FinMin bets on rosy economic outlook

Kathmandu, September 18

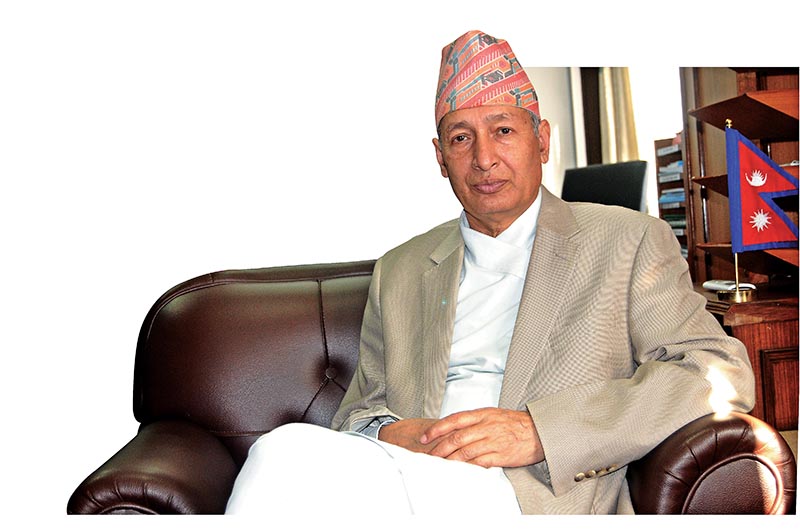

Finance Minister Yubaraj Khatiwada tried to dispel concerns related to low capital expenditure in the first two months of the current fiscal (mid-July to mid-August and mid-August to mid-September) stating that development expenditure will gather speed once projects are contracted.

The government spent Rs 103 billion in first two months of current fiscal, with expenses under recurrent heading at Rs 96 billion, under capital expenses at Rs six billion and under financing at Rs one billion.

Development expenses in the initial months comprise only of expenses of multi-year contract projects, according to the finance minister.

Finance minister further said that the remittance flow could rise as Nepali migrants will send more remittances to reap the advantages of exchange rate, and this will have positive impact on the liquidity in the financial sector and credit rate could be lowered and stabilised.

He further said that the Ministry of Finance (MoF) will finalise the hedging procedure shortly to bring in resources to invest in infrastructure projects and productive sector from foreign financial institutions. This will serve the rising appetite for credit through banking system and requirement of investment in infrastructure to accelerate growth. The country should be able to achieve the growth target of eight per cent, according to the finance minister.

The MoF has started holding regular discussions with ministries responsible for development expenses to facilitate them in properly spending earmarked capital budget. Finance Minister Khatiwada further said that negotiations were underway with development partners and the ExIm banks of India, South Korea and Japan to manage resources to finance construction of roads, tunnel ways and East-West Railway.

He stated that the government has expedited the drafting of working procedure, guidelines for execution of fiscal budget and also submitted crucial bills related to public finance management and financial sector, among others, to the Parliament for endorsement. Bills like Contributory Pension Act, Payment and Settlement Bill, Bill for the integration of the insurance laws, Federal Accounting and Reporting Bill have already been submitted at the Parliament.

Meanwhile, MoF is preparing to submit few other bills at the Parliament. These include Federal Financial Procedure Bill, bills to amend Investment Board and Public Procurement Act, according to the finance minister. The MoF has also been drafting other bills related to Citizen Investment Trust, Foreign Exchange Regulation Bill, Industrial Enterprise Bill and Public Corporation Operation Bill.

Similarly, a few other regulations and procedures — like, export incentive regulation, electoral constituency development programme procedure, and amendment in securities market regulations to include the pension fund and venture capital fund — are aimed at facilitating private investment and budget execution.

The federal government has also prepared and handed over the guidance to the lower layers of administration for fiscal discipline, accounting reporting and internal control in provinces and local governments.