Adequate space to ramp up borrowing: ADB

Kathmandu, September 3

Nepal has adequate space to ramp up borrowing to post higher economic growth rate in the coming years, without jeopardising fiscal sustainability, the Asian Development Bank (ADB) has said.

The ADB’s Macroeconomic Update launched today states that the country can continuously post economic growth rate of seven per cent per annum for eight years from fiscal year 2017-18 to fiscal 2024-25 if borrowing is gradually raised to 40.6 per cent of the gross domestic product (GDP) by 2024-25.

With this borrowing, the country’s primary balance — fiscal balance before interest payment on public debt — will stand at a negative of 4.1 per cent of the GDP in between fiscal 2017-18 and fiscal 2024-25, as against existing primary surplus of 1.6 per cent of the GDP.

Since Nepal’s weighted average real borrowing rate — which stands at a negative of 0.1 per cent — is much lower than the GDP growth rate, a small primary deficit will not jeopardise fiscal sustainability, says the ADB report. Also, public debt of around 40 per cent of the GDP is considered fiscally sustainable.

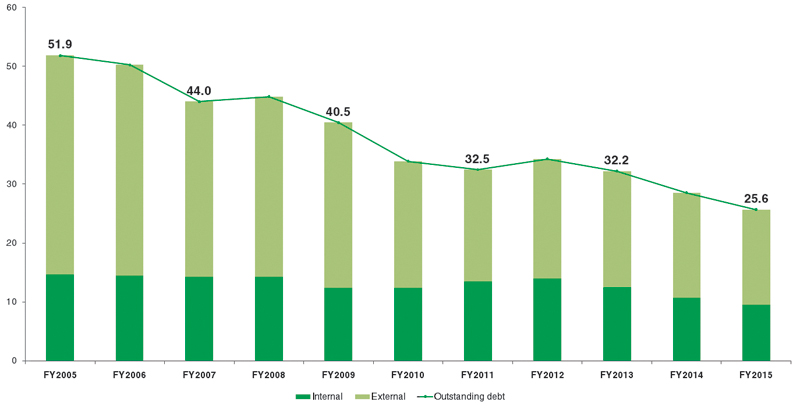

These scenarios pave the way for the country to ‘increase borrowing to a fiscally prudent level to finance productivity-enhancing capital investment’, adds the report. Nepal’s outstanding public debt has been declining over the years, reaching 25.6 per cent of the GDP in the last fiscal year, which ended on July 16.

The declining stock of public debt generally indicates sound public debt management. But this has come at a cost of low capital expenditure, which does not bode well for a country with huge infrastructure deficit, especially in energy and transport sectors.

In the last fiscal year, capital spending stood at 3.8 per cent of the GDP, as against the estimate of 5.5 per cent of the GDP made at the beginning of the fiscal.

One of the reasons for low capital spending or fund absorptive capacity, according to the ADB, is lack of project readiness, such as delay in detailed project design, land acquisition, establishment of project management offices and preparation of procurement plans.

Also, delay in budget approval, budget release and execution of procurement related processes, coupled with weak planning and implementation capacity have affected capital spending.

“In the context of damage caused by the earthquake and large investment needed to close the infrastructure gap, Nepal needs to drastically raise capital spending.

Else, the government’s overarching goal to become a middle-income country by 2030 will not be achieved,” the ADB report says, adding, “Given that tax revenue is barely sufficient to finance reconstruction projects and the compulsion to borrow more from internal and external sources to finance reconstruction projects, the country’s fiscal policy needs to be more prudent, yet expansionary in the coming years.”

Growth projection

KATHMANDU: The Asian Development Bank (ADB) estimates the country’s economic growth to stand between 4.5 per cent and 5.5 per cent in the current fiscal year.

These targets are lower than the government’s estimate of six per cent.

The ADB has said higher growth would largely depend on agricultural output and spending on reconstruction of infrastructure damaged or destroyed by the earthquakes of April and May.

The ADB estimates inflation to stand in between 8.5 per cent and 9.5 per cent this fiscal. The government’s inflation target stands at 8.5 per cent.