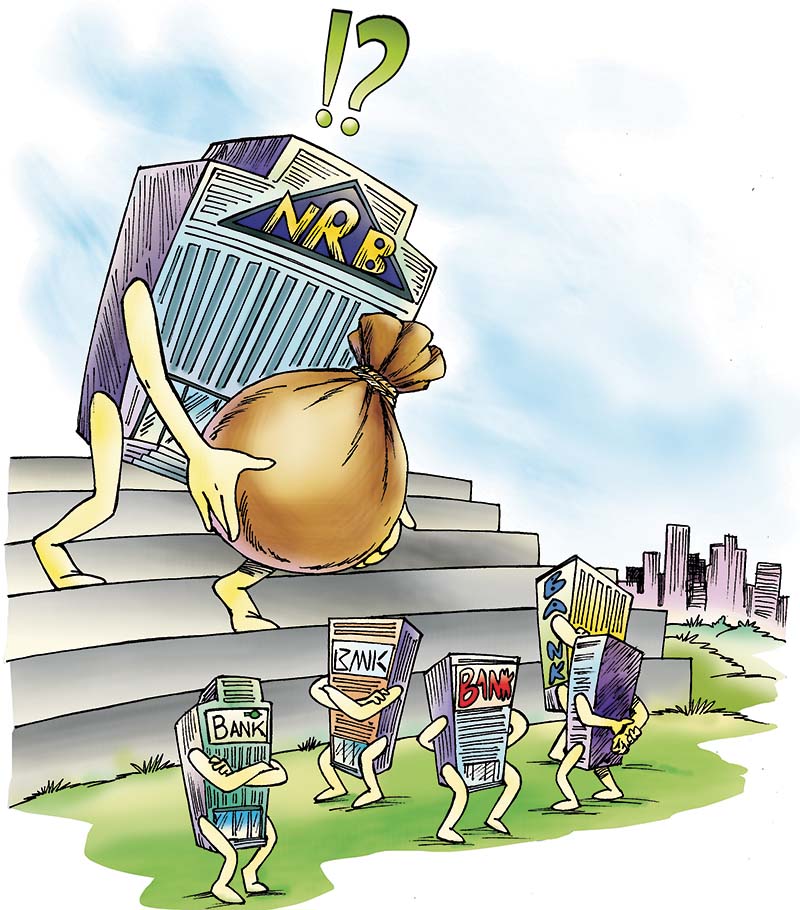

How acute is the liquidity crunch?

Kathmandu

Chief among multiple reasons behind the starvation of liquidity and feeble economy in the country is the government’s inability to spend capital expenditure, exponential growth in credit and banks’ failure to win the confidence of depositors. As a result, commercial banks have been suffering from a liquidity crunch for a while are now not only squeezed by the Credit to Deposit (CD) ratio but also gradually being pushed towards a credit crunch. Nepal Rastra Bank (NRB) has set the CD ratio at 80:20, which means a bank cannot lend more than 80 per cent out its deposits.

Bankers are worried as they have not been able to encourage deposits even after offering higher interest rates. In this difficult time, NRB is doing all it can to ease the liquidity crunch and had been injecting liquidity through repos to the banks. However, commercial banks, which have been seeking financing facility from the central bank to ease the problem of liquidity crunch, have showed reluctance to receive funds from the central bank under repo. Repo refers to a type of NRB’s financing facility to BFIs when there is shortfall of funds to meet cash reserve requirement (CRR).

Freeze in govT funds

“Liquidity crunch is largely caused by the freeze in government funds as they are not commencing any new projects,” complained Pashupati Murarka, President of Federation of Nepalese Chambers of Commerce and Industry (FNCCI), adding that it will have a negative impact on the national and will compel to slow down the whole economy.

“The government’s inability to spend is the major setback for the economy,” he said, adding that already victimised by the lack of investment friendly environment, political instability, labour problem and high production cost, the business community is badly back-ridden by the liquidity and credit crunch at present. “The enthusiasm of industrialists has been killed by the frequent increase in interest rates and there are slim chances of opening new industries,” he said, adding that instead they are inclined towards trading business.

"The enthusiasm of industrialists has been killed by the frequent increase in interest rates and there are slim chances for opening new industries"

-Pashupati Murarka, President of FNCCI

As of January 12, the government has spent merely Rs 34.7 billion out of total capital budget of Rs 311.94 billion. This makes hardly 11.13 per cent of the total capital expenditure while around Rs 280 billion remains unspent in the government treasury. On the top of that, the government is soaking up around Rs 40 billion in deposits to be withdrawn for the purpose of income tax submission.

Out of Rs 20 billion offered by the central bank on January 4, banks subscribed only Rs 1.9 billion (only 9.5 per cent) of the available fund. NRB offered another Rs 10 billion repo on January 8, and it came as a surprise for the central bank as banks subscribed merely Rs 34.9 million of the fund. NRB officials say that repos were issued in line with the request of bankers to provide financing facility to address the liquidity problem. Bankers say that the repo offered by the central bank was too costly for them. The central bank has set interest rate for repo at 4.8753 per cent.

“The financial health of the country is weak at the moment as the financial intermediates are not so healthy,” said Swarnim Wagle, Member of National Planning Commission. “The pattern of public investment has been crowded out by the government,” he said, adding that the government’s inability to spend capital expenditure and huge revenue collection has affected the liquidity status of the banks. He opined that the government should be able to make wise use of its capital expenditure. According to him, the tight liquidity situation will ease once the local elections are held and the political stability will be attained.

Govt needs to spend

Citing that there are two major reasons behind the existing tight liquidity situation, President of Nepal Bankers’ Association (NBA), Anil Keshary Shah said, “On one hand, discouraged by the April 2015 earthquake and economic blockade, the confidence of the private sector was enhanced with the super budget of this fiscal and there was a huge influx in the demand for loans. On the other hand, in the middle of this fiscal the government’s achievement in the revenue generation has exceeded its targets but when it comes to expenditure – it is negligible.”

Stating that the government is the major player in the national economy, he said, “More than Rs 250 billion is frozen at the government’s exchequer that’s why there is tight liquidity situation in the banking system.”

"More than Rs 250 billion is frozen at the government's exchequer that’s why there is tight liquidity situation in the banking system"

-Anil Keshary Shah, President of NBA

Is repo a solution ?

“The liquidity situation is going to be even worse in days to come. So there has to be means for the government to spend money,” said Shah, who is also the CEO of Mega Bank, adding that the CD ratio of majority of banks is already above 79 per cent. “Going forwards the banks will not be able to provide loans if more liquidity is not injected in the market,” he said, adding that there is a huge chance for the quasi-formal sector to boom if the banking sector does not come to its comfort zone on time.

“The repo is just a temporary solution to maintain the cash reserve that we are required to park at the central bank. The government needs to come up with a relatively long-term financing facility to help us maintain our CD ratio so that we are at a comfortable liquidity position,” added Shah. Stating that there is no depth in the Nepali market, he said, “All the concerned parties should work together to achieve a durable solution to this recurring problem.”

"Either liquidity crunch is not as acute as it is portrayed or the interest rate on the repos is high"

-Narayan Prasad Paudel, Spokesperson of NRB

“We issued repos twice within seven days to ease liquidity situation at least for the time being as BFIs were saying that they have been facing liquidity problem,” said Narayan Prasad Paudel, Spokesperson for the NRB. “However, there was a lukewarm response from the commercial banks to our offer,” he said, adding that either it is because liquidity crunch is not as acute as it is portrayed or the interest rate on the repos is high.

When asked about the bankers’ complaints about high interest rate on repos, Paudel, who is also the Chief of Banks and Financial Institutional Regulation Department at NRB, said, “It is true that banks can borrow from each other at lower rates to maintain cash reserve, but it is not sure if they will get loans for this. Moreover, that does not help to inject liquidity in the system. But repo obviously does.”

Going through the statements of NRB officials and bankers it seems that they are at odds over the understanding and diagnosis of the liquidity problem. According to bankers, the repo instrument can in no way address the liquidity problem so the banks are not interested in such offer. However, majority of banks are having tough time maintaining their CD ratio, which bars them from lending any more.