18pc lost regular income source after quakes

At least 18 out of every 100 working-age people residing in quake-affected urban areas lost their regular income sources after the earthquakes of April and May, 2015, a latest study shows.

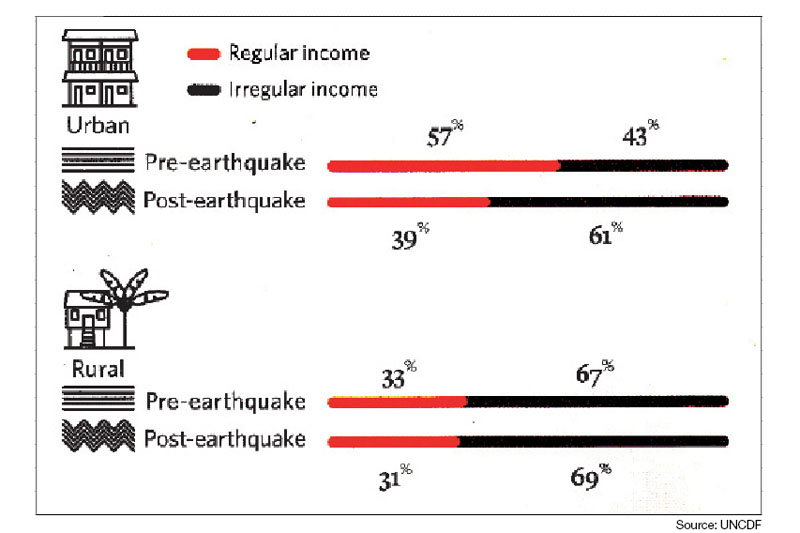

Prior to the earthquakes, 57 per cent of the working-age group residing in quake-affected urban areas had regular income sources, says a report titled ‘A Comparison of the Pre- and Post-Earthquake Situations in Affected Districts’ recently released by the United Nations Capital Development Fund. After the quakes, only 39 per cent of working-age people residing in quake-affected urban areas said they had regular income sources.

The earthquakes also hit regular income sources of rural residents, but the impact was not as severe.

Prior to the quakes, 33 per cent of people living in quake-affected rural areas had regular income sources. That number fell by two percentage points to 31 per cent after the quakes, shows the report prepared on the basis of survey conducted among 768 adults in 14 districts that were badly hit by quakes.

A big chunk of people residing in districts hit hard by quakes was dependent on farming or own businesses for income. Others relied on income of other household members, remittances, piece work and salaries.

The earthquakes took lives of close to 9,000 people and injured over 22,000. The disasters also completely destroyed over 500,000 houses, more than 7,000 school buildings and hundreds of health posts.

In the 14 quake-hit districts, where the surveys were conducted, as many as 95 per cent of houses were destroyed, around three million people were displaced and millions of other livelihoods were adversely affected.

As people’s livelihood was affected, savings rate of females in quake-affected districts declined to 68 per cent from 74 per cent, while that for males fell to 61 per cent from 65 per cent, says the report, adding, “A possible explanation for the decrease is that adults exhausted their savings to cope with the impact of the disaster.”

Also, savings group membership as percentage of adult population fell to 26 per cent from 33 per cent, while savings in savings group dropped to 27 per cent from 35 per cent.

While savings of people living in quake-affected districts shrank, the number of borrowers did not increase, the report shows.

The number of female borrowers, which stood at 42 per cent before the quakes remained at the same level, while number of male borrowers declined from 46 to 33 per cent.

Though 50 per cent of respondents did not give any specific reason for not borrowing after the quakes, 31 per cent said they had enough funds to cover living expenses, while 17 per cent said they feared getting trapped in debt. Another four per cent said they did not borrow as they were not allowed by their spouse, family members or others, and three per cent said interest rates were too high.