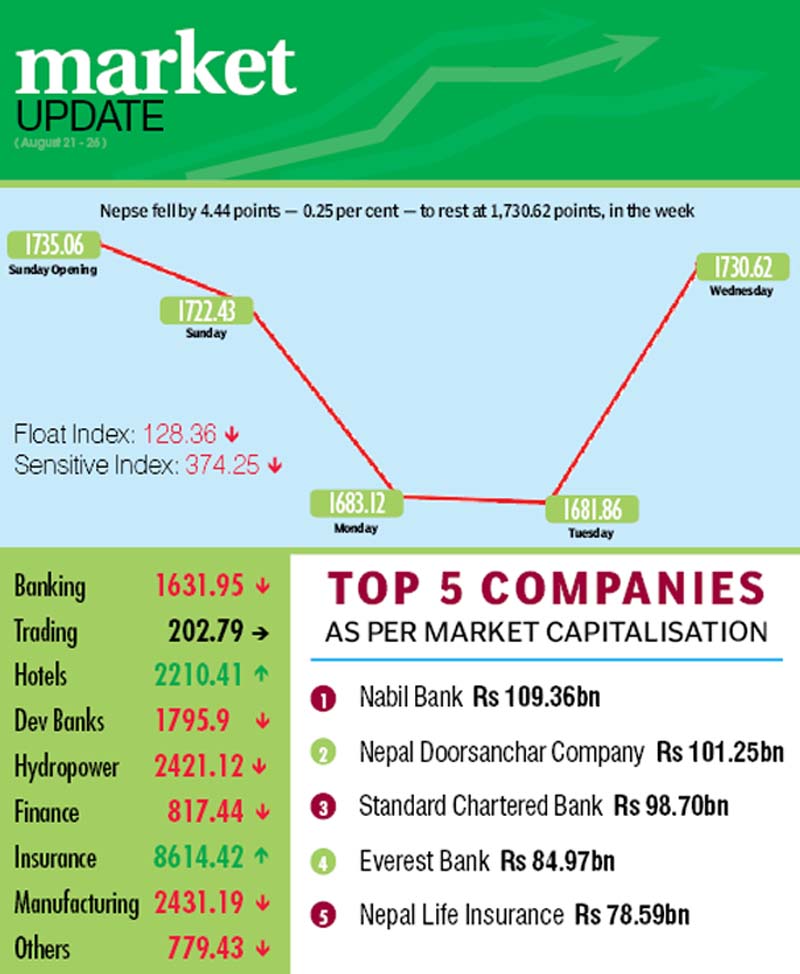

The recovery in the last trading day of the week helped the Nepal Stock Exchange (Nepse) index limit its weekly loss to 4.44 points or 0.25 per cent to rest at 1,730.62 points in the week between August 21 to 24.

Starting the week at 1,735.06 points on Sunday, the benchmark index had dropped 12.63 points by the day’s closing.

Continuing southbound, Nepse plunged by nearly 40 points in a single day on Monday to retreat below the 1,700-point threshold and shed another 1.26 points on Tuesday.

On Wednesday, however, the local bourse surged by 48.76 points to end the week above the 1,700-point mark again. The domestic share market remained closed on Thursday in celebration of Krishna Janmasthami.

All in all, 4.78 million shares of 156 companies worth Rs 3.45 billion were traded through 19,954 transactions during the week. The traded amount was 21.4 per cent less compared to the previous week when 25,679 transactions of 8.32 million scrips of 152 firms that amounted to Rs 4.39 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell 0.36 point or 0.1 per cent to 374.25 points. Likewise, the float index that measures the performance of shares actually traded also dropped 0.52 point or 0.4 per cent to 128.36 points.

While trading continued to hold steady at 202.79 points, hotels and insurance were the only two subgroups to witness gains during the review period.

Hotels recouped the previous week’s loss of 2.03 per cent as the subgroup advanced by 74.77 points or 3.5 per cent to rest at 2,210.41 points. Even as Taragaon Regency’s share value dropped by Rs 15, hotels sub-index rose on the back of stock price of Soaltee going up by Rs 17 to Rs 415 and of Oriental by Rs 31 to Rs 602.

Insurance subgroup also managed to salvage the past week’s plunge of 2.24 per cent by escalating 214.34 points or 2.55 per cent to 8,614.42 points. Stockholders of Shikhar saw their share value go up by Rs 65 to Rs 3,320 and that of Prudential by Rs 54 to Rs 1,534, among others.

At the other end of the spectrum, manufacturing subgroup plummeted by 103.8 points or 4.09 per cent to 2,431.19 points. The sub-index was weighed down by Unilever Nepal’s share price dropping by Rs 665 to Rs 33,115 and Bottlers Nepal (Tarai) plunging by Rs 1,016 to Rs 5,182.

Adding to the previous week’s fall of 1.05 per cent, finance took a dive of 32.44 points or 3.82 per cent to close at 817.44 points.

Citizen Investment Trust lost Rs 230 to Rs 4,620, United dropped by Rs 18 to Rs 432 and Lumbini was down Rs 25 to Rs 459.

Hydropower retreated by 65.06 points or 2.62 per cent to 2,421.12 points. Stock price of Chilime went down by Rs 24 to Rs 1,270, that of Api was down Rs 35 to Rs 635 and Barun landed at Rs 445, down Rs 10.

Others dropped 19.38 points or 2.43 per cent to 779.43 points. Nepal Telecom shed nine rupees to close at Rs 675 and Hydroelectric Investment and Development Company Ltd (HIDCL) lost Rs 20 to Rs 335.

Development banks and banking subgroups witnessed muted losses. The sub-index of development banks was down 12.69 points or 0.7 per cent to 1,795.9 points and banking subgroup fell 1.98 points or 0.12 per cent to 1,631.95 points.

Meanwhile, Nepal Investment Bank topped the charts in terms of transactions and highest turnover, recording 3,087 deals under its name worth Rs 281.39 million.

Other firms that made it to the top five with regards to high turnover were Nepal Bangladesh Bank with Rs 206.36 million, Lumbini General Insurance Company with Rs 154.76 million, Himalayan General Insurance with Rs 131.15 million and Everest Bank with Rs 123.57 million.

NMB Sulav Investment Fund – I was the forerunner in terms of trading volume with 291,000 of its shares changing hands.