Big merger: Why now?

Due to M&A, the market share of some banks could increase dramatically, and hence the increased bargaining power of the banks could lead to collusions, cartellings and unhealthy practices in core lending rates

The Nepali financial system, particularly the banking sector, has seen frequent policy changes in a short period of time. Nepal Rastra Bank (NRB) has a history of dumping long-term policies in the middle of its course. There was a time when the central bank would issue as many licenses as there were applications for new banking and financial institutions (BFIs) in Nepal - specifically, from 2007 to 2012. There was a saying that banking was a post-retirement business of senior executives of the NRB. As many as 67 licenses were issued to new BFIs in five years from 2008-2012. However, NRB abruptly put a squeeze on new licenses at the end of 2012, when there were 211 BFIs in Nepal, and started popularising the term merger and acquisitions (M&A). The question is, why should they go for a merger just a year or two of their operation?

This shows nothing but lack of foresight among the policymakers. The rampant controls on the market - frequent short-term policies to control the interest rates, cash reserve ratio, spread rates and credit flow - in a free-market economy is nothing but hindsight of poorly defined policies. For example, NRB all of a sudden raised the paid-up capital of BFIs through the monetary policy of 2015/16 four-fold without reckoning its probable impact on the stock market. The argument is not whether the policy was wrong, no it wasn’t. But the policy-makers failed to restrain the BFIs from issuing right shares and bonus shares to accumulate the required paid-up capital.

So rather than getting into big mergers and acquisitions, the stock market was awash with the shares of BFIs. The result is what the Nepal stock exchange is facing now: stocks that were worth Rs 3000 then are now trading for less than Rs 600. Therefore, unless we have a culture of making decisions on a policy only after doing research on both the positive and negative aspects, it will not bode well for both the industry and the nation.

Since NRB is all set to unveil the monetary policy for 2019/20 and its Governor Chiranjibi Nepal has suggested BFIs start finding the right partner for a big merger, let’s analyse the good and the ugly sides of it.

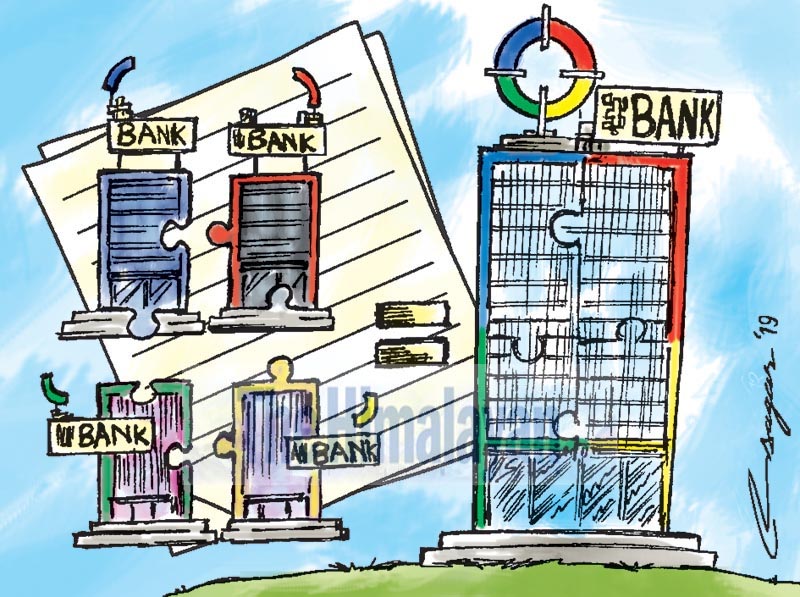

The Nepali financial market has been awash with merger talks since the incumbent governor took office. Some economists and policy-makers argue that there should be no more than 15 commercial banks in Nepal - currently there are 28. However, such arguments are not backed by any substantial research. To better understand the advantages of mergers, the rampant banking problems should be understood first.

One major issue of the Nepali financial market is the large number of urban-based BFIs with lower paid-up capital. There were 151 BFIs in 2018. Given the size of the economy, this number is unnecessarily high. Unhealthy competition in deposit collection and loan disbursement, lack of capacity to finance large-scale projects, higher interest rate sensitivity and increment in flow of bad loans are some of the problems that an economy faces when it has a large number of small BFIs in the market.

Let’s recall that the Nepali banking crisis of 2011-12 is nothing but the result of such an unhealthy practice. Large-scale investment in the real estate sector by almost all Nepali BFIs back then was not just a coincidence. It was a result of the unnecessarily higher number of BFIs with overlapping banking segments and lower investment opportunities. So a large volume of loans distributed by state-owned banks turned into bad loans. The ratio of non-performing loans to total loans was once above 50 per cent in the case of these banks.

Similarly, interest rate sensitivity is another problem that banks face with lower capital base. The performance of small banks is highly elastic to interest rate change. Thus, a small change in the interest rate costs these banks heavily, and hence they cannot reduce their interest rate even if they want to. And when concerned bodies try to do so, the result is significant reduction in the profitability, and the impact is seen in the stock market and economy as a whole.

Therefore, going for mergers will reduce the number of BFI by strengthening the capital base and lending capacity, increase the ability to withstand interest rate sensitivity due to advantage of economies of scale, and restrain the unhealthy competitions in the market. Similarly, a small number of large banks are also considered immune to short-term financial upheavals. Therefore, the economy would sustain from external shocks.

But reducing the number is increasing the concentration of banks in the market, which incites monopoly by decreasing competition. Due to M&A, the market share of some banks could increase dramatically, and hence the increased bargaining power of the banks could lead to collusions, cartellings and unhealthy practices in core lending rate settings, which is bad for the customer. Similarly, merging two or more well-established institutions into one is not an easy task, especially when it comes to employee management.

Nepal indeed needs only a few large banks with high lending and risk absorbing capacity. However, it does not mean forceful merger is the only solution. The NRB should, therefore, thoroughly analyse the consequences of forceful merger at least from three angles, the customer, organisation and employees, before policing it.