Insurers settle only 60pc of claims

Kathmandu, September 25

Exactly five months have passed since the devastating 7.8-magnitude earthquake hit the country on April 25.

But non-life insurance companies here have settled only 60 per cent of the claims related to damage or destruction caused by the quake.

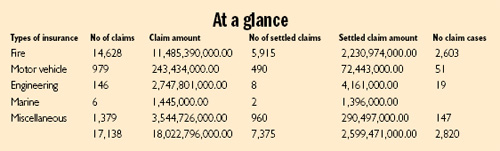

As of Thursday, 16 non-life insurance companies settled only 7,375 claims. Another 2,820 claims have been confirmed as cases of ‘no claim’, which means insurance companies do not have to extend compensation to victims because claim amount did not meet the settlement threshold.

The number of claims settled so far and ‘no claim’ cases makes up 60 per cent of the total claims of 17,138 received by non-life insurance companies.

However, this result, according to the Insurance Board (IB), the insurance sector regulator, is ‘mediocre’.

“We were expecting settlement of 70 to 80 per cent of the claims by now. So, non-life insurers have failed to meet our expectation,” IB Director Raju Raman Paudel said.

Paudel, however, said the good news was that almost all of the smaller claims filed by individuals or households have been settled.

Since the April 25 earthquake, non-life insurance companies have received claims worth Rs 18.02

billion. Of this, Rs 2.60 billion, or 14.42 per cent, has been extended as compensation.

Since the IB does not have data on the worth of ‘no claim’ cases, it is not known how much non-life insurers owe to clients who have filed claims.

Yet, the discrepancy in percentage of settled claims and settled claim amount also shows that non-life insurers have settled most of the smaller claims, meaning most of the clients who have filed bigger claims are yet to get compensation.

“It generally takes time to settle bigger claims because damage assessment process is longer. This is because most of the times reinsurance companies located abroad send their own surveyors to assess the damage, which is time consuming,” Paudel said, adding, “The IB, however, has been instructing non-life insurers to expedite the process of settling bigger claims as well.”

Of the total claims received by non-life insurance companies, 14,628 or 85 per cent are related

to fire. Fire insurance policy covers damage and losses caused by earthquake.

Of the total fire insurance claims received by non-life insurers, 5,915 claims worth Rs 2.23 billion have been settled, while 2,603 claims have been deemed as ‘no claim’ cases. Among others, non-life insurers have received 979 claims related to motor vehicles, 146 claims related to engineering, six claims related to marine and 1,379 claims of various nature.