Domestic share market witnesses volatile week

Kathmandu, July 16

Political uncertainty followed by the unveiling of the c for fiscal year 2016-17 saw the domestic share market go on a roller-coaster ride in the week of July 10 to 14.

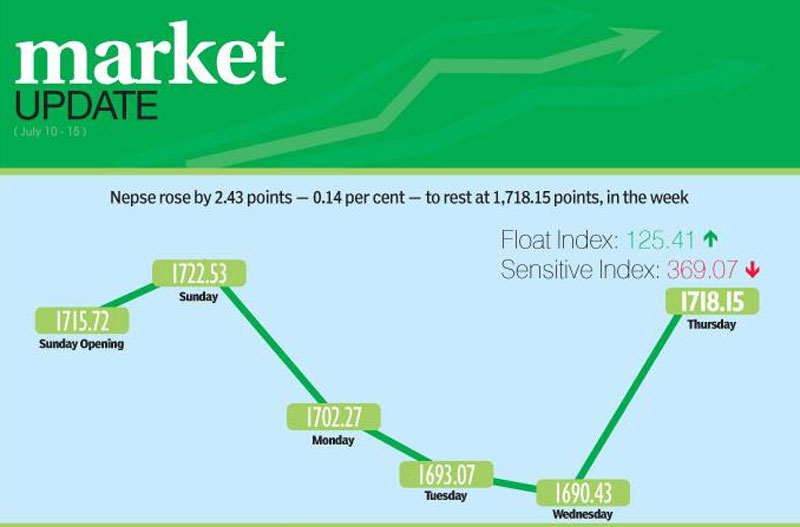

Still, the Nepal Stock Exchange (Nepse) index managed to record a weekly gain of 2.43 points or 0.14 per cent.

Starting the week at 1,715.72 points on Sunday, the benchmark index had gone up by 6.81 points by the day’s closing.

On Monday, Nepse plunged by 20.26 points and the daily turnover also dropped below Rs one billion.

The local bourse dropped 9.2 points to retreat below 1,700-point threshold on Tuesday, as the main Maoist party withdrew its support from the ruling coalition and called for the formation of a new government, threatening to topple Prime Minister KP Sharma Oli.

The political uncertainty resulted in the benchmark index shedding another 2.64 points on Wednesday.

On Thursday, the day the monetary policy for fiscal 2016-17 was unveiled, Nepse surged by 27.72 points to close the week at 1,718.15 points.

In total, 10.1 million shares of 159 companies worth Rs 6.05 billion were traded through 26,094 transactions during the week.

The traded amount was 0.78 per cent higher than the preceding week when 24,433 transactions of 9.96 million scrips of 147 firms that amounted to Rs 6.01 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, was down 0.25 per cent to 369.07 points. However, the float index that measures the performance of shares actually traded inched up 0.33 per cent to 125.41 points during the trading week.

“The market is still on the higher side at present and stock investors should adopt caution but not panic with slight correction,” opined Shreejesh Ghimire, CEO of NMB Capital.

As the trading hours in the country’s only secondary market has been extended by one hour starting Sunday, the general expectation is that the trading volume will go up in the coming days.

“The move will likely also give stock investors ample time to make sensible decisions while trading in the share market, thereby reducing volatility,” Ghimire added.

Similar to the previous week, trading was the only subgroup to remain constant at 202.79 points this time around as well.

Banking — the share market heavyweight — rose by 1.26 per cent to 1,573.71 points. Standard Chartered gained Rs 20 to Rs 3,600 and Janata Bank soared by Rs 75 to Rs 450, among others.

The manufacturing subgroup surged by 5.29 per cent to 2,581.52 points as stock price of Bottlers Nepal (Tarai) soared by Rs 1,893 to Rs 5,936, while that of Unilever Nepal went up by Rs 10 to Rs 35,021.

Even as Nepal Telecom’s share value dropped by three rupees to Rs 689, the others subgroup advanced by 4.34 per cent to 848.26 points on the back of newly-listed Hydroelectricity Investment and Development Company Ltd’s scrips surging by Rs 74 to Rs 433.

On the flipside, insurance subgroup plunged by 4.54 per cent

to 8,722.4 points, because of insurance companies like National Life plummeting by Rs 134 to Rs 3,300, Prime Life down Rs 126 to Rs 2,200 and Nepal Life down Rs 89 to Rs 1,235.

Finance dropped 1.6 per cent to 837.82 points, development banks fell 1.22 per cent to 1,772.75 points, hydropower was down 1.02 per cent to 2,690.18 points and hotels dipped 0.28 per cent to 2,030.71 points.

Meanwhile, Everest Bank topped the chart in terms of turnover with Rs 275.46 million, followed by Janata Bank with Rs 194.28 million, First Microfinance Development Bank with Rs 193.83 million, Taragaon Regency Hotel with Rs 187.75 million and Hydroelectricity Investment and Development Company with Rs 187.01 million.

Siddhartha Equity Oriented Scheme was the forerunner with regards to trading volume, with 1.23 million of its scrips changing hands. Janata Bank clocked 1,222 transactions — the most number of transactions recorded by a single listed firm in the week.