Credit demand reduces by half

The growth in credit volume of banks and financial institutions (BFIs) dipped by 50 per cent in the first four months of the current fiscal year, as demand for loans fell due to protests in the Tarai and blockade on Nepal-India border points.

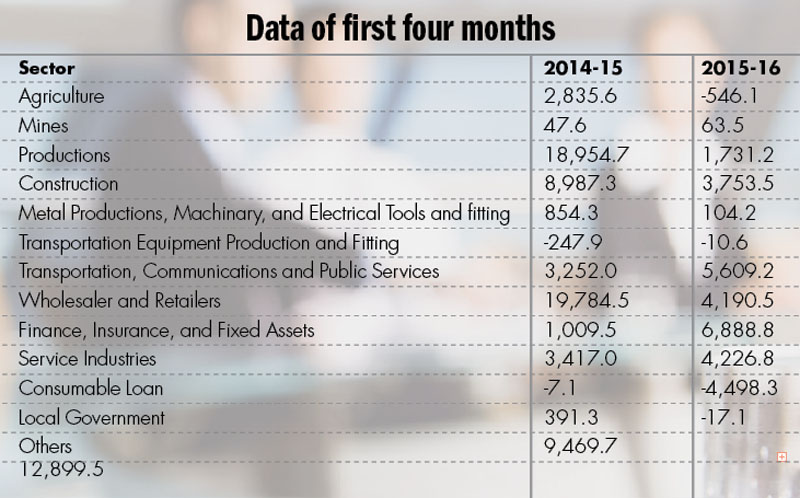

BFIs extended loans worth Rs 34.39 billion in between mid-July and mid-November. In the same period last year, BFIs had extended credit worth Rs 68.75 billion.

“The Tarai protests and blockade have affected almost every sector. This, in turn, has reduced demand for loans,” said Sanima Bank CEO Bhuvan Kumar Dahal.

One of the sectors where demand for loans has fallen drastically is production. BFIs extended only Rs 1.73 billion in loans to this sector in the four-month period, as against Rs 18.95 billion in the same period last fiscal year.

Also, demand for loans from the wholesale and retail sector has fallen drastically. In the four-month period of this fiscal, this sector absorbed only Rs 4.19 billion in loans, as against Rs 19.78 billion in the same period last fiscal year.

Like these sectors, construction sector has also been badly hit by the protests and blockade. As a result, demand for loans in the sector fell to Rs 3.75 billion in the first four months of the current fiscal year. In the same period last fiscal, the sector had consumed Rs 8.99 billion of credit.

Among others, lending to the agriculture sector contracted by Rs 546 million in the review period, which indicates growth in the number of borrowers who paid the debt.

While demand for loans is falling in most of the sectors — except services and finance — deposits are rising in BFIs due to hike in remittance income.

Nepalis working abroad sent Rs 215.39 billion back home in the first four months of the current fiscal. As a result, fresh deposit to the tune of Rs 51.51 billion was added to the coffers of BFIs.

But deposits received by BFIs in the review period are sitting idle, as demand for loan has dipped. Currently, BFIs are sitting on top of around Rs 130 billion, which could be immediately extended as loans.

Inability to convert deposits into loans will add financial burden on BFIs because they will have to continue paying interest to depositors. This is expected to hit the balance sheets of BFIs in the coming days.